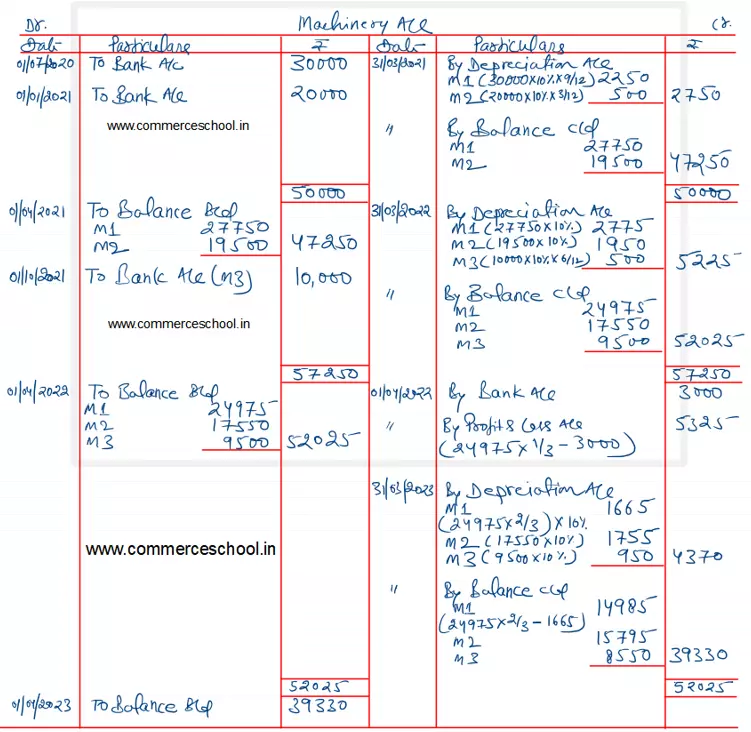

A company whose accounting year is the financial year, purchased on 1st July, 2020 machinery costing ₹ 30,000

A company whose accounting year is the financial year, purchased on 1st July, 2020 machinery costing ₹ 30,000. If further purchased machinery on 1st January, 2021 costing ₹ 20,000 and on 1st October, 2021 costing ₹ 10,000.

On 1st April, 2022, one-third of the machinery installed on 1st July, 2020 became obsolete and was sold for ₹ 3,000.

Show how the Machinery Account would appear in the books of company if depreciation is charged @ 10% p.a. by Written Down Value Method.

Anurag Pathak Changed status to publish October 24, 2023