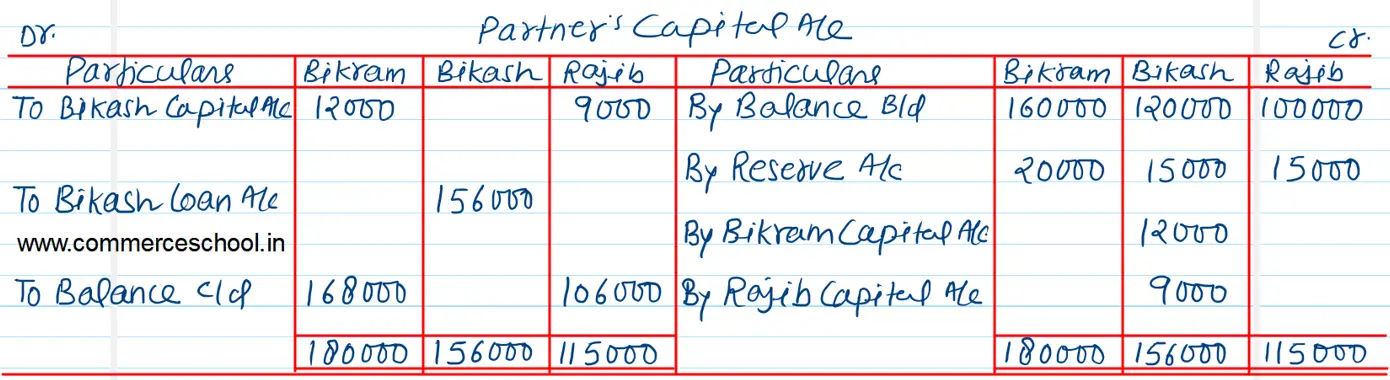

Bikram, Bikash and Rajib were partners sharing profits and losses 2/5, 3/10 and 3/10 respectively. Their Balance Sheet as at 31st March, 2023 was as follows

Bikram, Bikash and Rajib were partners sharing profits and losses 2/5, 3/10 and 3/10 respectively. Their Balance Sheet as at 31st March, 2023 was as follows:

| Liabilities | ₹ | Assets | ₹ | |

|

Capital A/cs: Bikram Bikash Rajib Reserves Bills Payable Creditors |

1,60,000 1,20,000 1,00,000 50,000 20,000 80,000 |

Building Plant Motor Car Stock Debtors Less: PDD Cash at Bank |

70,000 10,000 |

1,80,000 1,40,000 40,000 1,00,000

60,000 10,000 |

| 5,30,000 | 5,30,000 |

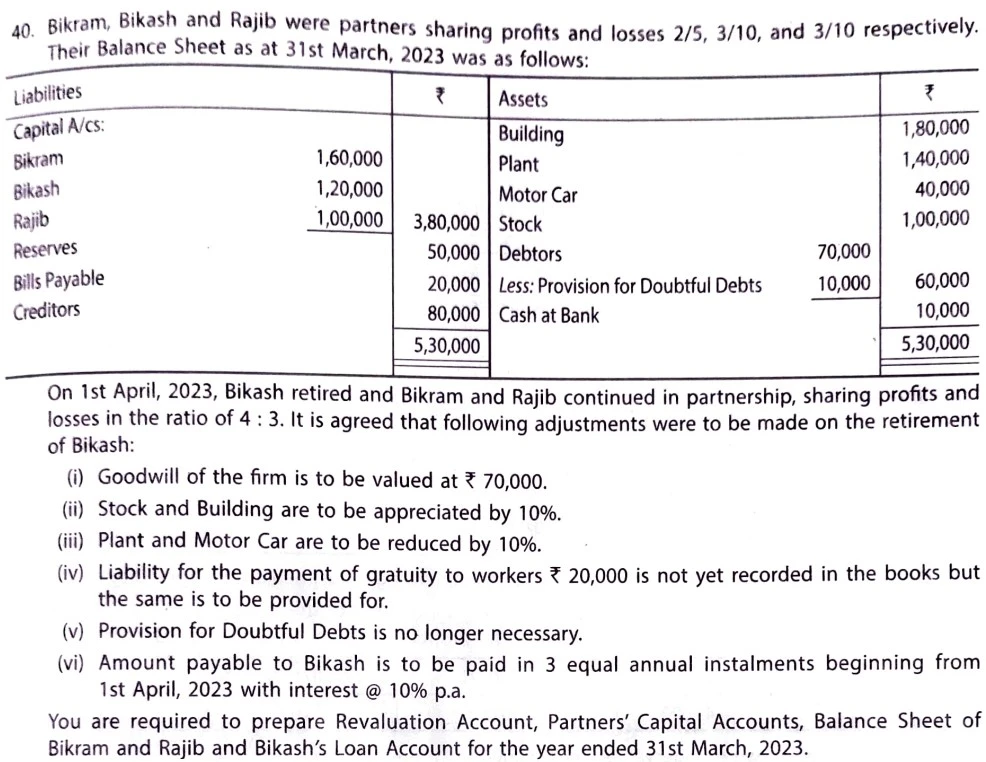

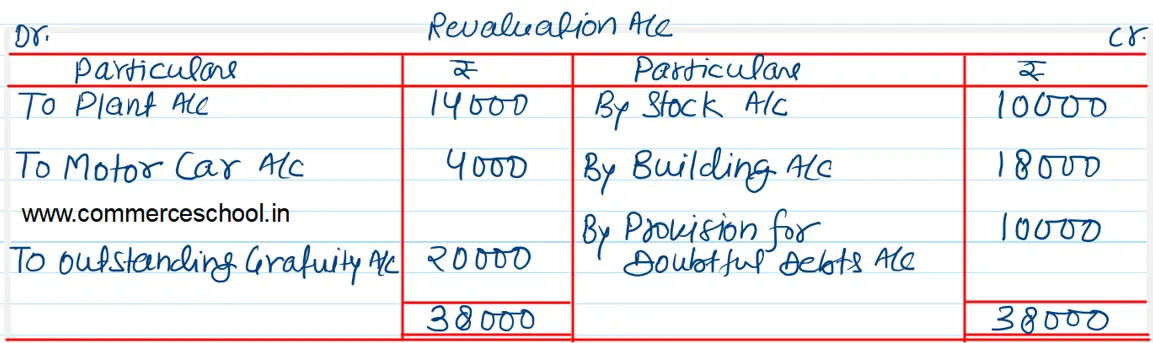

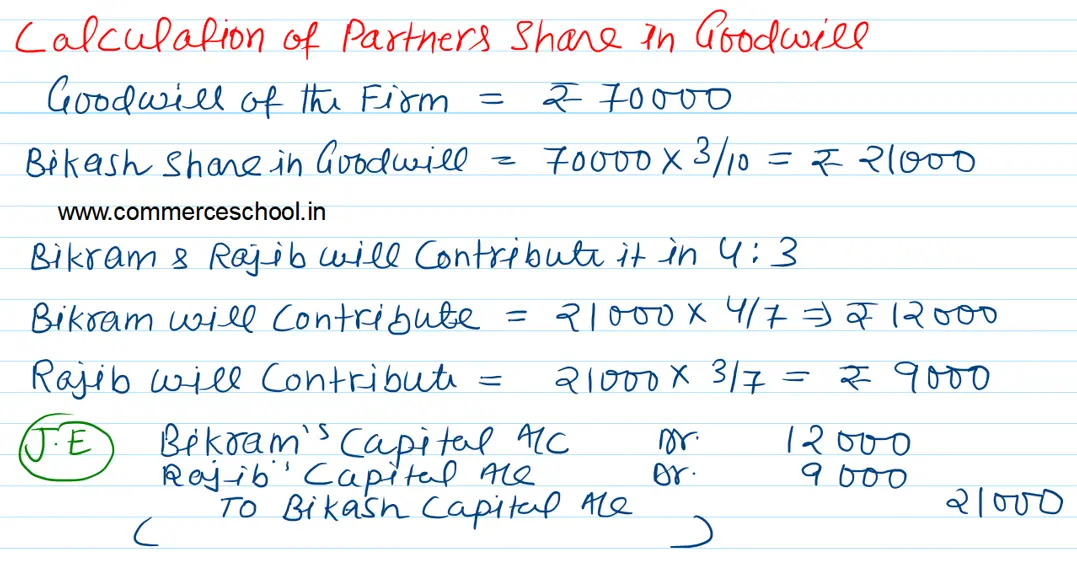

On 1st April, 2023, Bikash retired and Bikram and Rajib continued in partnership, sharing profits and losses in the ratio of 4 : 3. It is agreed that following adjustments were to be made on the retirement of Bikash:

(i) Goodwill of the firm is to be valued at ₹ 70,000.

(ii) Stock and Building are to be appreciated by 10%

(iii) Plant and Motor Car are to be reduced by 10%.

(iv) Liability for the payment of gratuity to workers ₹ 20,000 is not yet recorded in the books but the same is to be provided for.

(v) Provision for Doubtful Debts is no longer necessary.

(vi) Amount payable to Bikash is to be paid in 3 equal annual instalments beginning from 1st April, 2023 with interest @ 10% p.a.

You are required to prepare Revaluation Account, Partner’s Capital Accounts, Balance Sheet of Bikram and Rajib and Bikash’s Loan Account for the year ended 31st March, 2023.