From the following particulars, prepare Cash Flow Statement Share Capital: Equity Share Capital ₹ 2,40,000 Reserves and Surplus ₹ 1,50,000

From the following particulars, prepare Cash Flow Statement:

Balance Sheet

| Particulars | 31st March, 2023 (₹) | 31st March, 2022 (₹) |

| I. EQUITY AND LIABILITIES | ||

|

1. Shareholders’ Funds (a) Share Capital: Equity Share Capital (b) Reserves and Surplus |

2,40,000 1,50,000 |

2,00,000 1,20,000 |

|

2. Non-Current Liabilities Long-term Borrowings (10% Debentures) |

90,000 | 1,00,000 |

|

3. Current Liabilities (a) Trade Payables (b) Other Current Liabilities |

2,20,000 10,000 |

1,80,000 5,000 |

| Total | 7,10,000 | 6,05,000 |

| II. ASSETS | ||

|

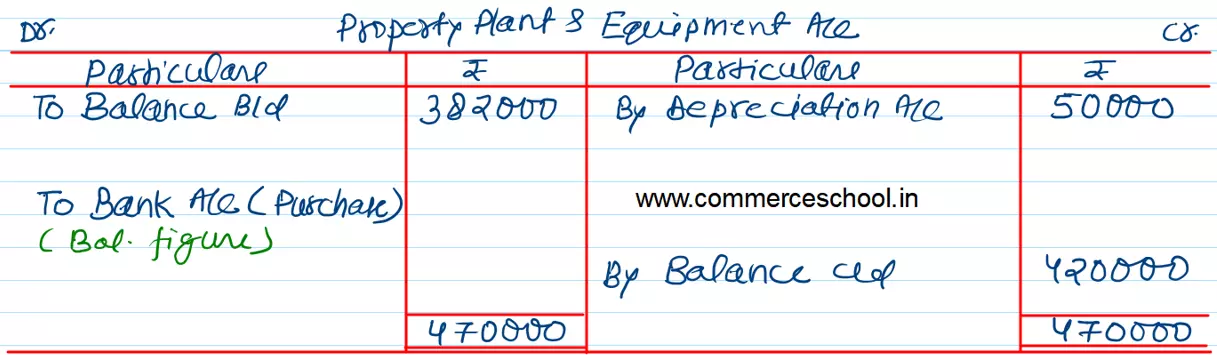

1. Non-current Assets (a) Property, Plant and Equipment and Intangible Assets: Property, Plant and Equipment (b) Non-Current Investments (Trade) |

4,20,000 50,000 |

3,82,000 40,000 |

|

2. Current Assets (a) Current Investments (b) Inventories (c) Trade Receivable (d) Cash and Bank Balance (Cash at Bank) |

40,000 1,00,000 98,000 2,000 |

20,000 80,000 80,000 3,000 |

| Total | 7,10,000 | 6,05,000 |

Note: to Accounts:-

| Particulars | 31st March, 2023 (₹) | 31st March, 2022 (₹) |

|

Reserves and Surplus General Reserve Surplus, i.e., Balance in Statement of Profit & Loss |

1,20,000 30,000 |

1,00,000 20,000 |

| 1,50,000 | 1,20,000 | |

|

Other Current Liabilities Dividend Payable |

10,000 | 5,000 |

Note: Dividend Proposed for the years ended 31st March, 2022 and 2023 are ₹ 30,000 and ₹ 40,000 respectively.

Additional Information:-

- Depreciation charged on Property, Plant and Equipment amounted to ₹ 50,000.

- Dividend proposed for 31st March, 2022 was paid on 1st May, 2022.

- Debentures interest paid during the year ₹ 10,000.

- Share issue expenses of ₹ 7,000 incurred during the year and written off from statement of Profit & Loss.