Calculate the amount of annual depreciation and rate of depreciation under Straight Line Method in each of the alternative cases

Calculate the amount of annual depreciation and rate of depreciation under Straight Line Method in each of the alternative cases:

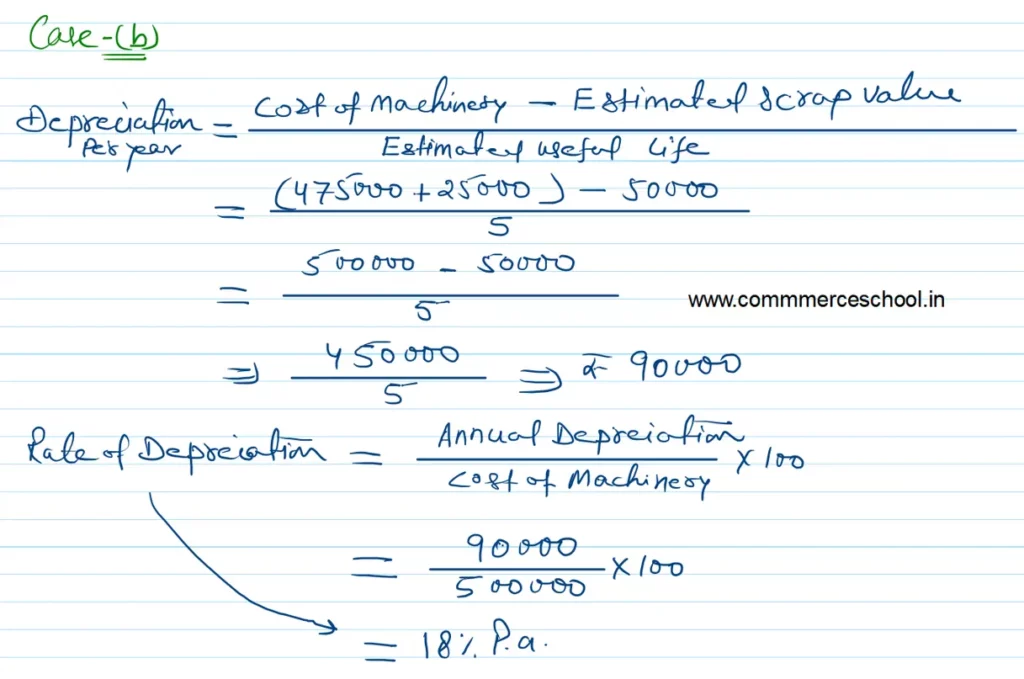

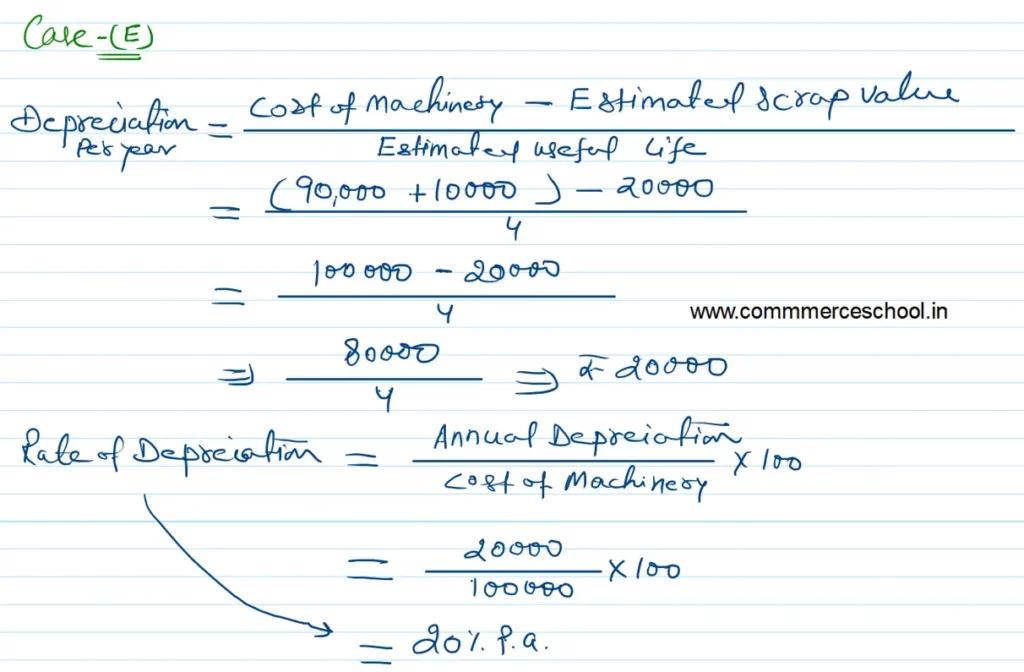

| Case | Purchase Price of Machinery (₹) | Installation Charges (₹) | Estimated Scrap Value (₹) | Estimated useful Life (in years) |

| (a) (b) (c) (d) (e) | 1,80,000 4,75,000 90,000 3,40,000 90,000 | 20,000 25,000 10,000 60,000 10,000 | 10,000 50,000 20,000 40,000 20,000 | 5 5 10 10 4 |

Anurag Pathak Changed status to publish