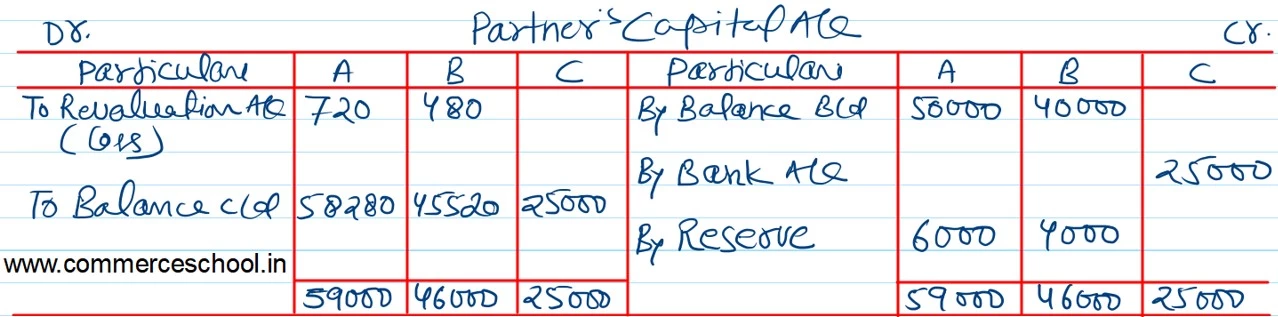

A and B are partners in a firm. Net profit of the firm is divided as follows: 1/2 to A, 1/3 to B and 1/6 carried to a Reserve. They admit C as a partner on 1st April, 2023 on which date, the Balance Sheet of the firm was:

A and B are partners in a firm. Net profit of the firm is divided as follows: 1/2 to A, 1/3 to B and 1/6 carried to a Reserve. They admit C as a partner on 1st April, 2023 on which date, the Balance Sheet of the firm was:

| Liabilities | ₹ | Assets | ₹ |

| Capital A/cs:

