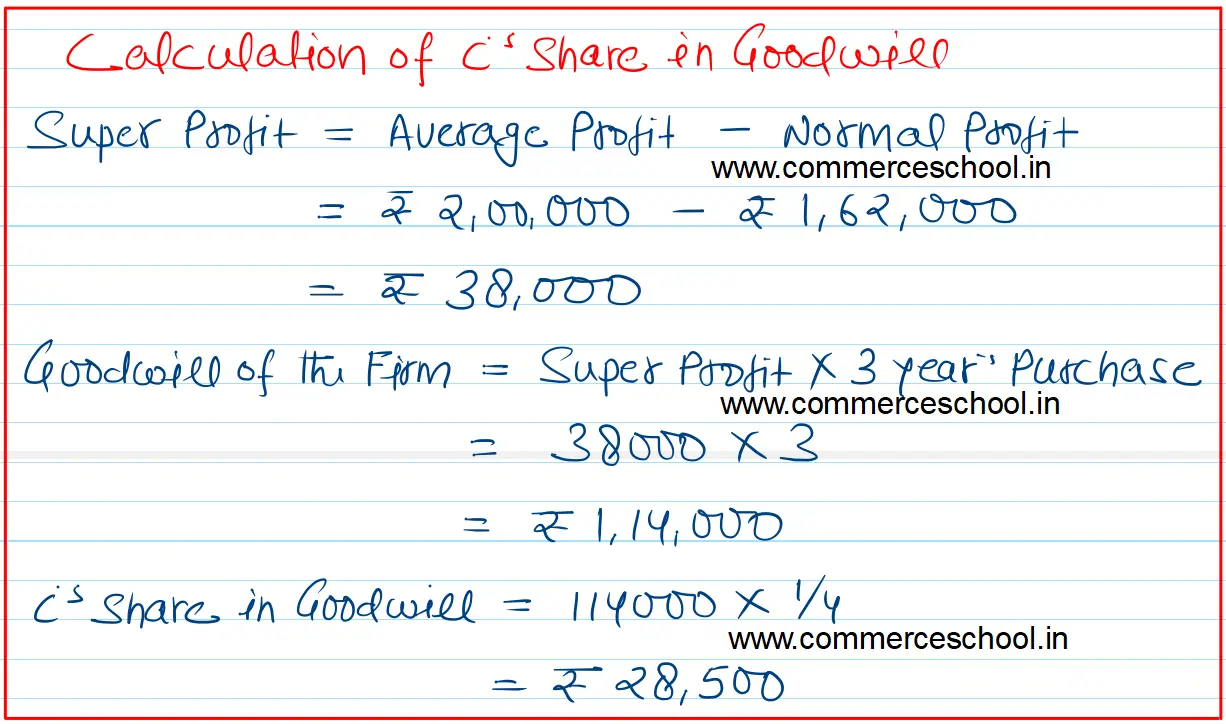

A and B are partners. They admit C for 1/4th share in profits. For this purpose goodwill is to be valued at three year’s purchase of super profits.

A and B are partners. They admit C for 1/4th share in profits. For this purpose goodwill is to be valued at three year’s purchase of super profits.

Following information is provided to you:

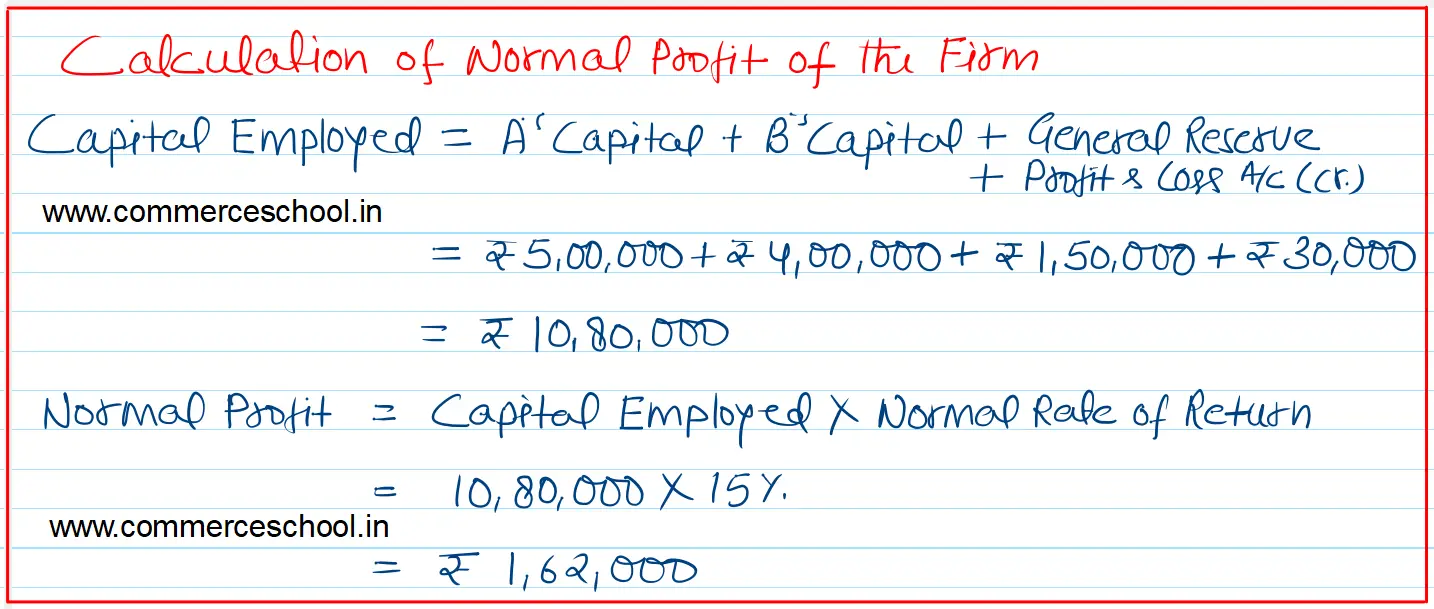

The normal rate of return is 15% p.a. Average Profits are ₹ 2,00,000 per year. You are required to calculate C’s share of goodwill.

[Ans. C’s share of goodwill ₹ 28,500.]

| ₹ | |

| A’s Capital | 5,00,000 |

| B’s Capital | 4,00,000 |

| General Reserve | 1,50,000 |

| Profit & Loss A/c (Cr.) | 30,000 |

| Sundry Assets | 12,00,000 |

Anurag Pathak Answered question July 12, 2024