From the following information, Calculate: (i) Return on Investment Ratio. (ii) Net Assets Turnover Ratio.

From the following information, Calculate:

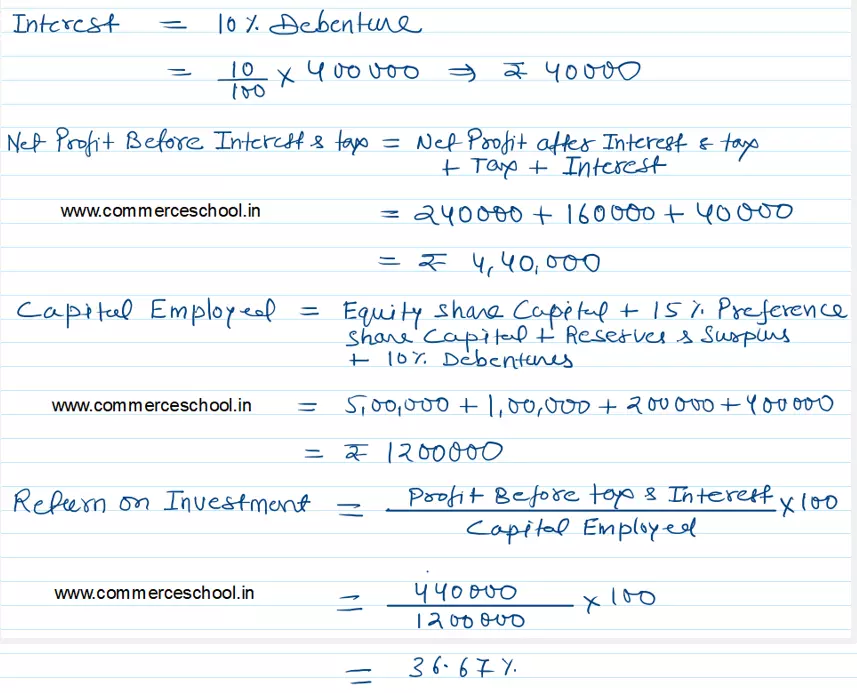

(i) Return on Investment Ratio.

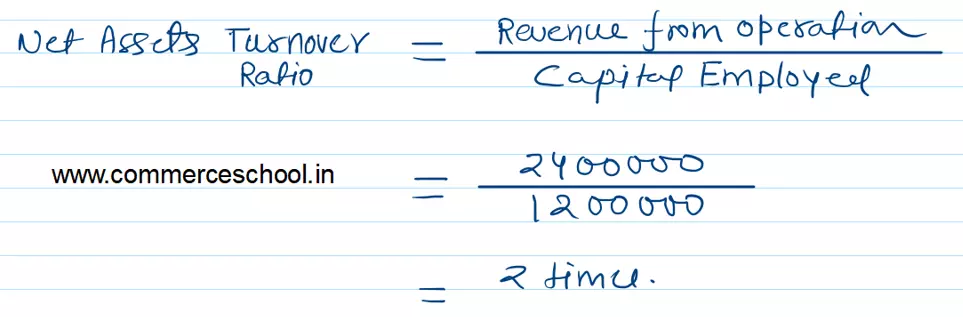

(ii) Net Assets Turnover Ratio.

[Ans.: (i) Return on Investment (ROI) = 36.67%; (ii) Net Assets of Capital Employed Turnover Ratio = 2 Times.]

| Particulars | ₹ |

| Net Profit after Interest and Tax | 2,40,000 |

| Tax | 1,60,000 |

| Net Fixed Assets: Property, Plant and Equipment, and Intangible Assets | 10,00,000 |

| Non-Current Investments (Non-Trade) | 1,00,000 |

| Equity Share capital (Face Value ₹ 10 per share) | 5,00,000 |

| 15% Preference Share Capital | 1,00,000 |

| Reserves and Surplus (including surplus of the year udner consideration) | 2,00,000 |

| 10% Debentures | 4,00,000 |

| Revenue from Operations | 24,00,000 |

Anurag Pathak Changed status to publish