A, B and C sharing profits in the proportion of 3 : 2 : 1 agreed upon dissolution of their partnership firm on 31st March, 2024 on which date their balance sheet was as under:

A, B and C sharing profits in the proportion of 3 : 2 : 1 agreed upon dissolution of their partnership firm on 31st March, 2024 on which date their balance sheet was as under:

| Liabilities | ₹ | Assets | ₹ |

|

Capital A/cs: A B |

40,000 20,000 | Machinery | 40,500 |

| Mrs. A’s Loan | 10,000 | Stock-in-trade | 7,550 |

| Creditors | 18,500 | Investments | 20,000 |

| Investments Fluctuation Fund | 6,000 | Accrued Income | 830 |

|

Debtors 9,300 Less: Provision for Doubtful Debts 600 |

8,700 | ||

| Current A/c – C | 11,500 | ||

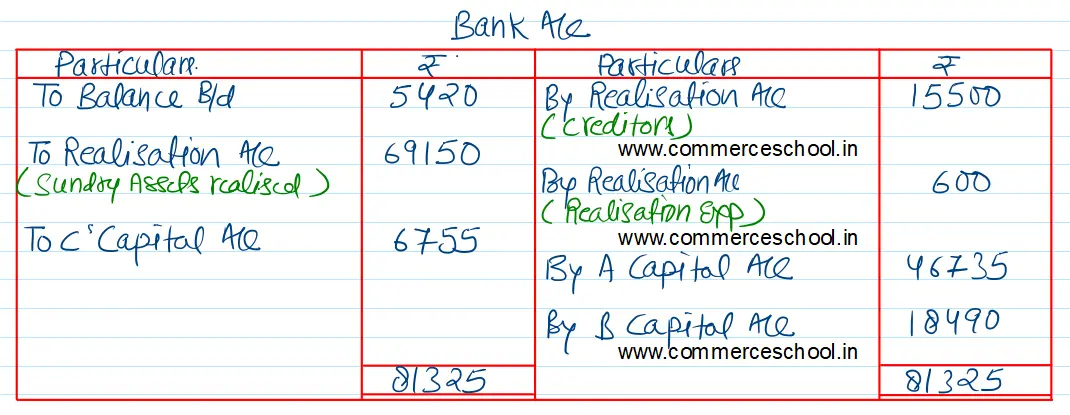

| Cash at Bank | 5,420 | ||

| 94,500 | 94,500 |

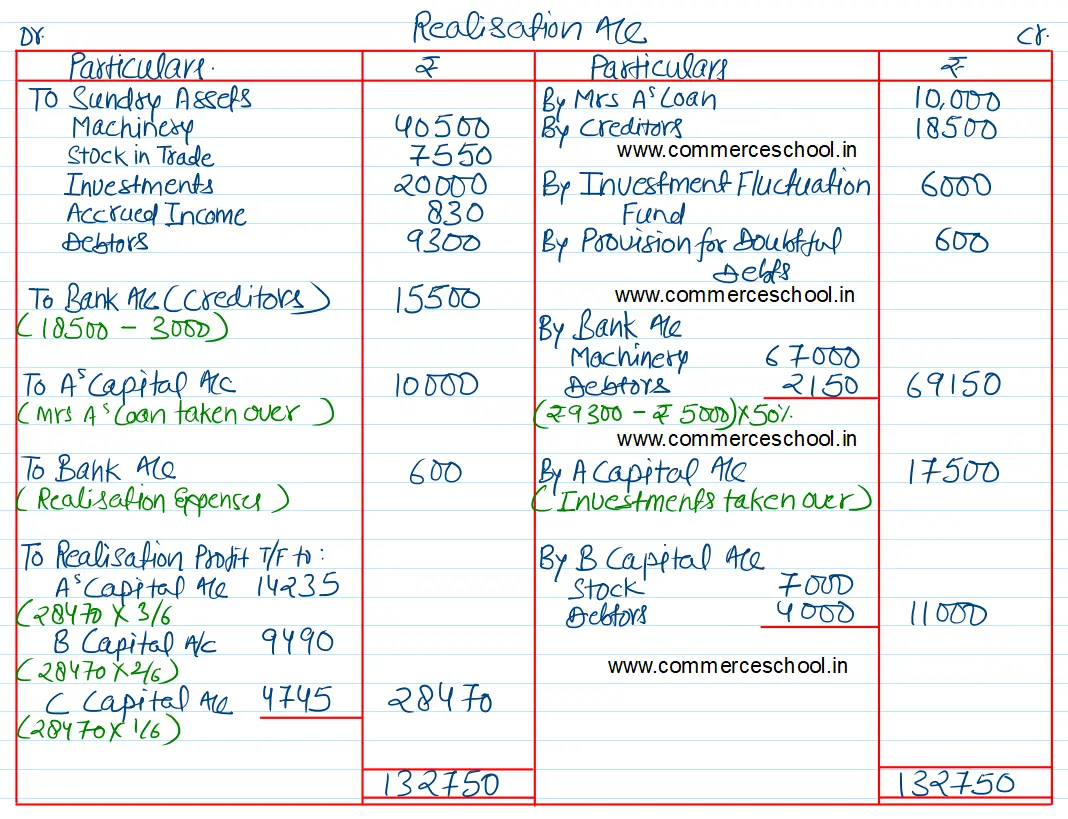

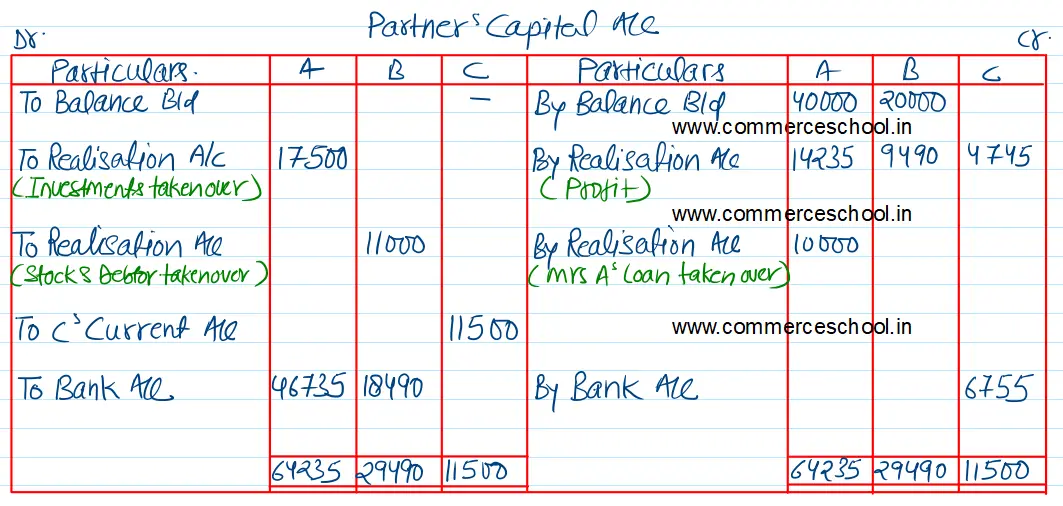

The investments are taken over by A for ₹ 17,500. A agrees to discharge his wife’s loan. B takes over all the stock at ₹ 7,000 and debtors amounting to ₹ 5,000 at ₹ 4,000. Machinery is sold for ₹ 67,000. The remaining debtors realise 50% of book value. The expenses of realisation amount to ₹ 600. It is found that an investment not recorded in the books is worth ₹ 3,000 and it is taken over by one of the creditors at this value. Show the necessary ledger accounts on completion of the dissolution of firm.

[Ans. Gain on realisation ₹ 28,470; Cash brought in by C ₹ 6,755; Payment to A ₹ 46,735 and B ₹ 18,490. Total of Bank A/c ₹ 81,325.]

Solution:-

Notes:-

(1) C’s Current A/c appears on the assets side, which means that is has a debit balance. As such, it will be transferred to the Debit Side of C’s Capital Account.

(2) Accrued income will not be realised.