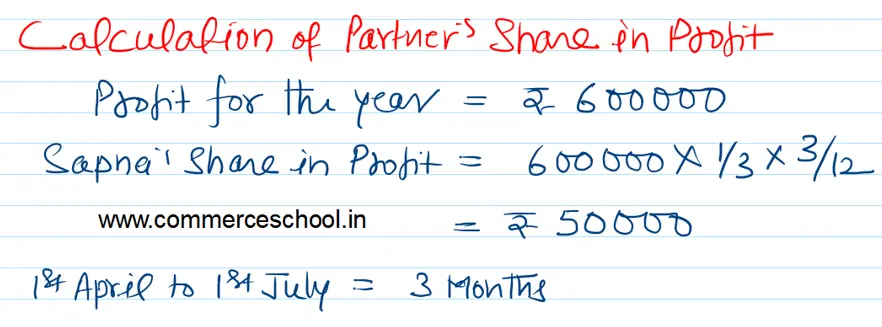

Sunil, Nitish and Sapna were partners in a trading firm, sharing profits and losses equally. On 31st March, 2023, the Balance Sheet of the firm stood as follows

Sunil, Nitish and Sapna were partners in a trading firm, sharing profits and losses equally. On 31st March, 2023, the Balance Sheet of the firm stood as follows:

| Liabilities | ₹ | Assets | ₹ |

|

Creditors General Reserve Bank Loan Capital A/cs: Sunil Nitish Sapna |

1,35,000 1,20,000 50,000

1,50,000 1,00,000 80,000 |

Cash at Bank Debtors Stock Building Goodwill |

59,000 80,000 1,16,000 2,30,000 1,50,000 |

| 6,35,000 | 6,35,000 |

On 1st July, 2023, Sapna retires and the following conditions were agreed upon:

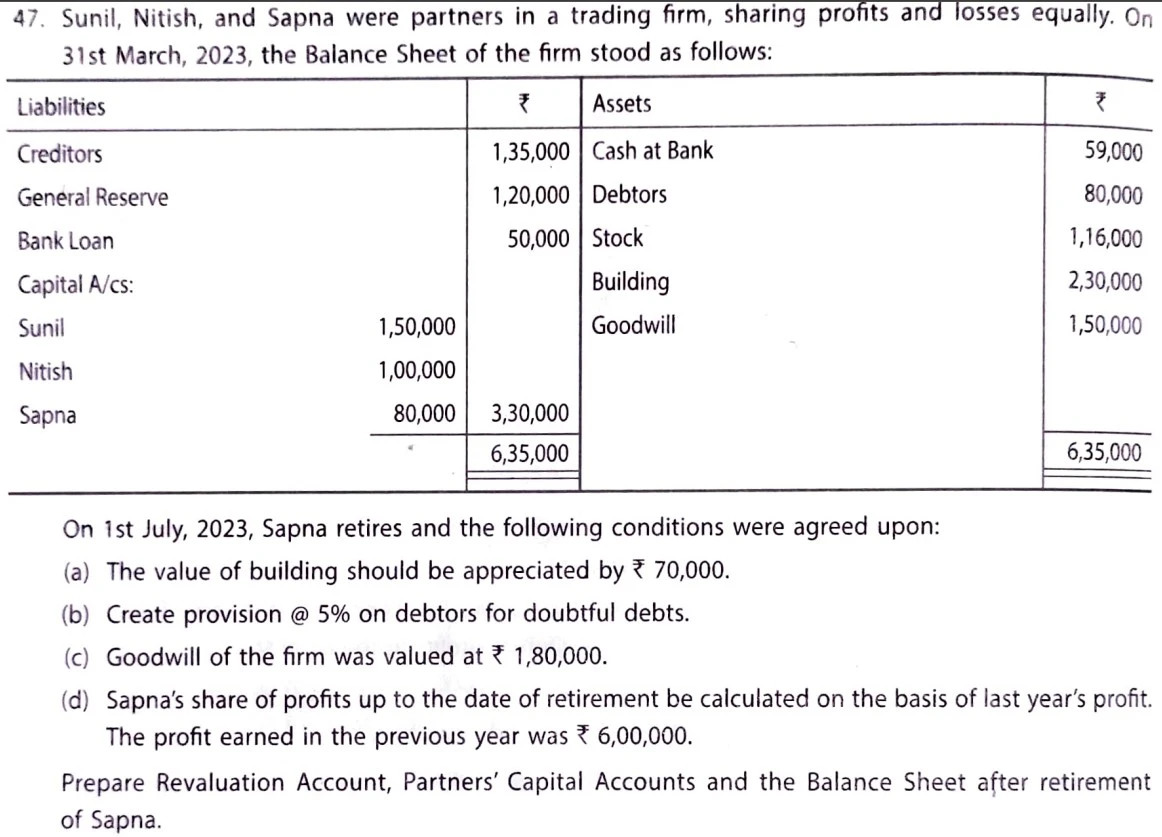

(a) The value of Building should be appreciated by ₹ 70,000.

