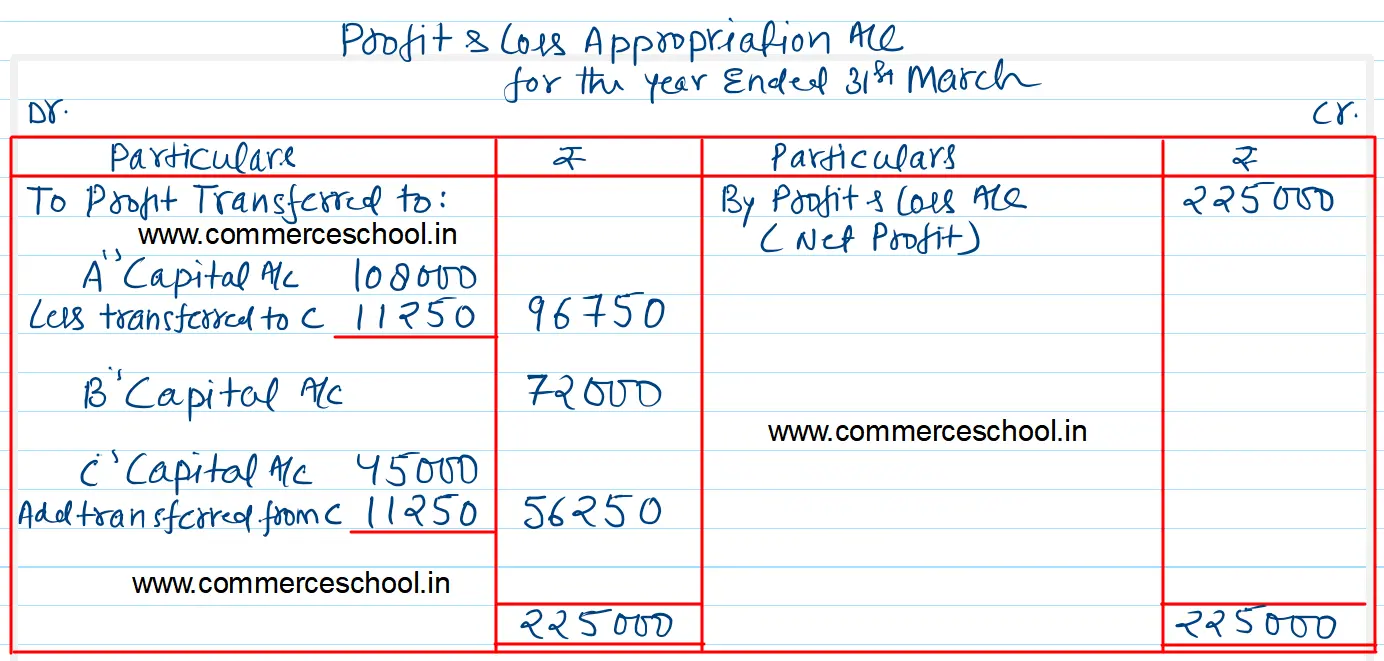

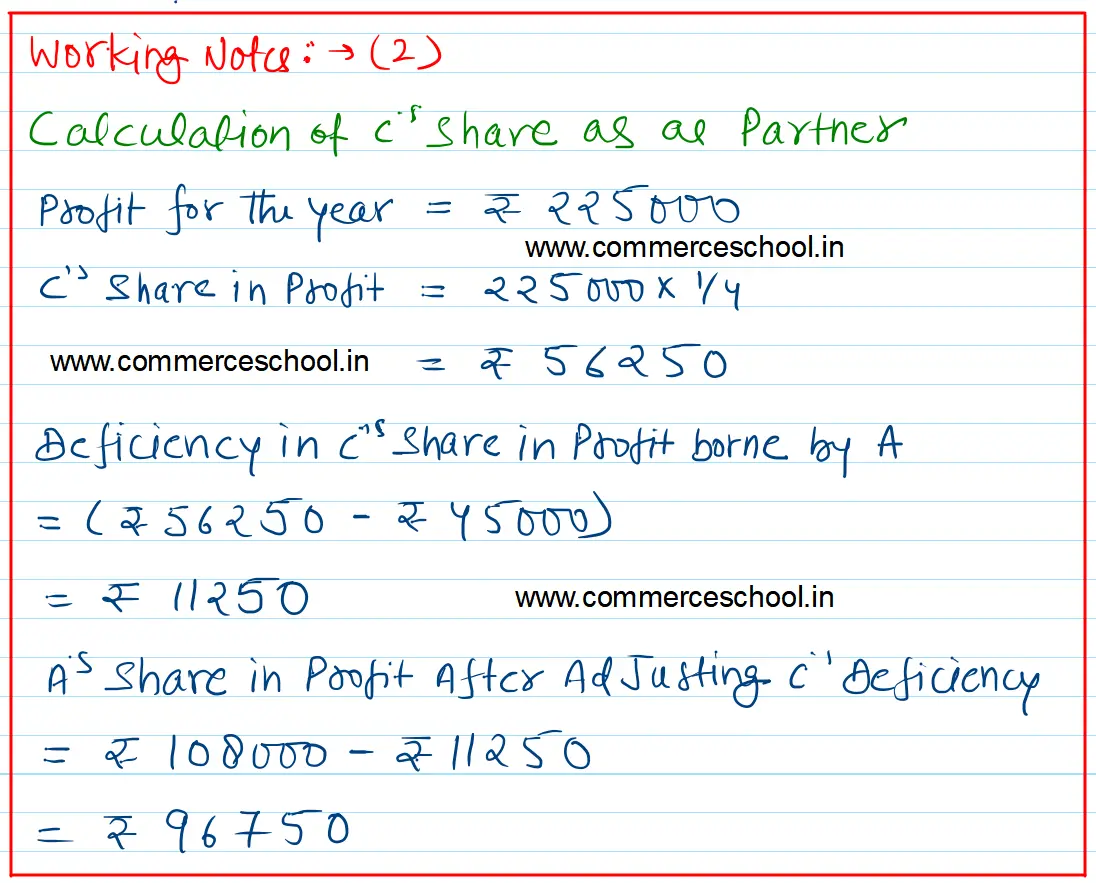

A and B are in partnership sharing profits and losses in the ratio of 3;2. They admit C, their manager, as a partner with effect from 1st April 2022, for 1/4th share of profits.

A and B are in partnership sharing profits and losses in the ratio of 3;2. They admit C, their manager, as a partner with effect from 1st April 2022, for 1/4th share of profits.

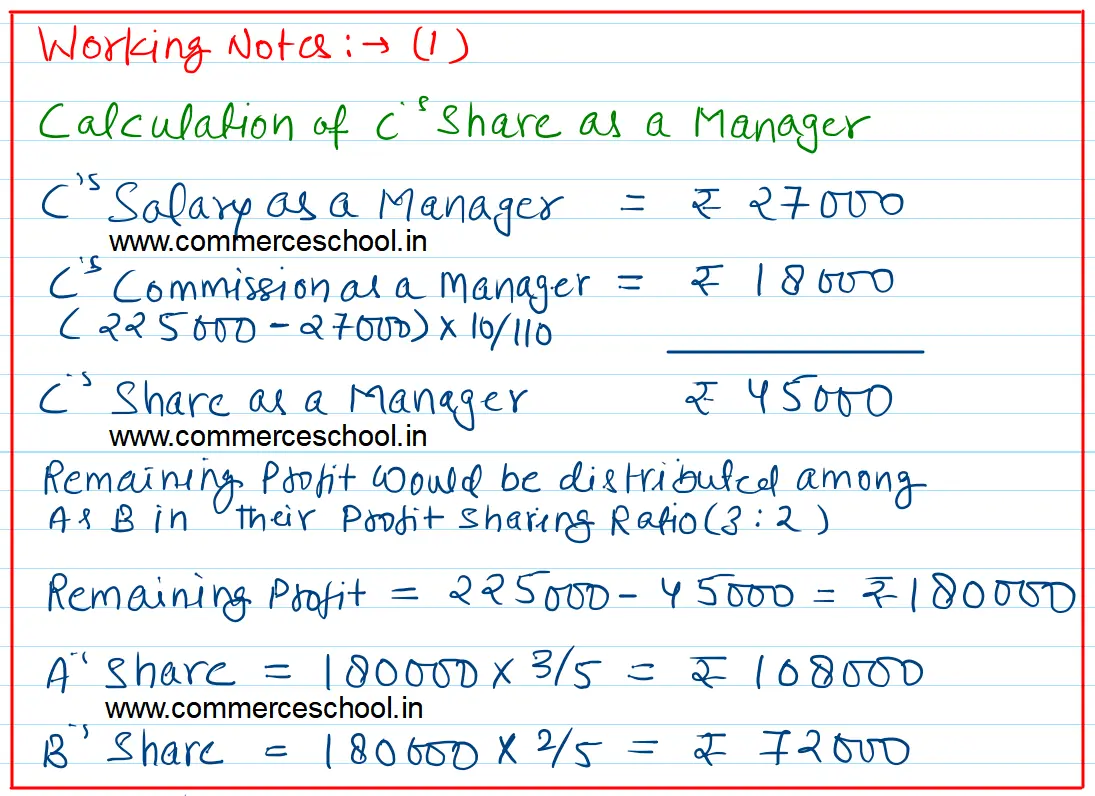

C, while a Manager, was in receipt of a salary of ₹ 27,000 p.a. and a commission of 10% of net profit after charging such salary and commission.

In terms of the Partnership deed, any excess amount, which C will be entitled to receive as a partner over the amount which would have been due to him if he continued to be the manager, will be borne by A, Profit for the year ended 31st March 2023 amounted to ₹ 2,25,000.

Prepare Profit and Loss Appropriation Account for the year ended 31st March, 2023.

Anurag Pathak Changed status to publish April 11, 2024