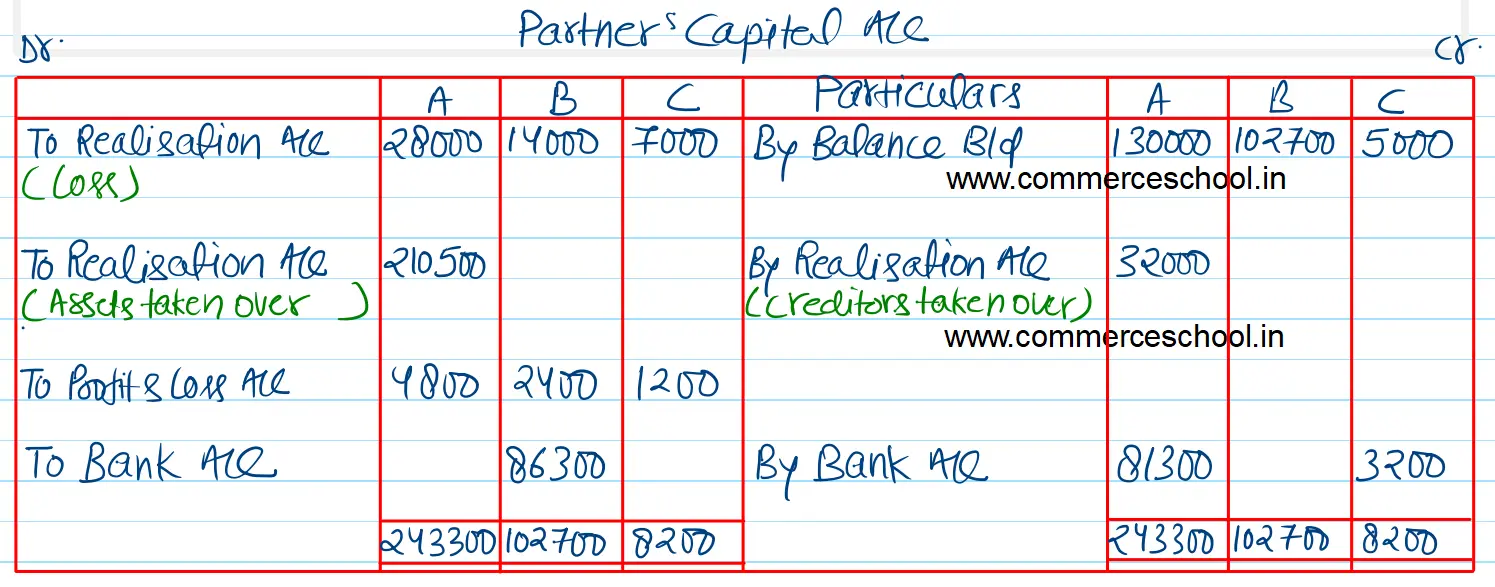

A, B and C are partners sharing profits and losses in the ratio of 4 : 2 : 1. On 31st March, 2024, their Balance Sheet was as follows:

A, B and C are partners sharing profits and losses in the ratio of 4 : 2 : 1. On 31st March, 2024, their Balance Sheet was as follows:

