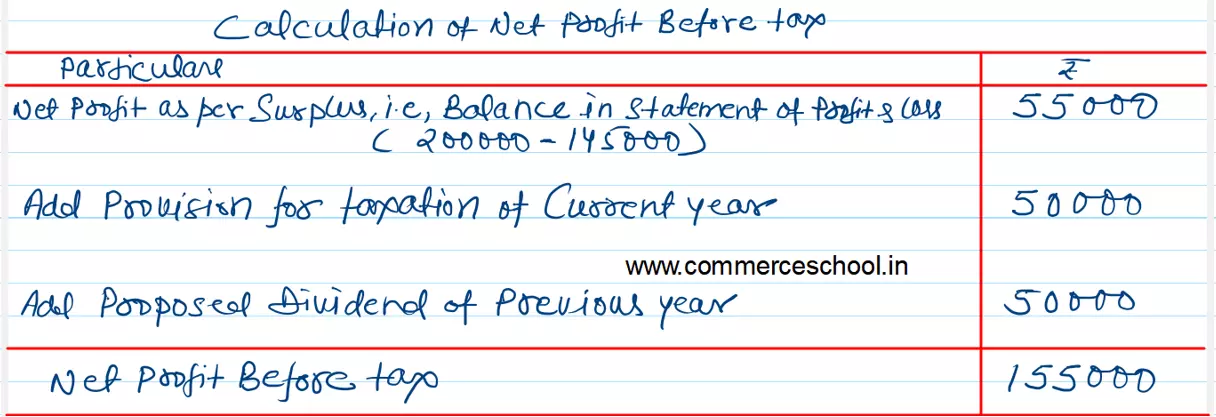

Calculate Net Profit before Tax of Power Tools Ltd. from its Balance Sheet as at 31st March, 2023

Calculate Net Profit before Tax of Power Tools Ltd. from its Balance Sheet as at 31st March, 2023:

Note: Proposed Dividend for the years ended 31st March, 2022 and 2023 are ₹ 50,000 and ₹ 25,000 respectively.

| Particulars | Note No. | 31st March, 2023 (₹) | 31st March, 2022 (₹) |

| I. Equity and Liabilities | |||

| 1. Shareholder’s Funds (a) Share Capital (b) Reserves and Surplus | 5,00,000 2,00,000 | 5,00,000 1,45,000 | |

| 2. Current Liabilities (a) Short-term Borrwings (b) Trade Payables (c) Other Current Liabilities (d) Short-term Provisions | 10,000 80,000 20,000 50,000 | 15,000 35,000 10,000 30,000 | |

| Total | 8,60,000 | 7,35,000 | |

| II. Assets | |||

| 1. Non-Current Assets (a) Property, Plant and Equipment and Intangible Assets: – Property, Plant and Equipment (b) Non-Current Investments | 4,00,000 1,50,000 | 3,75,000 1,50,000 | |

| 2. Current Assets | 3,10,000 | 2,10,000 | |

| Total | 8,60,000 | 7,35,000 |

| Particulars | 31st March, 2023 (₹) | 31st March 2022 (₹) |

| 1. Reserves and Surplus Surplus, i.e., Balance in Statement of Profit & Loss A/c | 2,00,000 | 1,45,000 |

| 2. Other Current Liabilities Outstanding Expenses | 20,000 | 10,000 |

| 3. Short-term Provisions Provision for Tax | 50,000 | 30,000 |

Anurag Pathak Changed status to publish