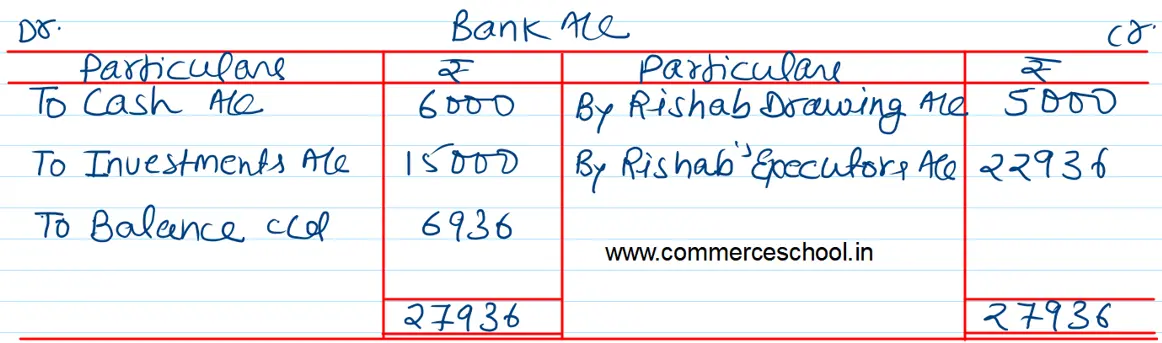

On 31st March, 2022, the Balance Sheet of Ankur, Raj and Rishab who were partners in a firm was as under:

On 31st March, 2022, the Balance Sheet of Ankur, Raj and Rishab who were partners in a firm was as under:

| Liabilities | ₹ | Assets | ₹ |

|

Sundry Creditors Reserve Fund Capital A/cs: Ankur Raj Rishab |

25,000 20,000 15,000 10,000 10,000 |

Building Investments Debtors Bills Receivable Stock Cash |

26,000 15,000 15,000 6,000 12,000 6,000 |

| 80,000 | 80,000 |

The Partnership Deed provides that the profits be shared in the ratio of 2 : 1 : 1 and in the event of death of a partner, his executors will be entitled to:

(i) The Capital to his credit till the date of last Balance Sheet.

(ii) His proportionate share of Reserve till the date of last Balance Sheet.

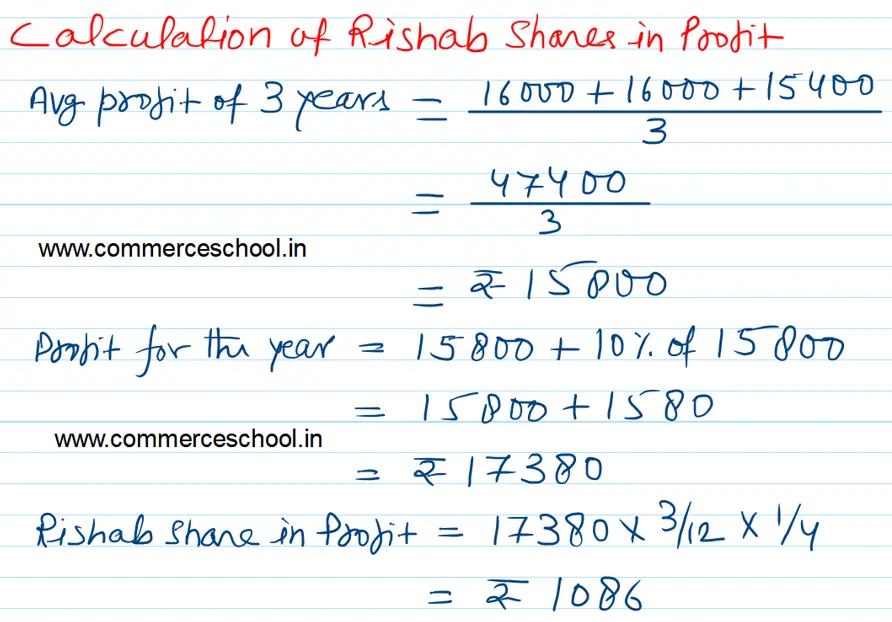

(iii) His share of profit till the date of death based on the average profit of the last three completed years, plus 10%.

(iv) By way of Goodwill, his share of the total profits for the three preceding years.

(v) Net Profits for the last three years ended 31st March, were:

2020 – ₹ 16,000; 2021 – ₹ 16,000; 2022 – ₹ 15,400.

