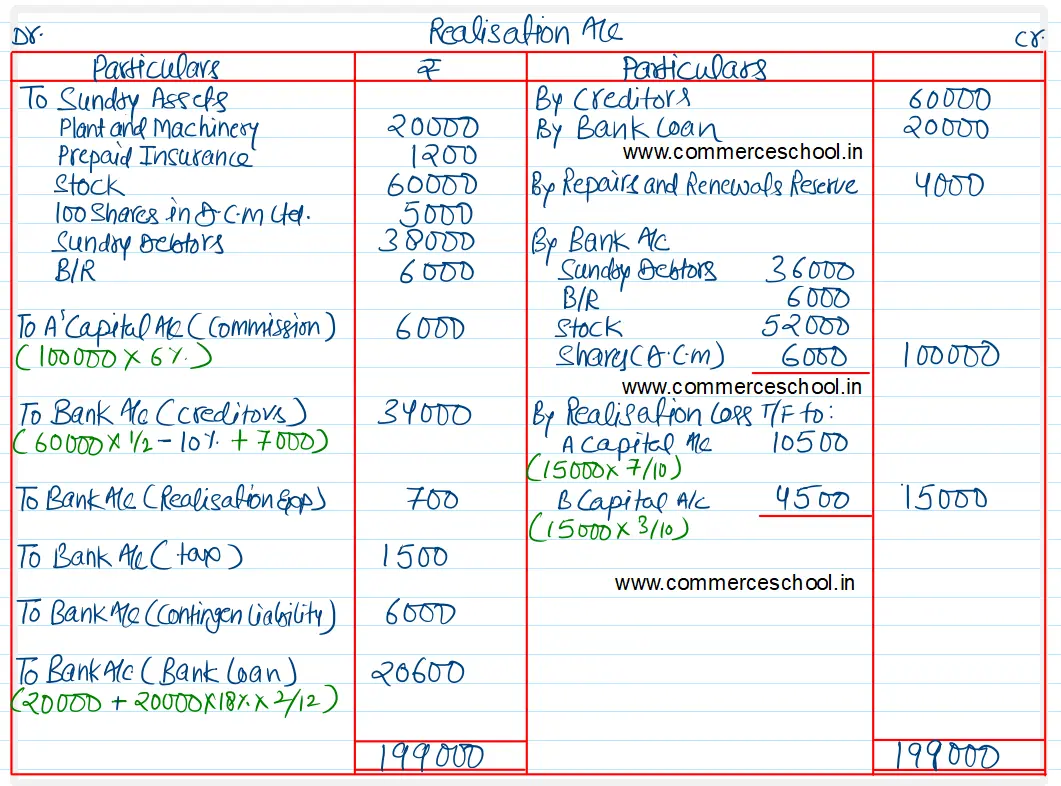

A and B shared profits in the ratio of 7 : 3. They dissolved the partnership and appointed A to realise the assets. A is to receive 6% commission on the amount realised from stock, Debtors, B/R and Shares

A and B shared profits in the ratio of 7 : 3 They dissolved the partnership and appointed A to realise the assets. A is to receive 6% commission on the amount realised from stock, Debtors, B/R and Shares.

The position of the firm was as follows:

Information:

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 60,000 | Plant and Machinery | 20,000 |