(b) Create Provision @ 5% on debtors for doubtful debts.

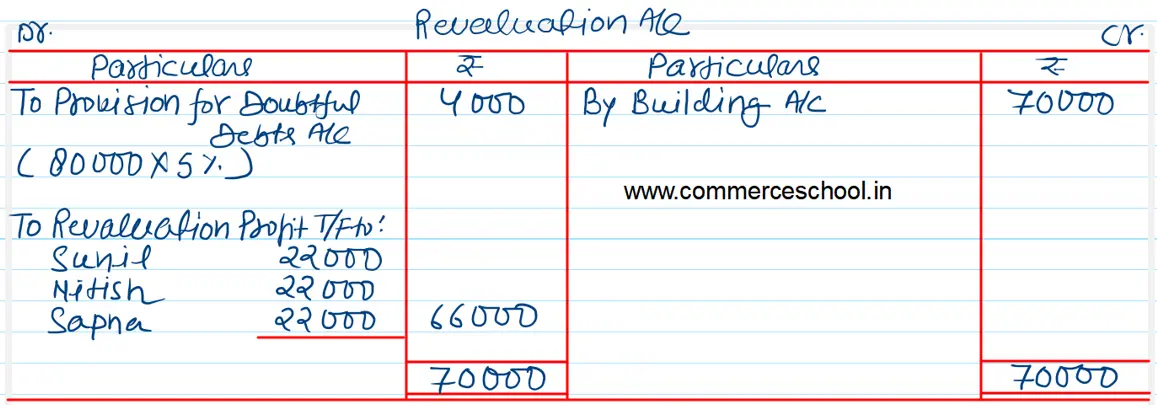

(c) Goodwill of the firm was valued at ₹ 1,80,000.

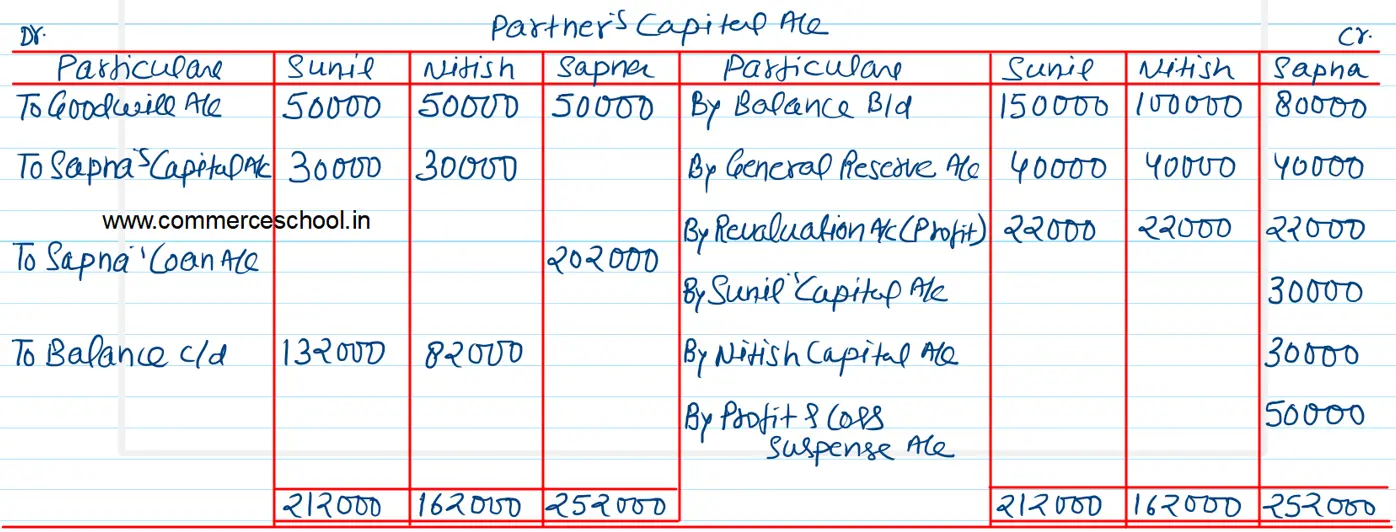

(d) Sapna’s share of profits up to the date of retirement be calculated on the basis of last year’s profit. The profit earned in the previous year was ₹ 6,00,000.

Prepare Revaluation Account, Partner’s Capital Accounts and the Balance Sheet after retirement of Sapna.