Ramesh and Suresh were partners in a firm sharing profits in the ratio of their capitals contributed on commencement of busienss which were ₹ 80,000 and ₹ 60,000 respectively

Ramesh and Suresh were partners in a firm sharing profits in the ratio of their capitals contributed on commencement of busienss which were ₹ 80,000 and ₹ 60,000 respectively. The firm started business on April 1, 2016.

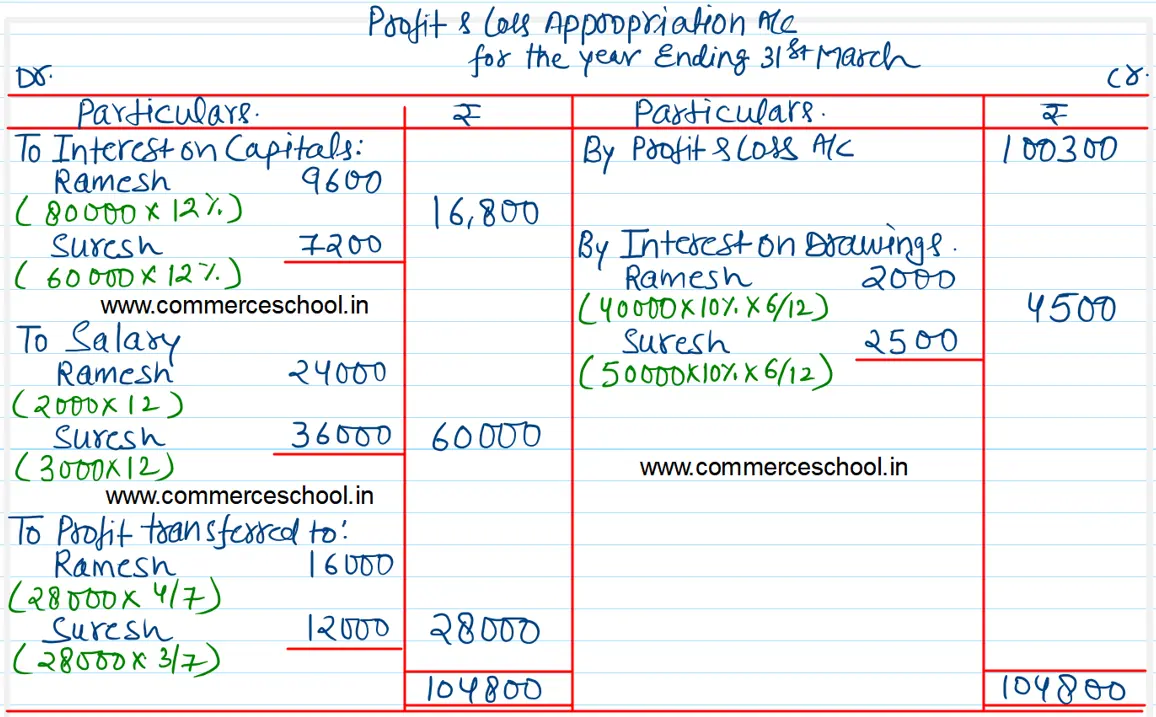

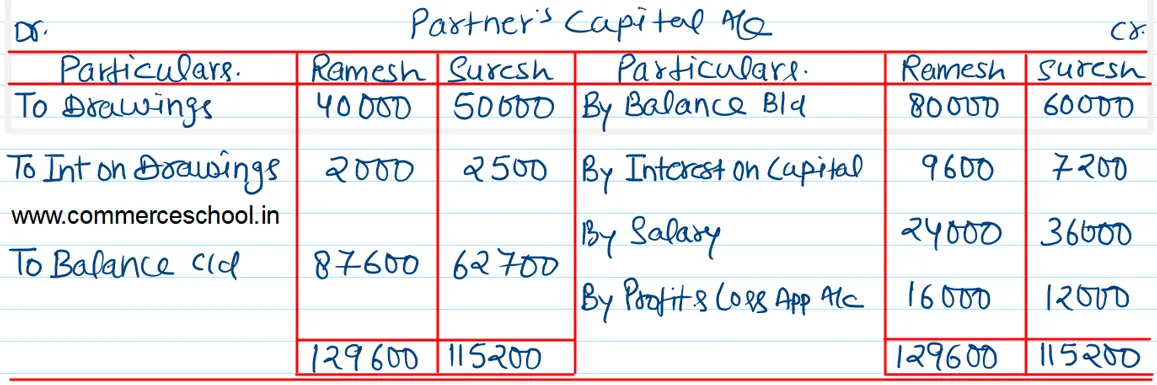

According to the partnership agreement, interest on capital and drawings are 12% and 10% p.a., respectively. Ramesh and Suresh are to get a monthly salary of ₹ 2,000 and ₹ 3,000 respectively.

The profits for year ended March 31, 2017 before making above appropriations was ₹ 1,00,300. The drawings of Ramesh and Suresh were ₹ 40,000 and ₹ 50,000, respectively. Interest on drawings amounted to ₹ 2,000 for Ramesh and ₹ 2,500 for Suresh. Parepare Profit and Loss Appropriation Account and partner’s Capital accounts, assuming that their capitals are fluctuating.

[Ans: Profit transferred to Ramesh’s Capital ₹ 16,000 and Suresh’s Capital ₹ 12,000]