| Repairs and Renewals Reserve | 4,000 | Prepaid Insurance | 1,200 |

| Bank Loan | 20,000 | Stock | 60,000 |

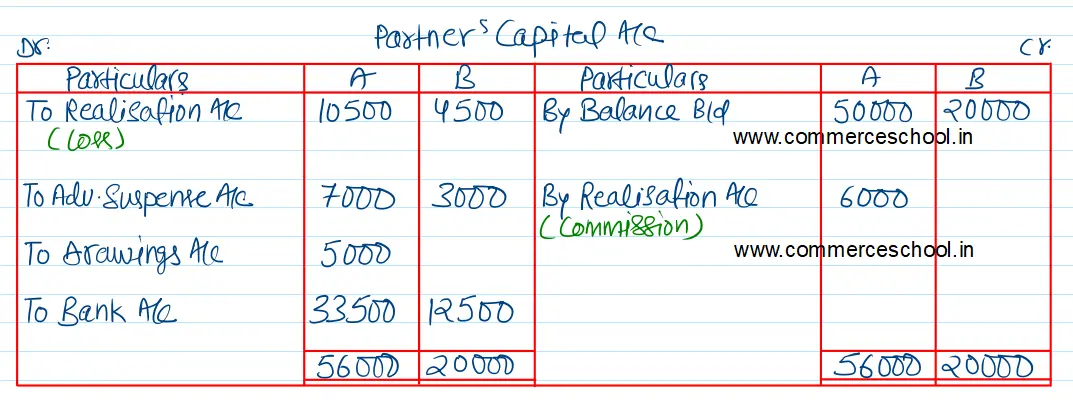

| A’s Capital A/c B’s Capital A/c | 50,000 20,000 | 100 Shares in D.C.M Ltd | 5,000 |

| Sundry Debtors | 38,000 | ||

| B/R | 6,000 | ||

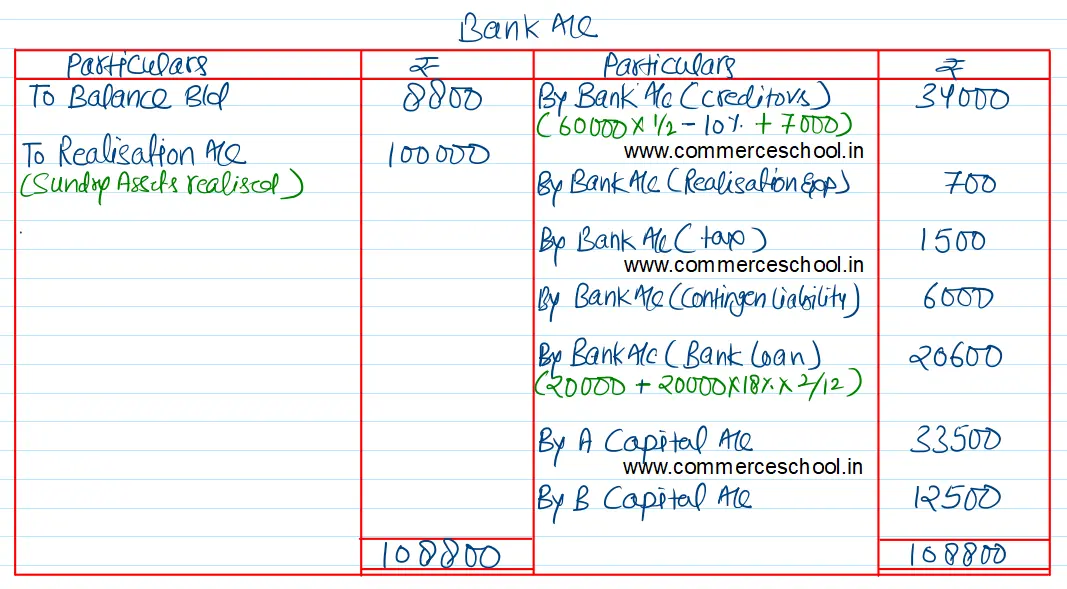

| Cash at Bank | 8,800 | ||

| A’s Drawings | 5,000 | ||

| Advertisement Suspense A/c | 10,000 | ||

| 1,54,000 | 1,54,000 |

- A realised the assets as follows:- Full amount from Sundry Debtors and B/R except from one for ₹ 2,000 being insolvent. Stock realised ₹ 52,000; Shares in D.C.M were sold for ₹ 60 each.

- Half the trade creditors accepted plant and machinery at an agreed valuation of 10% less than the book value and cash of ₹ 7,000 in full settlement of their claims.

- Remaining creditors were paid off at a discount of 10%. Expenses of realisation amounted to ₹ 700.

- On quarter’s tax amounting to ₹ 1,500 was due and had to be paid.

- There was a contingent liability amounting to ₹ 13,000. It was settled for ₹ 6,000.

- Bank Loan was discharged along with interest due for two months @ 18% p.a.

Anurag Pathak Answered question