Yadu, Vidu, and Radhu were partners in a firm sharing profits in the ratio of 4 : 3 : 3. Their fixed capitals on 1st April

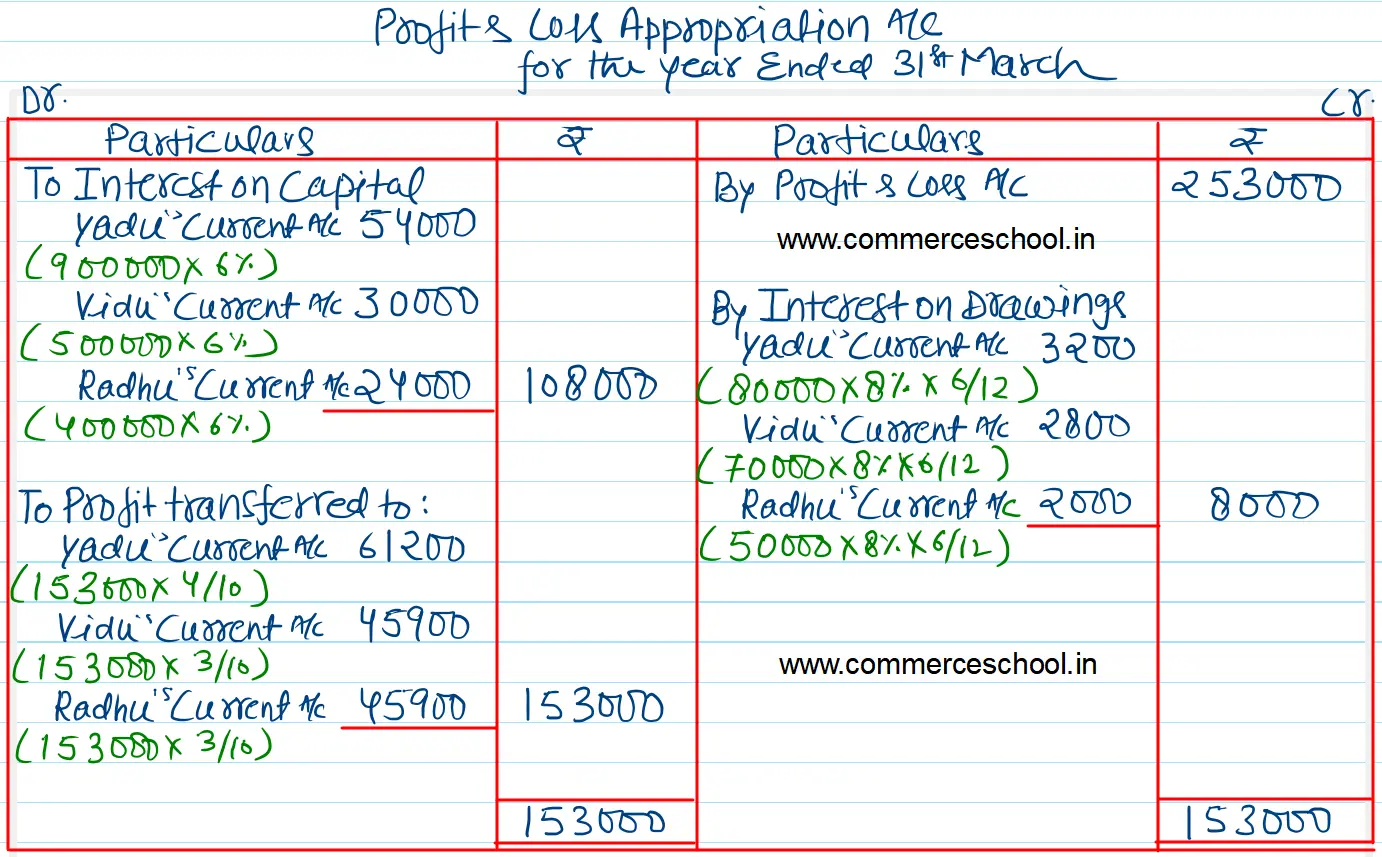

Yadu, Vidu, and Radhu were partners in a firm sharing profits in the ratio of 4 : 3 : 3. Their fixed capitals on 1st April 2018 were ₹ 9,00,000, ₹ 5,00,000 and ₹ 4,00,000 respectively. On 1st November 2018, Yadu gave a loan of ₹ 80,000 to the firm, as per the partnership agreement.

(i) The partners were entitled to an interest on capital @ 6% p.a.

(ii) Interest on partner’s drawings was to be charged @ 8% p.a.

The firm earned a profit of ₹ 2,53,000 (after interest on Yadu’s Loan) during the year 2018-19. Partner’s drawings for the year amounted to:

Yadu – ₹ 80,000, Vidu – ₹ 70,000 and Radhu – ₹ 50,000.

Prepare Profit and Loss Appropriation Account for the year ending 31st March 2019.

[Ans: Share of Profit: Yadu – ₹ 61,200; Vidu – ₹ 45,900; Radhu – ₹ 45,900.]

[Hint: Interest on drawings is charged on the total amount for an average period of 6 months]