Following balances were extracted from the books of Vijay on 31st March, 2023:

Following balances were extracted from the books of Vijay on 31st March, 2023:

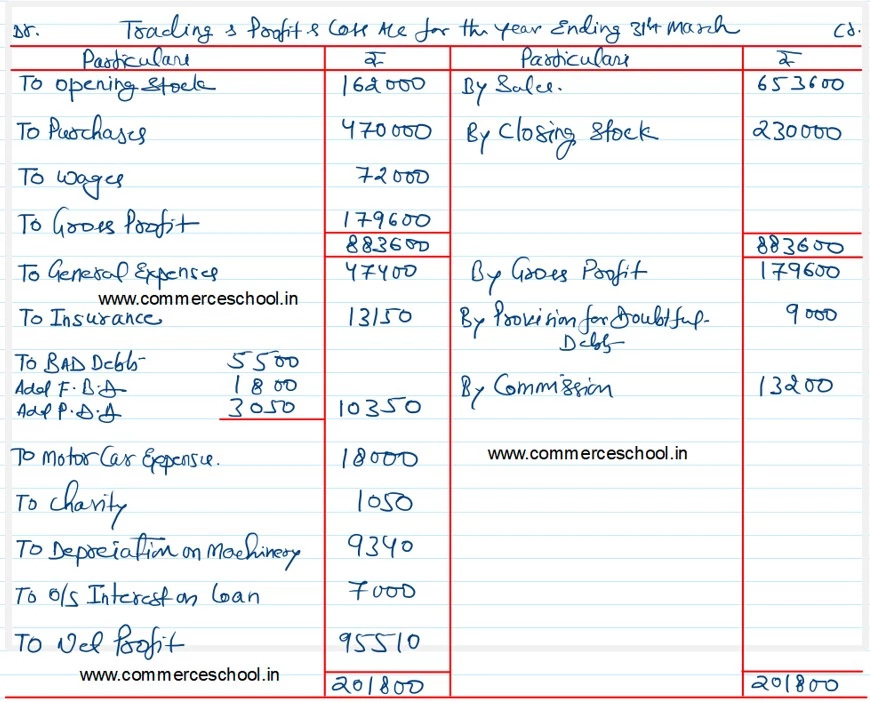

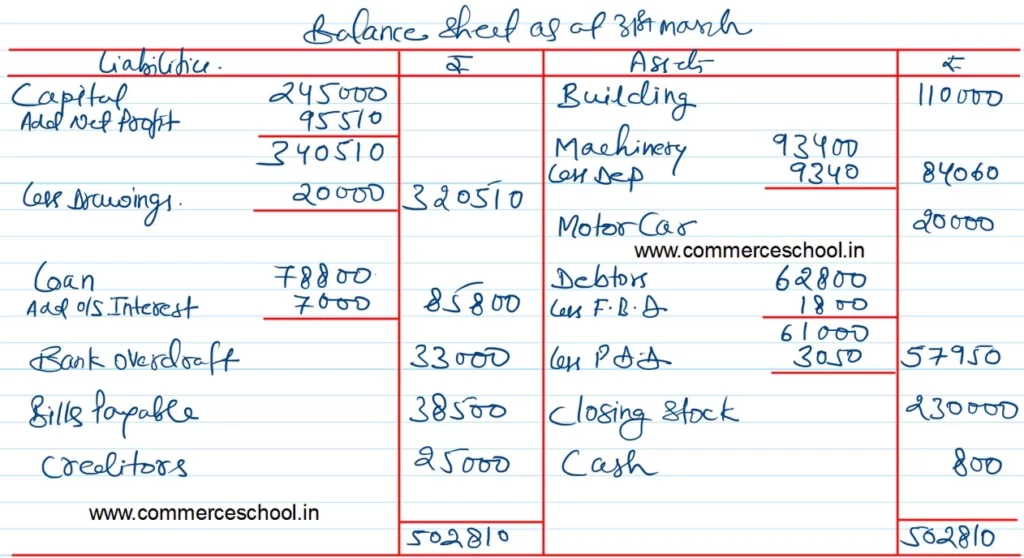

| Particulars | ₹ | Particulars | ₹ |

|

Capital Drawings General Expenses Building Machinery Stock on 1st April, 2022 Insurance Wages Debtors Creditors Bad Debts |

2,45,000 20,000 47,400 1,10,000 93,400 1,62,000 13,150 72,000 62,800 25,000 5,500 |

Loan Sales Purchases Motor Car Provision for Doubtful Debts Commission (Cr.) Motor Car Expenses Bills Payable Cash Bank Overdraft Charity |

78,800 6,53,600 4,70,000 20,000 9,000 13,200 18,000 38,500 800 33,000 1,050 |

Prepare Trading and Profit & Loss Account for the year ended 31st March, 2023 and Balance Sheet as at that date after giving effect to the following adjustments:

(a) Stock as on 31st March, 2023 was valued at ₹ 2,30,000.

(b) Write off further ₹ 1,800 as Bad Debts and maintain the Provision for Doubtful Debts at 5%.

(c) Depreciate Machinery at 10%.

(d) Provide ₹ 7,000 as outstanding interest on loan.