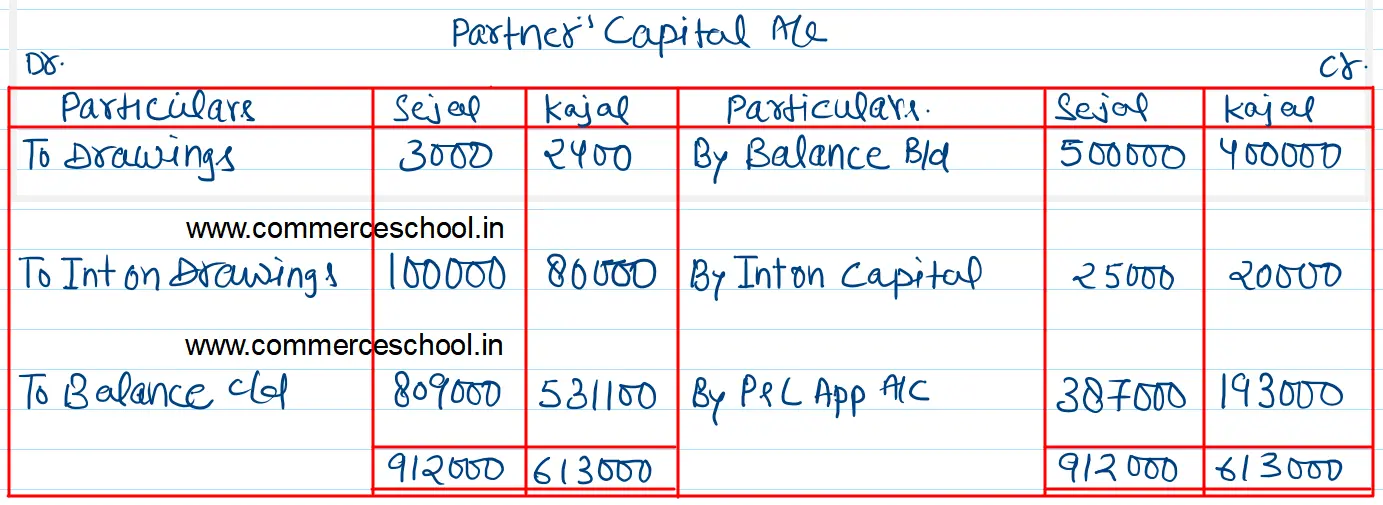

Sajal and Kajal are partners sharing profits and losses in the ratio of 2 : 1. on 1st April 2022, their capitals were: Sajal ₹ 5,00,000 and Kajal ₹ 4,00,000

Sajal and Kajal are partners sharing profits and losses in the ratio of 2 : 1. on 1st April 2022, their capitals were: Sajal ₹ 5,00,000 and Kajal ₹ 4,00,000.

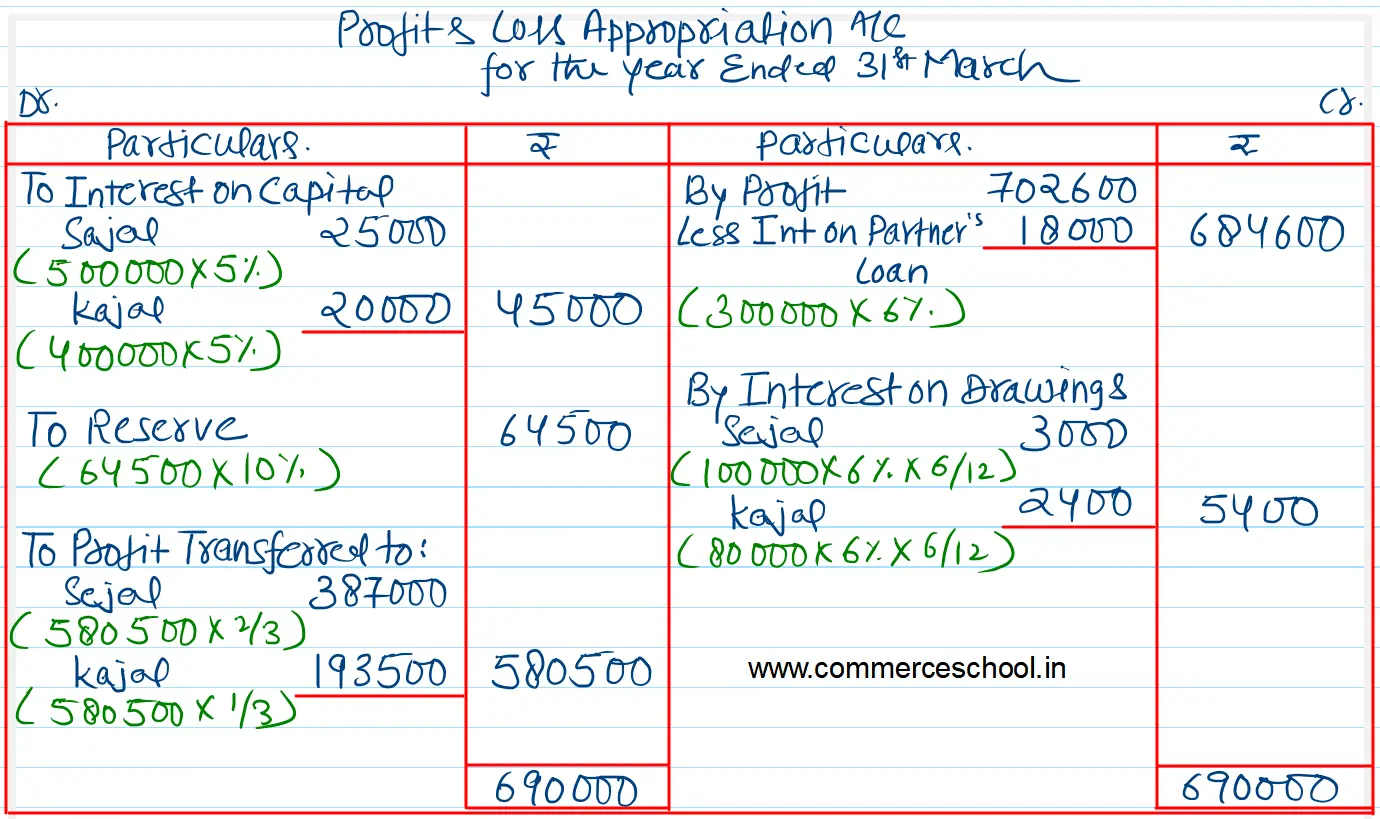

Prepare the Profit and Loss Appropriation Account and the Partner’s Capital Accounts for the year ended 31st March 2023 from the following information:

(a) Interest on Capital is to be allowed @ 5% p.a.

(b) Interest on the loan advanced by Kajal for the complete year, the amount of the loan being ₹ 3,00,000.

(c) Interest on partner’s drawings @ 6% p.a. Drawings: Sajal ₹ 1,00,000 and Kajal ₹ 80,000.

(d) 10% of the divisible profit is to be transferred to General Reserve.

Profit, before giving effect to the above, for the year ended 31st March 2023 is ₹ 7,02,600.

[Ans: Closing Balances of Capital A/cs: Sajal – ₹ 8,09,000; Kajal – ₹ 5,31,100; Share of Profit: Sajal – ₹ 3,87,000; Kajal – ₹ 1,93,500; General Reserve – ₹ 64,500.]

[Hint: Interest on a loan by a partner is a charge]