Jeet, Vijay and Priya are partners in a firm. Their Balance Sheet as at 31st March, 2022 is given below:

Jeet, Vijay and Priya are partners in a firm. Their Balance Sheet as at 31st March, 2022 is given below:

| Liabilities | ₹ | Assets | ₹ |

|

Creditors General Reserve Jeet’s Capital Vijay’s Capital Priya’s Capital |

25,000 25,000 50,000 37,500 12,500 |

Machinery Furniture Stock Debtors Investments |

50,000 6,250 26,250 37,500 30,000 |

| 1,50,000 | 1,50,000 |

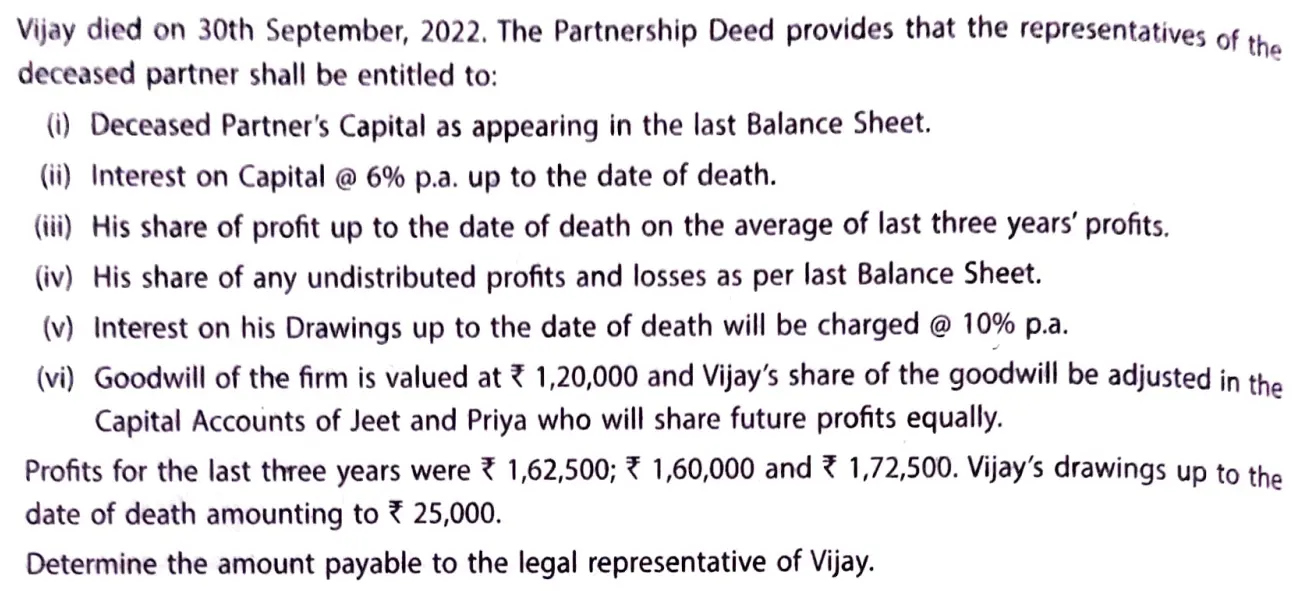

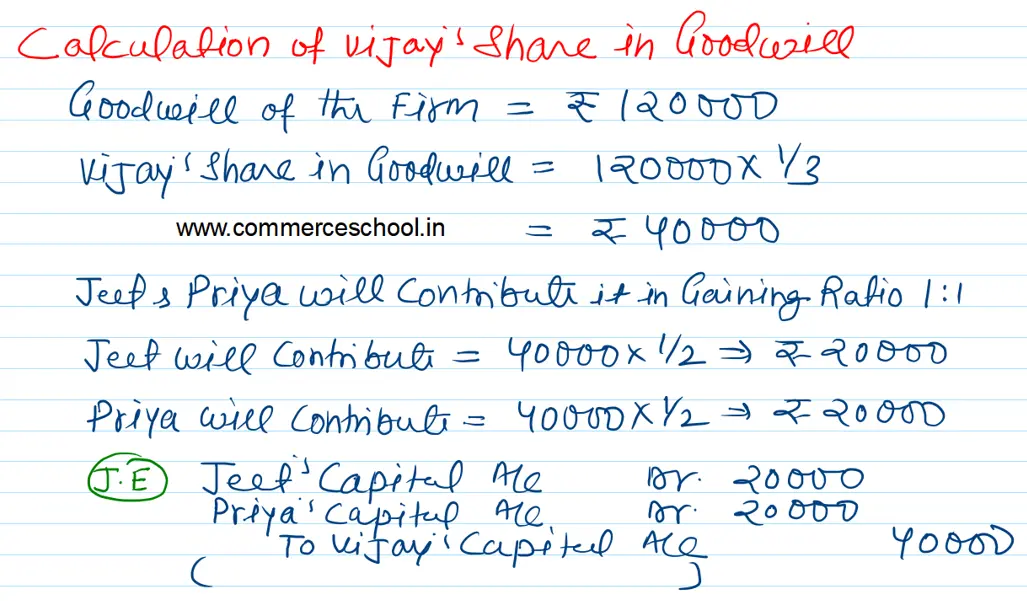

Vijay died on 30th September 2022. The Partnership Deed provides that the representatives of the deceased partner shall be entitled to:

(i) Deceased Partner’s Capital as appearing in the last Balance Sheet.