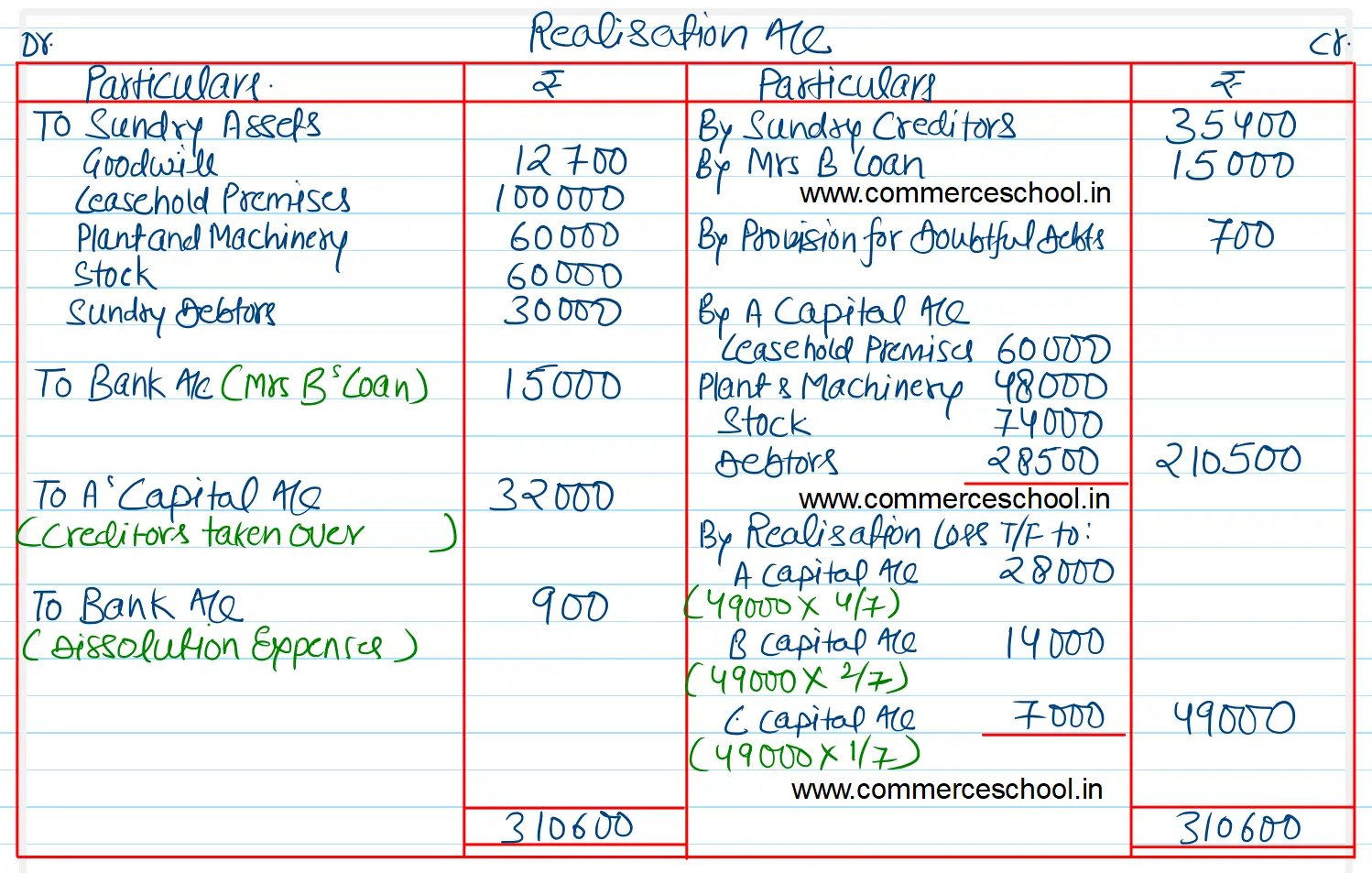

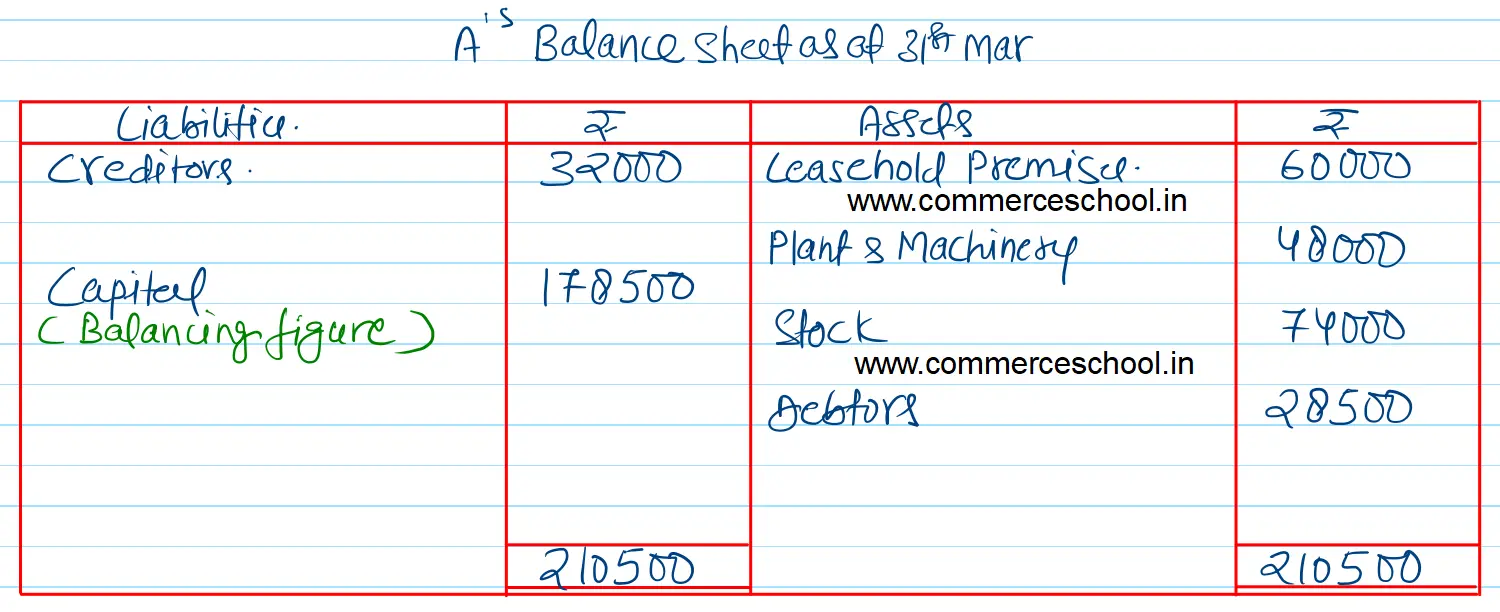

It was decided to dissolve the firm, A agreeing to take over the business (except Cash at Bank) at the following valuations:

