Following Trial Balance has been extracted from the books of Sundar on 31st March, 2023:

Following Trial Balance has been extracted from the books of Sundar on 31st March, 2023:

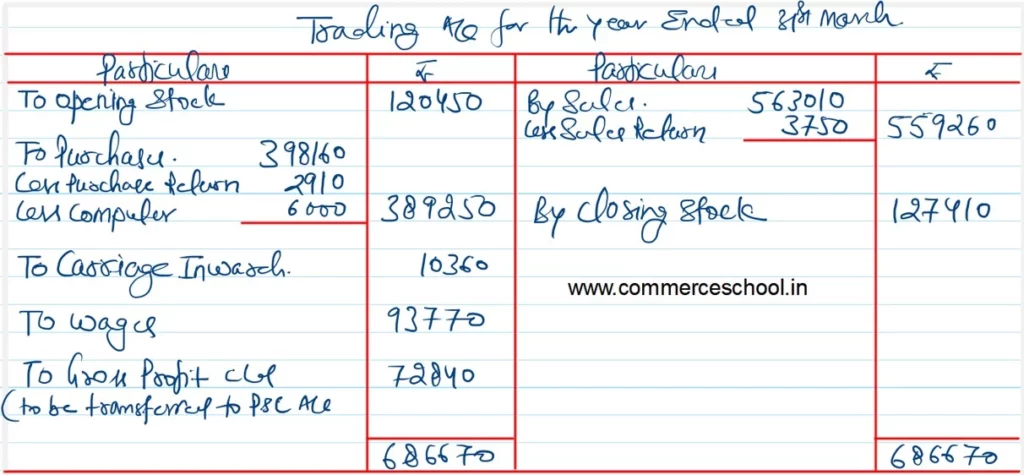

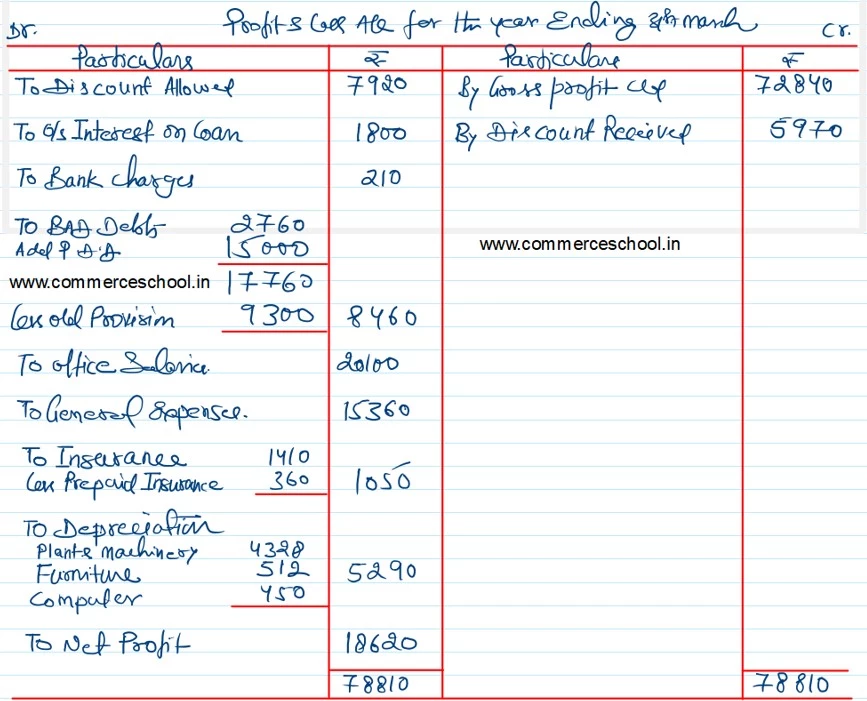

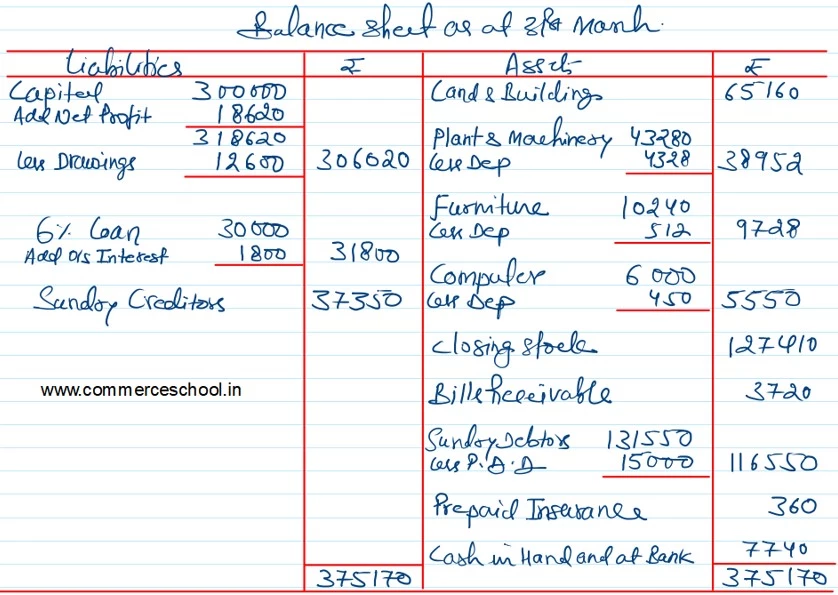

Prepare Trading and Profit & Loss Account for the year ended 31st March, 2023 and Balance Sheet as at that date after giving effect to the following adjustments:

(a) Closing Stock on 31st March, 2023 was ₹ 1,27,410

(b) Depreciate Planta nd Machinery @ 10% and Furniture @ 5%.

(c) Raise the Provision for Doubtful Debts to ₹ 15,000.

(d) Insurance includes annual premium of ₹ 720 on a policy which will expire on 30th September, 2023.

(e) Purchases includes a computer costing ₹ 6,000 purchased on 1st July, 2022 and is subject to depreciation @ 10% p.a.

| Particulars | Dr. (₹) | Cr. (₹) |

| Cash in Hand and at Bank Capital Drawings Bills Receivable Land and Building Furniture Wages Discount Allowed Discount Received 6% Loan Bank Charges Bad Debts Sundry Debtors Office Salaries Purchases Stock on 1st April, 2022 Sales Return Carriage Inwards General Expenses Plant and Machinery Purchases Return Sales Insurance Provision for Doubtful Debts Sundry Creditors | 7,740 – 12,600 3,720 65,160 10,240 93,770 7,920 – – 210 2,760 1,31,550 20,100 3,98,160 1,20,450 3,750 10,360 15,360 43,280 – – 1,410 – – | – 3,00,000 – – – – – – 5,970 30,000 – – – – – – – – – – 2,910 5,63,010 – 9,300 37,350 |

| Total | 9,48,540 | 9,48,540 |

Anurag Pathak Changed status to publish October 26, 2023