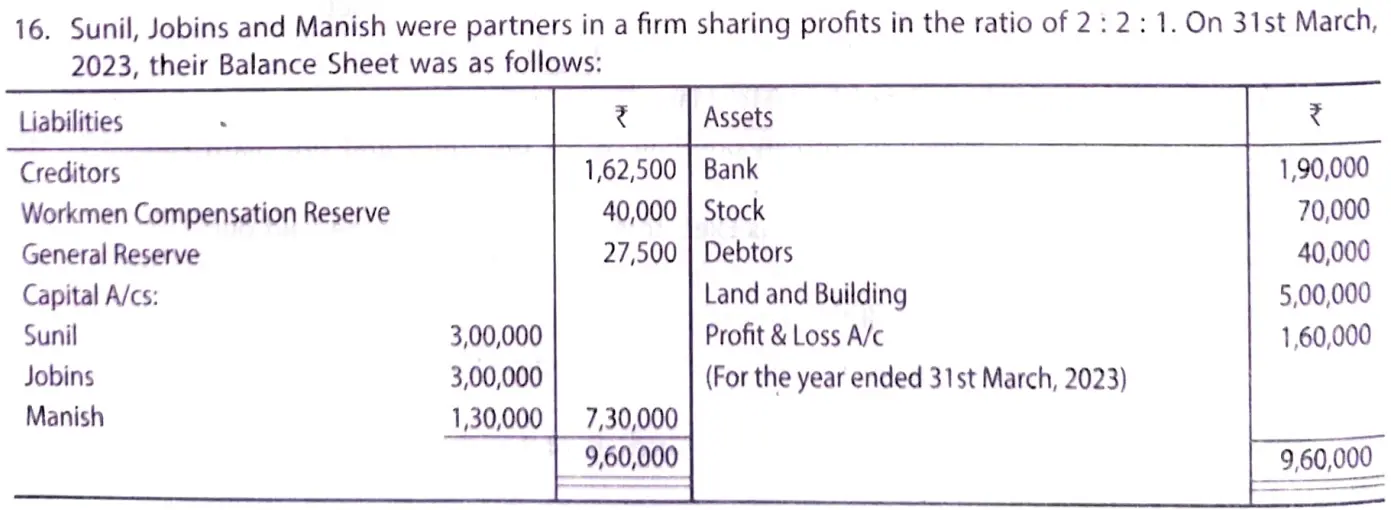

Sunil, Jobins and Manish were partners in a firm sharing profits in the ratio of 2 : 2 : 1. On 31st March 2023, their Balance Sheet was as follows:

Sunil, Jobins and Manish were partners in a firm sharing profits in the ratio of 2 : 2 : 1. On 31st March 2023, their Balance Sheet was as follows:

| Liabilities | ₹ | Assets | ₹ |

|

Creditors Workmen Compensation Reserve General Reserve Capital A/cs: Sunil Jobins Manish |

1,62,500 40,000 27,500

3,00,000 3,00,000 1,30,000 |

Bank Stock Debtors Land and Building Profit and Loss A/c (For the year ended 31st March, 2023) |

1,90,000 70,000 40,000 5,00,000 1,60,000 |

| 9,60,000 | 9,60,000 |

Jobins died on 30th June, 2023. Partnership Deed provided for the following on death of a partner:

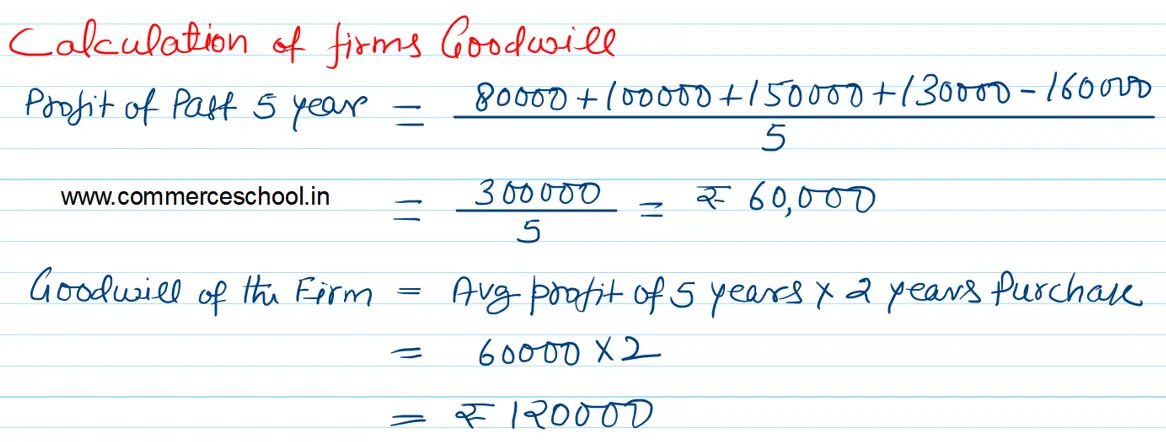

(i) Goodwill of the firm was to be valued at 2 years’ purchase of the average profit of last 5 years. The profits for the past four years ended 31st March, 2022 were ₹ 80,000; ₹ 1,00,000; ₹ 1,50,000 and ₹ 1,30,000 respectively.

(ii) Share of profit or loss till the date of his death was to be calculated on the basis of the profit or loss for the year ended 31st March, 2023.

(iii) Sunil and Manish decide to record the effect of Workmen Compensation Reserve and General Reserve without affecting their book values.

Prepare Jobin’s Capital Account at the time of his death to be presented to his executor.