Leasehold Premises at ₹ 60,000.

Plant and Machinery at ₹ 12,000 less than the book value.

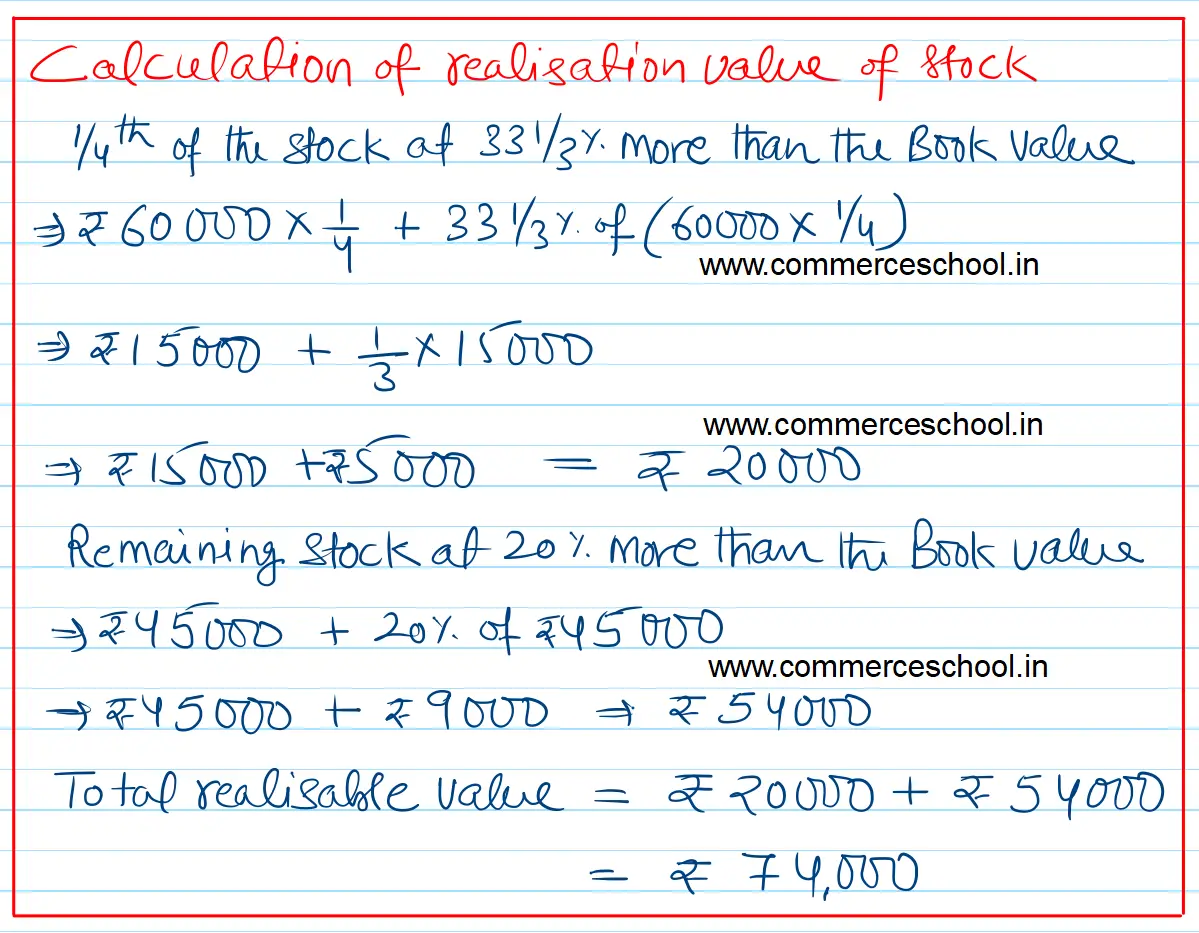

1/4th stock at 33 and 1/3% more than its book value.

