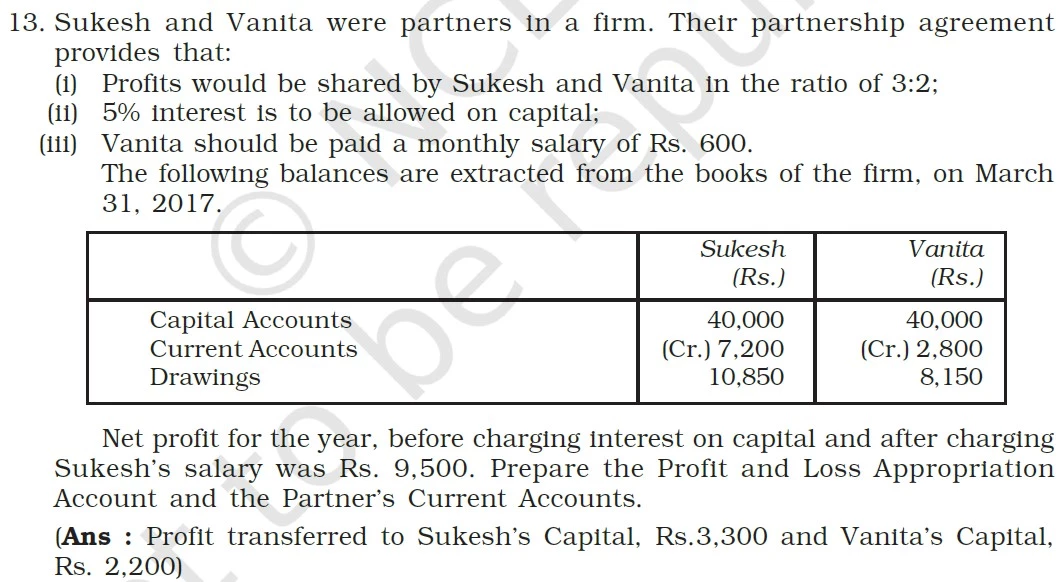

Sukesh and Vanita were partners in a firm. Their partnership agreement provides that:

Sukesh and Vanita were partners in a firm. Their partnership agreement provides that:

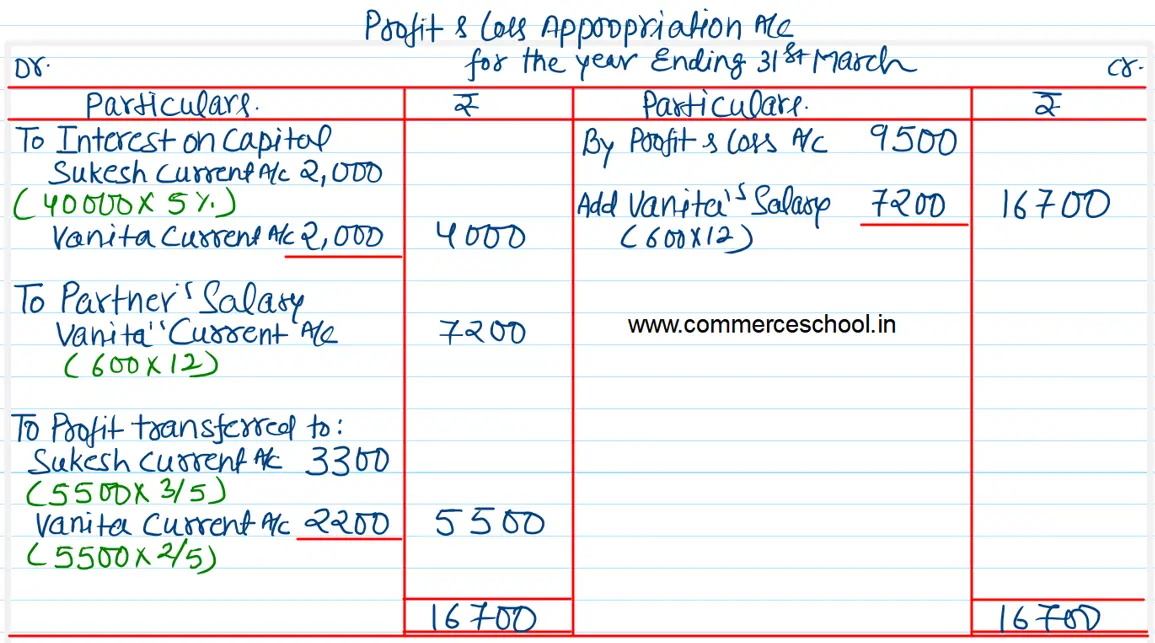

(i) Profits would be shared by Sukesh and Vanita in the ratio of 3 : 2;

(ii) 5% interest is to be allowed on capital:

(iii) Vanita should be paid a monthly salary of ₹ 600.

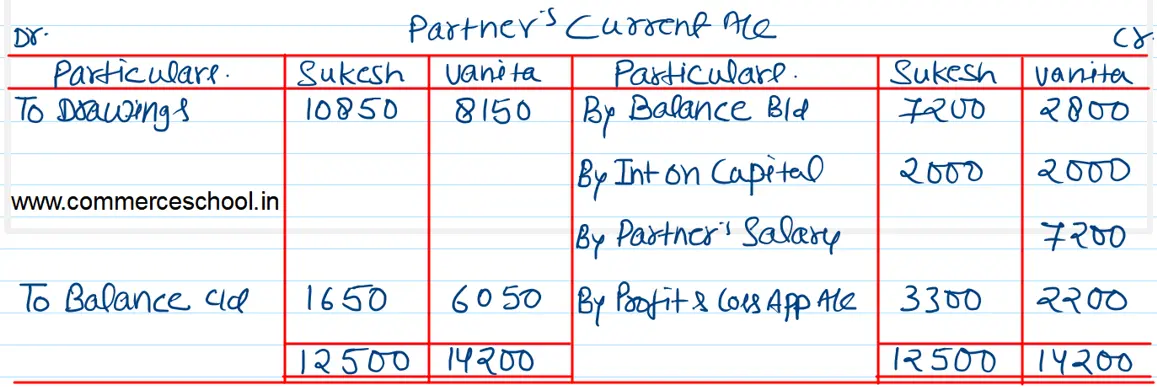

The following balances are extracted from the books of the firm, on March 31, 2017.

| Sukesh (₹) | Vanita (₹) | |

|

Capital Accounts Current Accounts Drawings |

40,000 (Cr.) 7,200 10,850 |

40,000 (Cr.) 2,800 8,150 |

Net profit for the year, before charging interest on capital and after charging Sukesh’s salary was ₹ 9,500. Prepare the Profit and Loss Appropriation Account and the Partner’s Current Accounts.

[Ans: Profit transferred to Sukesh’s Capital, ₹ 3,300 and Vanita’s Capital, ₹ 2,200]

Anurag Pathak Changed status to publish