There was a difference in the Trial Balance of M/s Jain & Sons, prepared for the year ended 31st March, 2009. The accountant put the difference in Suspense Account.

There was a difference in the Trial Balance of M/s Jain & Sons, prepared for the year ended 31st March, 2009. The accountant put the difference in Suspense Account.

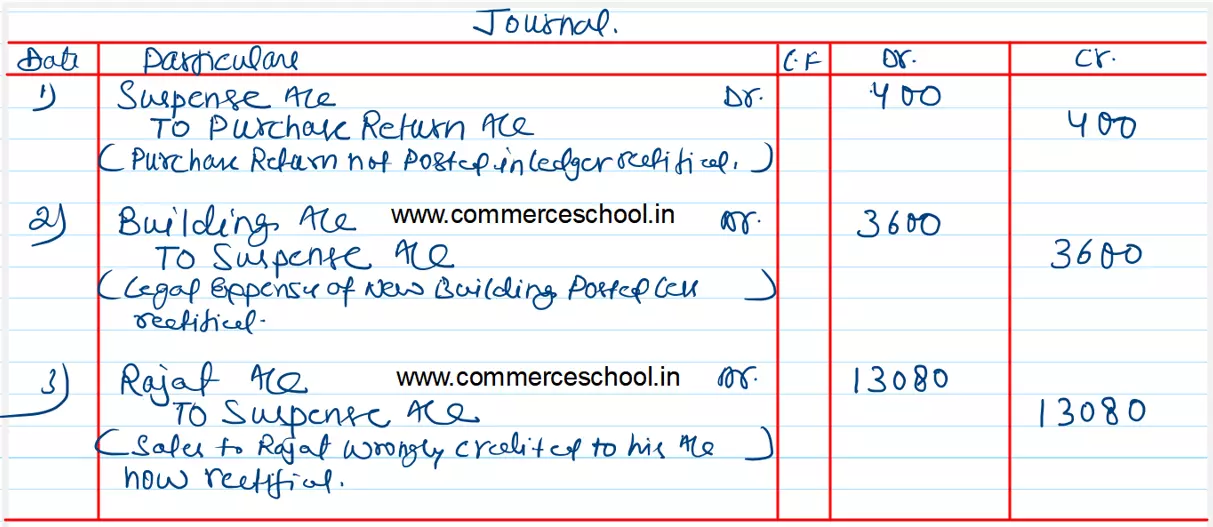

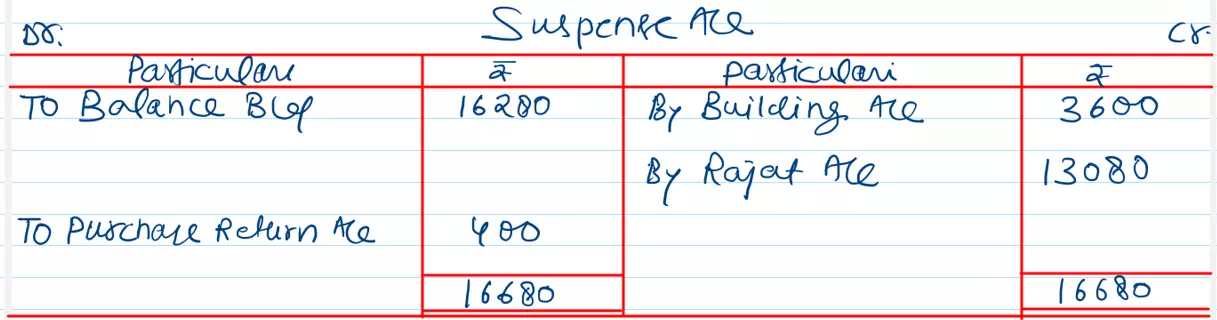

The following errors were found:

(i) Purchases Return Book total ₹ 400 has not been posted to Ledger Account.

(ii) ₹ 5,100 spent on legal expense for the newly acquired Building was debited to the Building Account as ₹ 1,500.

(iii) A sale of ₹ 6,540 to Rajat has been credited to his account.

Rectify the errors and show the Suspense Account with Nil Closing Balance.

Anurag Pathak Changed status to publish