Remaining stock at 20% more than the book value.

Sundry Debtors subject to a provision of 5%.

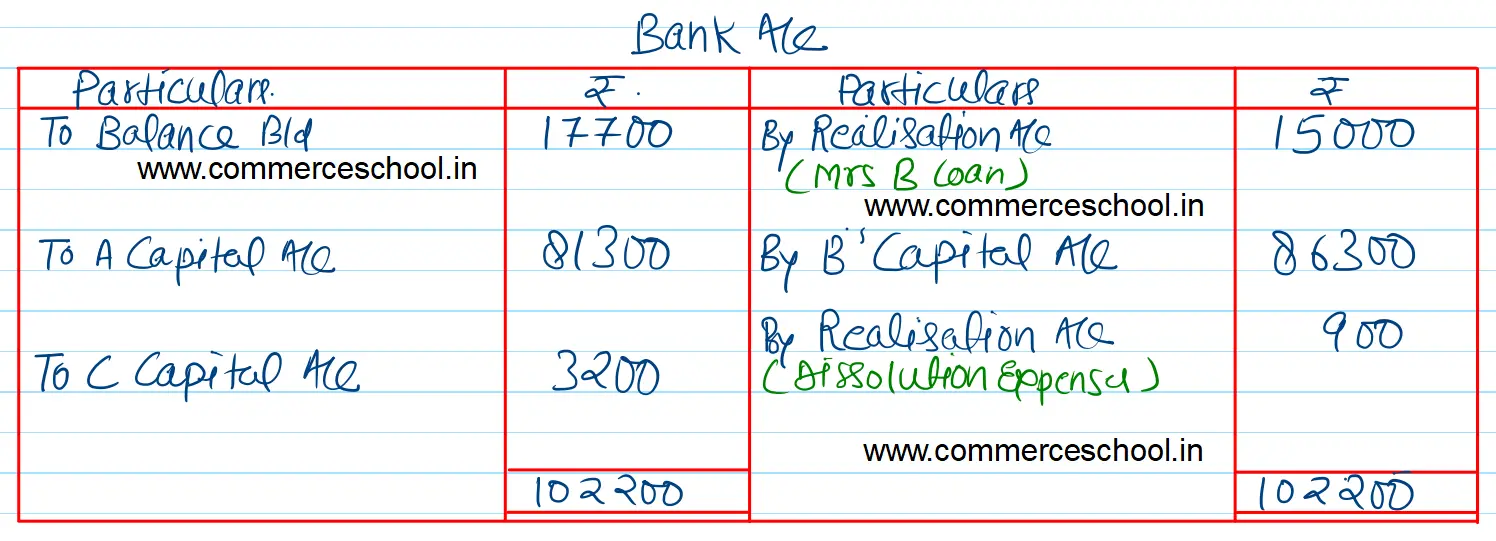

Mrs. B’s Loan was paid in full and the creditors were proved at ₹ 32,000 and were taken over by A. Expenses of dissolution came to ₹ 900.

Prepare necessary accounts to close the books of the firm and prepare the Balance Sheet of A.

[Ans. Loss on Realisation ₹ 49,000; Cash brought in by A ₹ 81,300 and By C ₹ 3,200; Cash paid to B ₹ 86,300; Total of Bank A/c ₹ 1,02,200; B/S Total ₹ 2,10,500.]

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors | 35,400 | Goodwill | |

| Mrs. B’s Loan | 15,000 | Leasehold Premises | |

| Capital Accounts: A B C | 1,30,000 1,02,700 5,000 | Plant and Machinery | |

| Stock | |||

| Sundry Debtors 30,000 Less: Provision 700 | 29,300 | ||

| Cash at Bank | 17,700 | ||

| Profit & Loss A/c | 8,400 | ||

| 2,88,100 |

Anurag Pathak Answered question