A B Reserve Creditors Outstanding Expenses |

50,000

40,000 10,000 20,000 5,000 |

Building

Plant and Machinery Stock Debtors Bank |

50,000

30,000 18,000 22,000 5,000 |

| 1,25,000 | 1,25,000 |

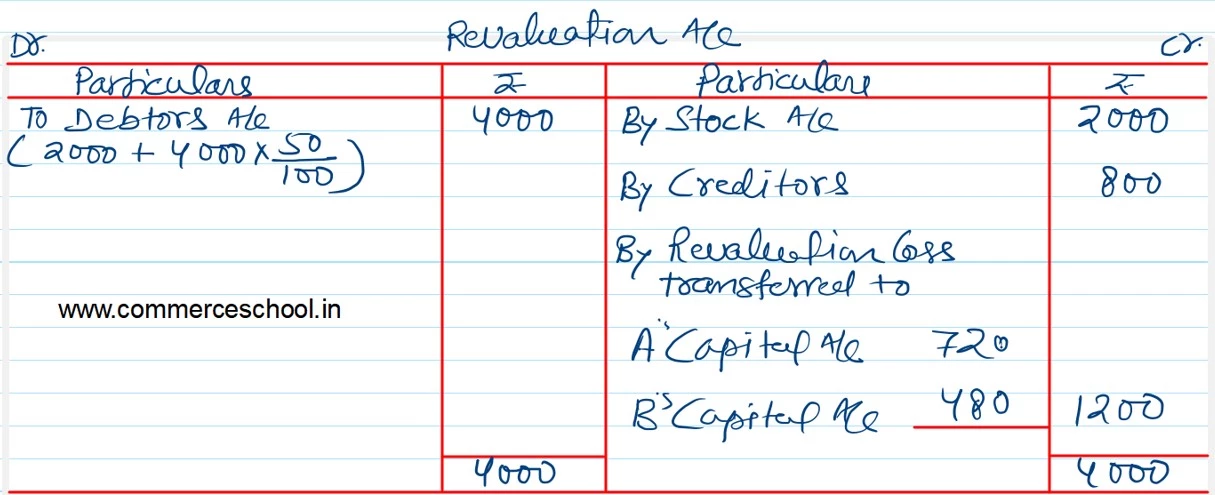

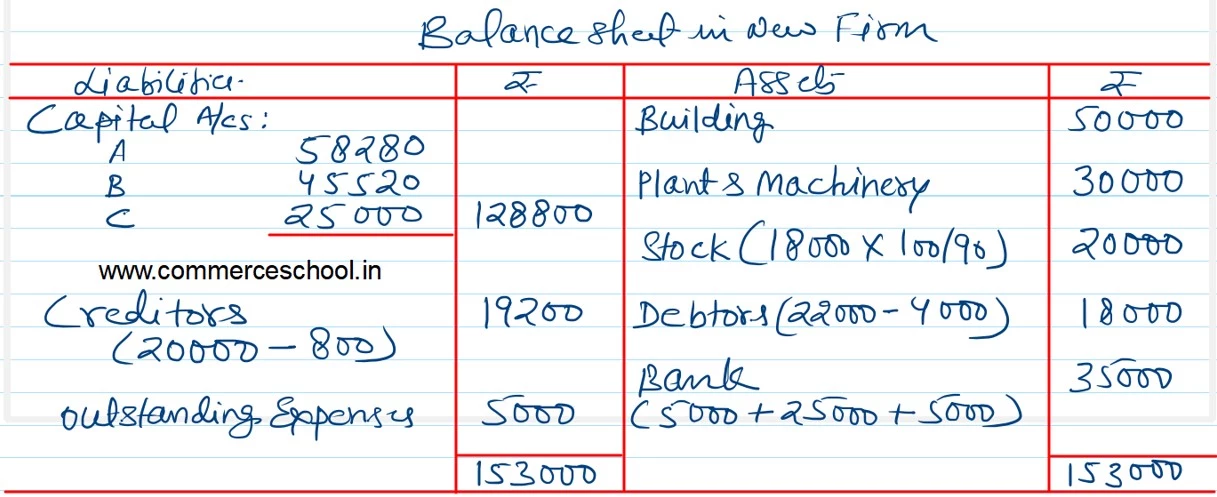

Following are the required adjustments on admission of C:

a) C brings in ₹ 25,000 towards his capital

b) C also brings in ₹ 5,000 for 1/5th share of goodwill.

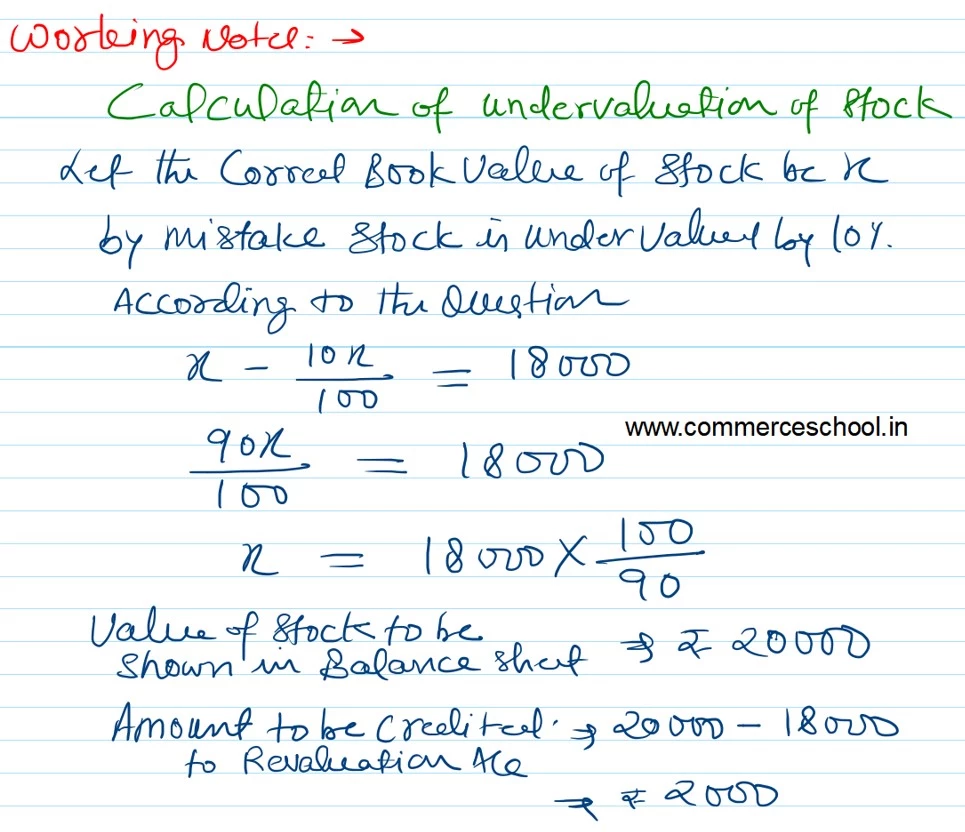

c) Stock is undervalued by 10%.

d) Creditors include a liability of ₹ 4,000, which has been decided by the court at ₹ 3,200.

e) In regard to the Debtors, the following Debts proved Bad or Doubtful

₹ 2,000 due from X – Bad to the full extent;

₹ 4,000 due from Y – insolvent, estate expected to pay only 50%

You are required to prepare Revaluation Account, Partner’s Capital Accounts and Balance Sheet of the new firm.