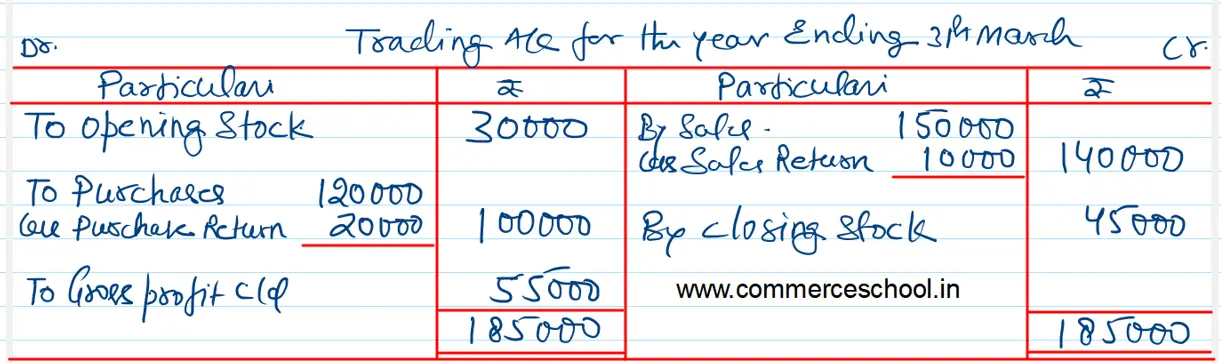

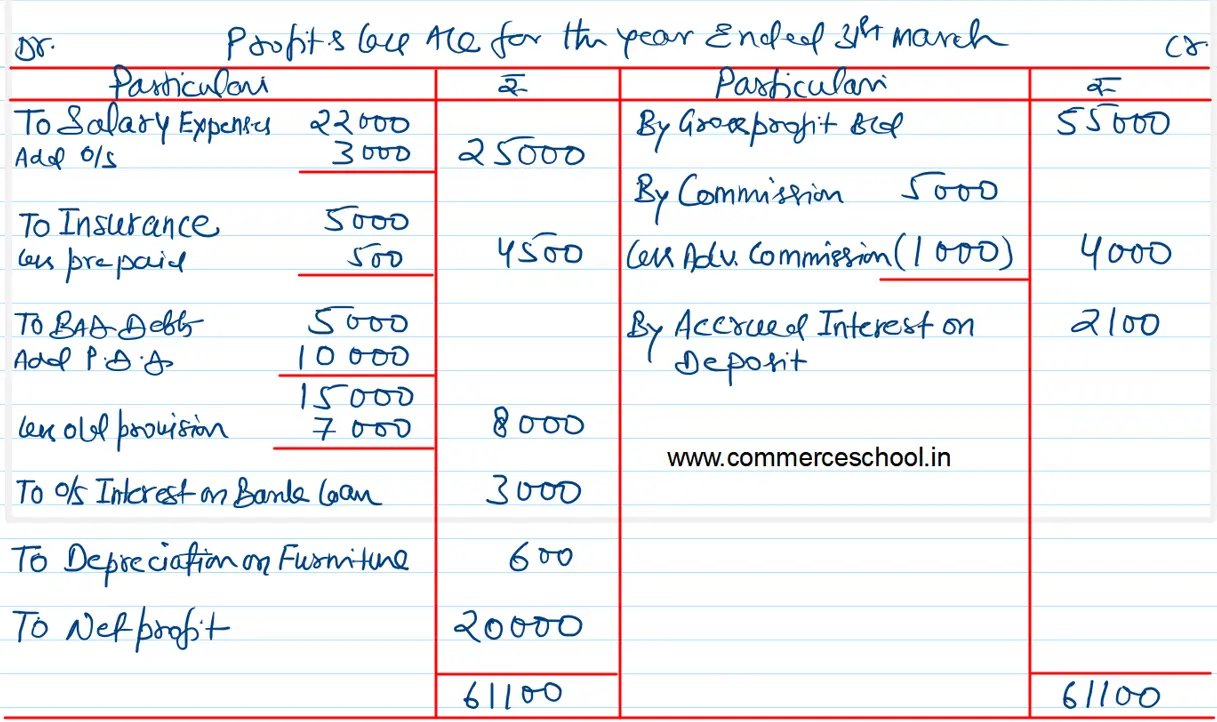

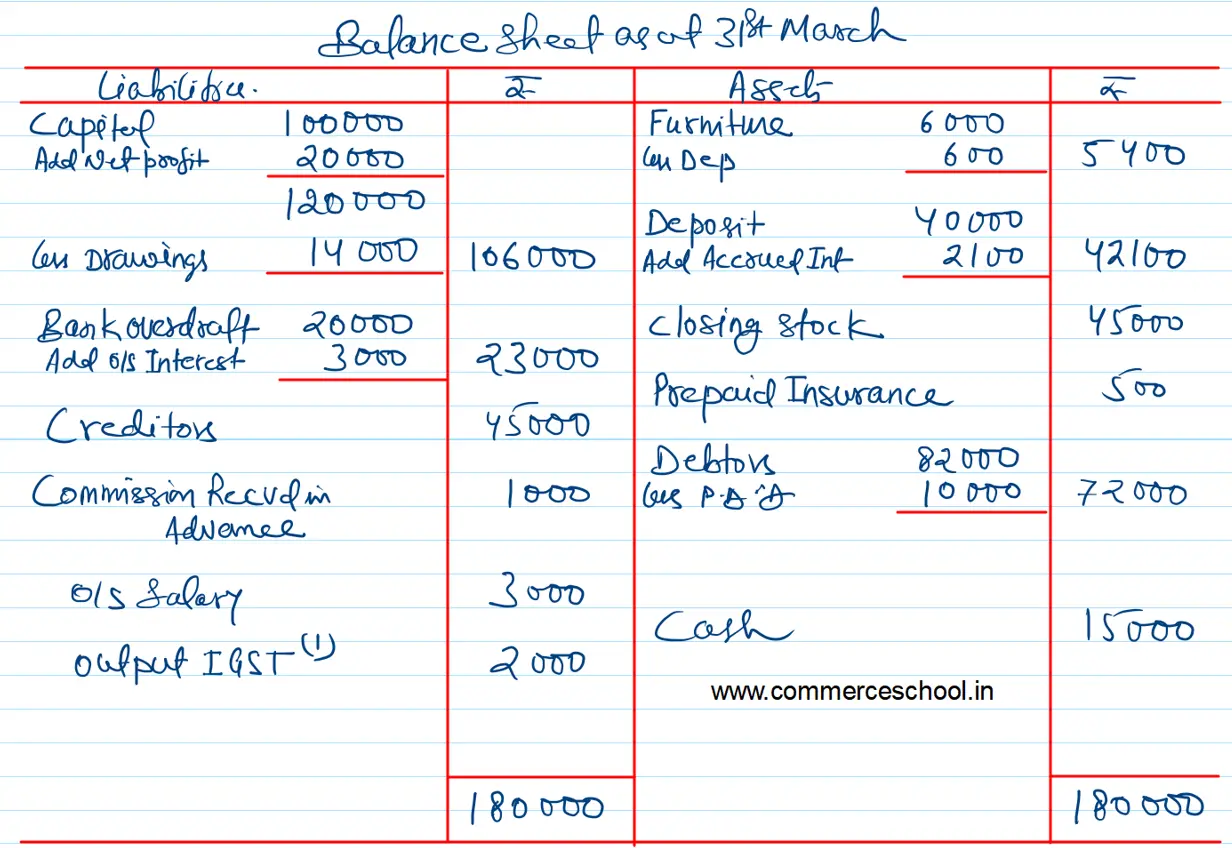

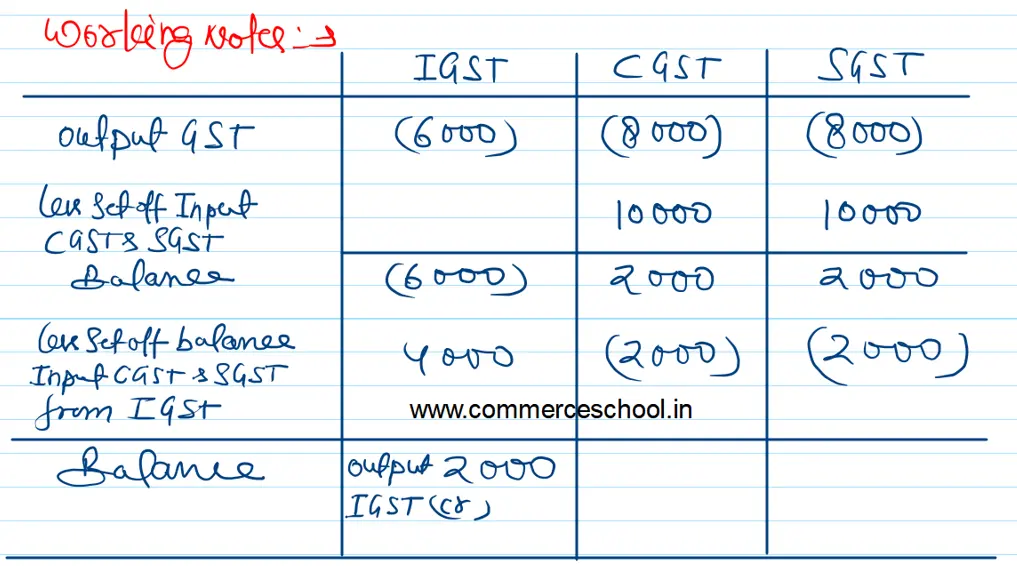

Prepare Trading and Profit & Loss Account for the year ended 31st March, 2023 and Balance Sheet as at that date from the following Trial Balance: Capital 1,00,000 Cash 15,000

Prepare Trading and Profit & Loss Account for the year ended 31st March, 2023 and Balance Sheet as at that date from the following Trial Balance:

| Heads of Accounts | L.F. | Dr. (₹) | Cr. (₹) |

|