(ii) Interest on Capital @ 6% p.a. up to the date of death.

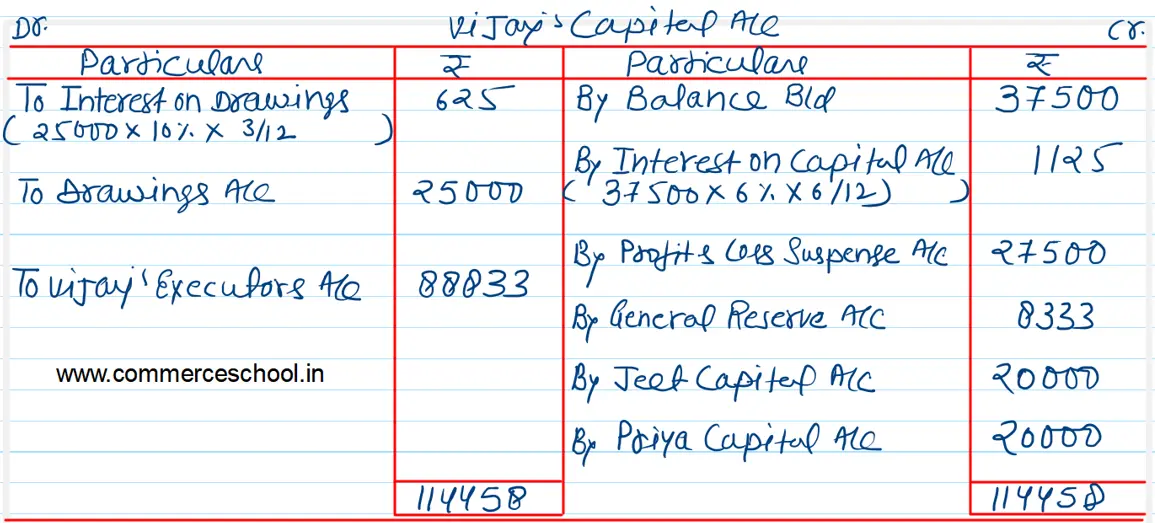

(iii) His share of profit up to the date of death on the average of last three year’s profits.

(iv) His share of any undistributed profits and losses as per last Balance Sheet.

(v) Interest on his Drawings up to the date of death will be charged @ 10% p.a.

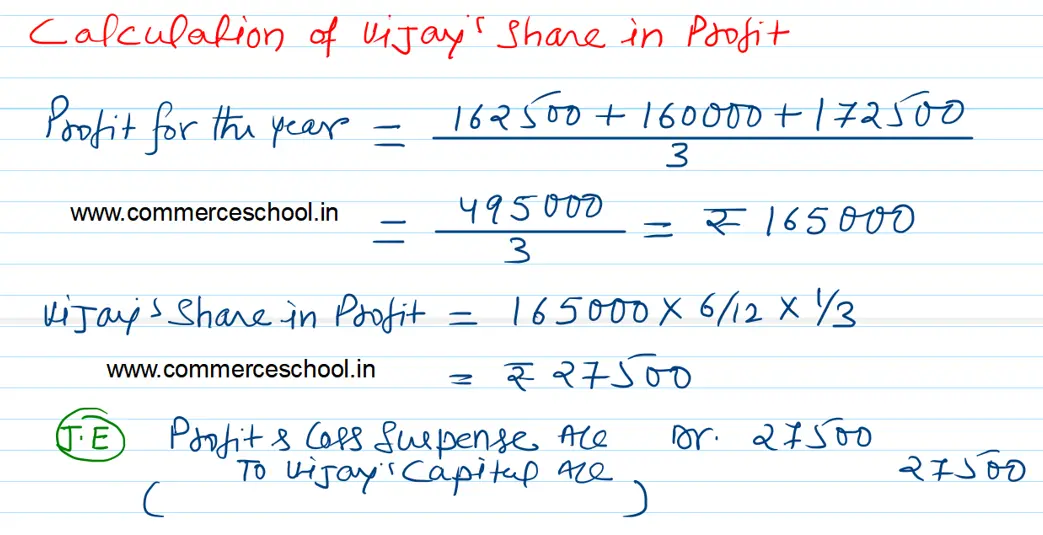

(vi) Goodwill on the firm is valued at ₹ 1,20,000 and Vijay’s share of the goodwill be adjusted in the Capital Accounts of Jeet and Priya who will share future profits equally.

Profits for the last three years were ₹ 1,62,500; ₹ 1,60,000 and ₹ 1,72,500. Vijay’s drawings up to the date of death amounting to ₹ 25,000.

Determine the amount payable to the legal representative of Vijay.