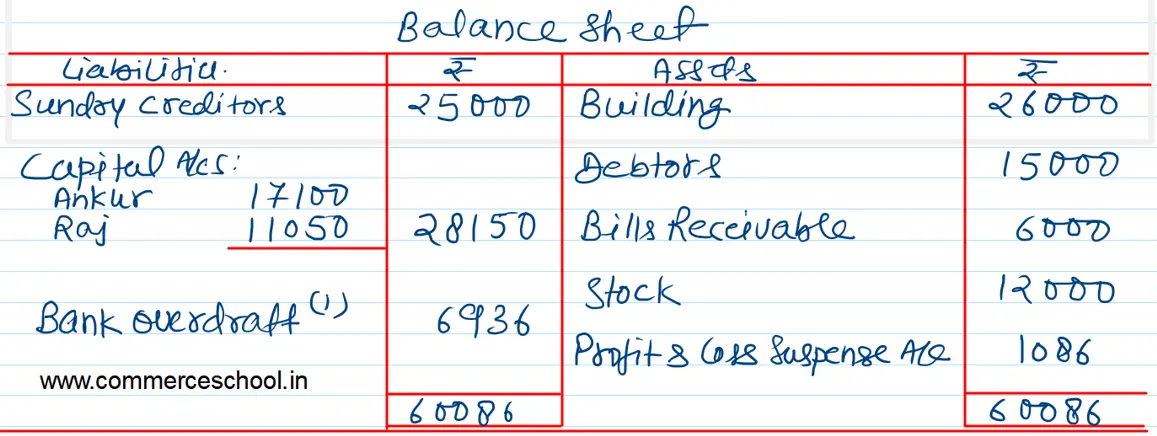

Rishab died on 1st July, 2022. He had withdrawn ₹ 5,000 up to the date of his death. The investments were sold at par and Rishab’s Executors were paid.

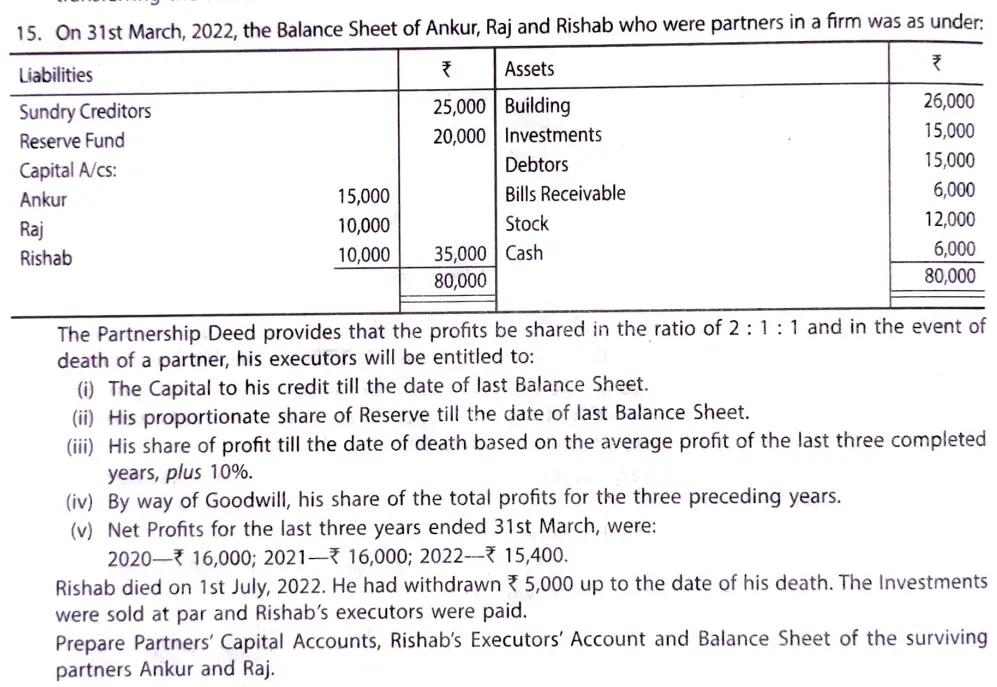

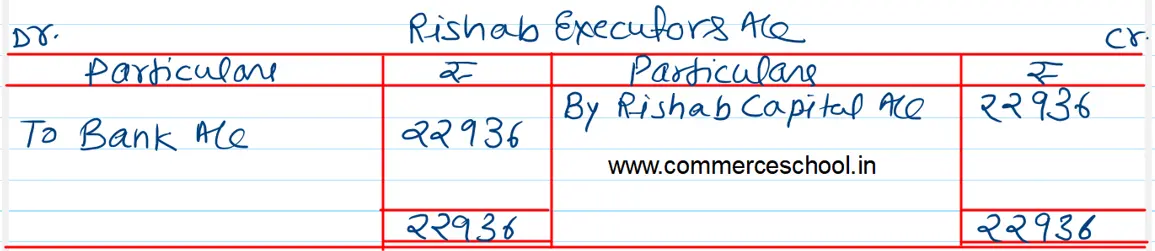

Prepare Partner’s Capital Accounts, Rishab’s Executors Account and Balance Sheet of the Surviving partners Ankur and Raj.