Capital Cash Bank Loan Purchases Sales Sales Return Purchases Return Salary Expenses Insurance Bad Debts Provision for Doubtful Debts Debtors Creditors Commission Deposits Opening Stock Drawings Furniture Bills Receivable Bills Payable Input CGST Input SGST Output CGST Output SGST Output IGST |

– 15,000 – 1,20,000 – 10,000 – 22,000 5,000 5,000 – 50,000 – – 40,000 30,000 14,000 6,000 32,000 – 10,000 10,000 – – – |

1,00,000 – 20,000 – 1,50,000 – 20,000 – – – 7,000 – 20,000 5,000 – – – – – 25,000 – – 8,000 8,000 6,000 |

|

| 3,69,000 | 3,69,000 |

Adjustments:

(i) Salaries of ₹ 3,000 are outstanding but Insurance ₹ 500 is prepaid.

(ii) Commission ₹ 1,000 received in advance for the next year.

(iii) Interest ₹ 2,100 is to be received on Deposits and Interest on Bank Loan ₹ 3,000 is to be paid.

(iv) Provision for Doubtful Debts to be maintained at ₹ 10,000.

(v) Depreciate Furniture by 10%.

(vi) Closing Stock (at cost) as on 31st March, 2022 was ₹ 45,000 and its Net Relisable Value (Market Value) was ₹ 50,000.

(vii) A fire occured on 1st April, 2022 destroying goods costing ₹ 10,000. The stock was fully insured (Ignor GST)

[Gross Profit – ₹ 55,000; Net Profit – ₹ 20,000; Balance Sheet Total – ₹ 1,80,000.]