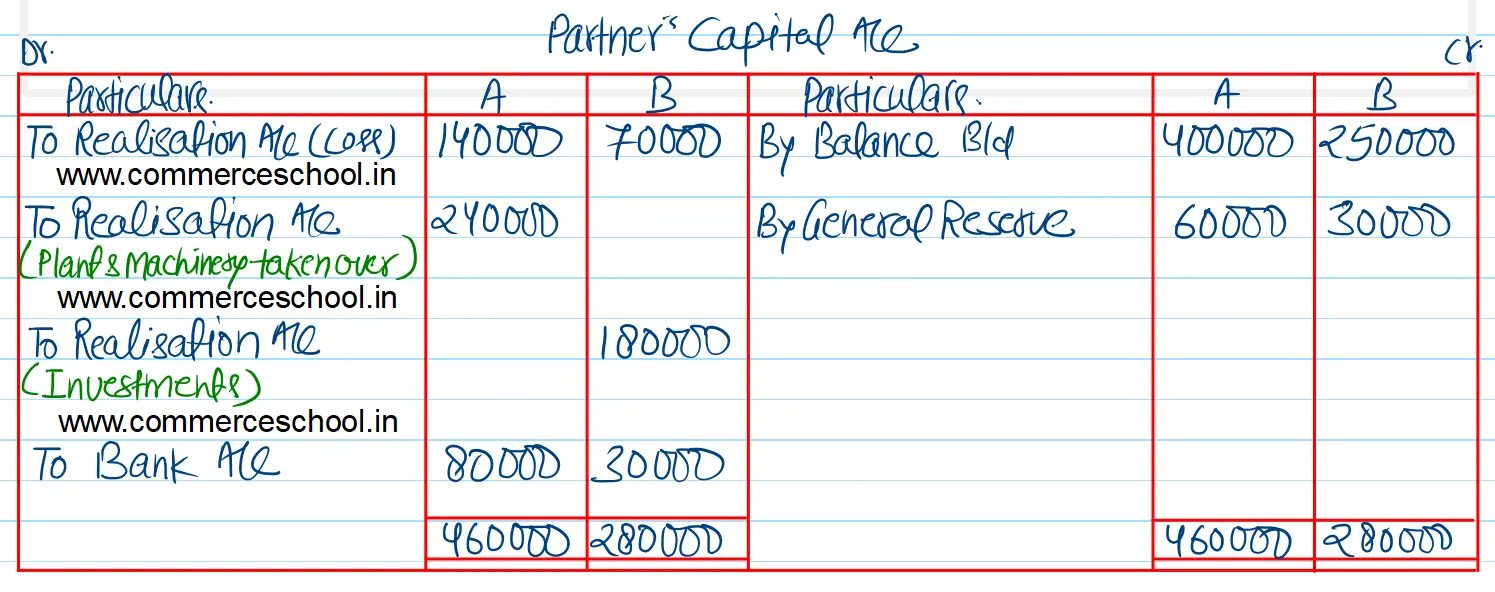

A and B were partners sharing profits and losses in 2 : 1. Their Balance Sheet as at 31st March, 2023 was as follows:

A and B were partners sharing profits and losses in 2 : 1. Their Balance Sheet as at 31st March, 2023 was as follows:

| Liabilities | ₹ | Assets | ₹ |

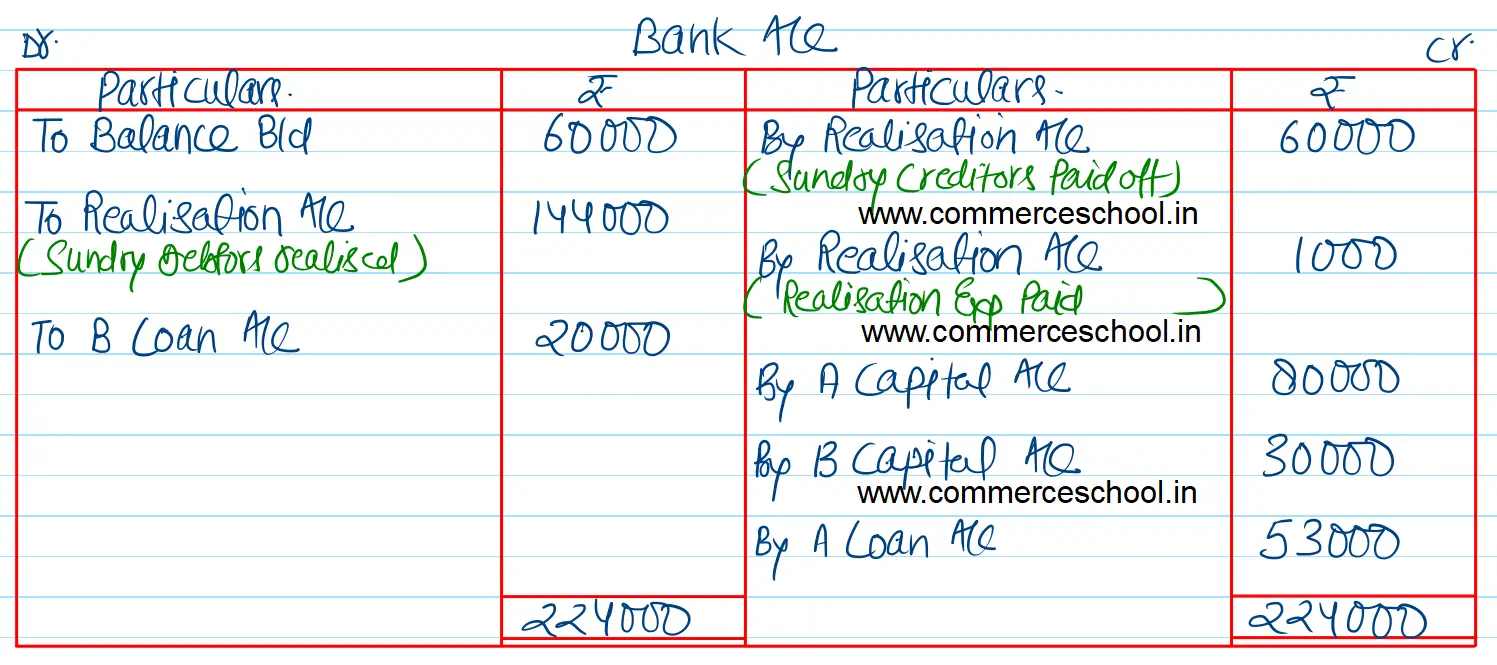

| Sundry Creditors | 2,10,000 | Cash at Bank | 60,000 |

| A’s Loan @ 12% p.a. | 50,000 |

Sundry Debtors 1,80,000 Less: Provision for Doubtful Debts 10,000 |

1,70,000 |

| General Reserve | 90,000 | Stock | 2,00,000 |

|

A’s Capital B’s Capital |

4,00,000 2,50,000 |

Investments | 1,50,000 |

| Plant & Machinery | 4,00,000 | ||

| B’s Loan | 20,000 | ||

| 10,00,000 | 10,00,000 |

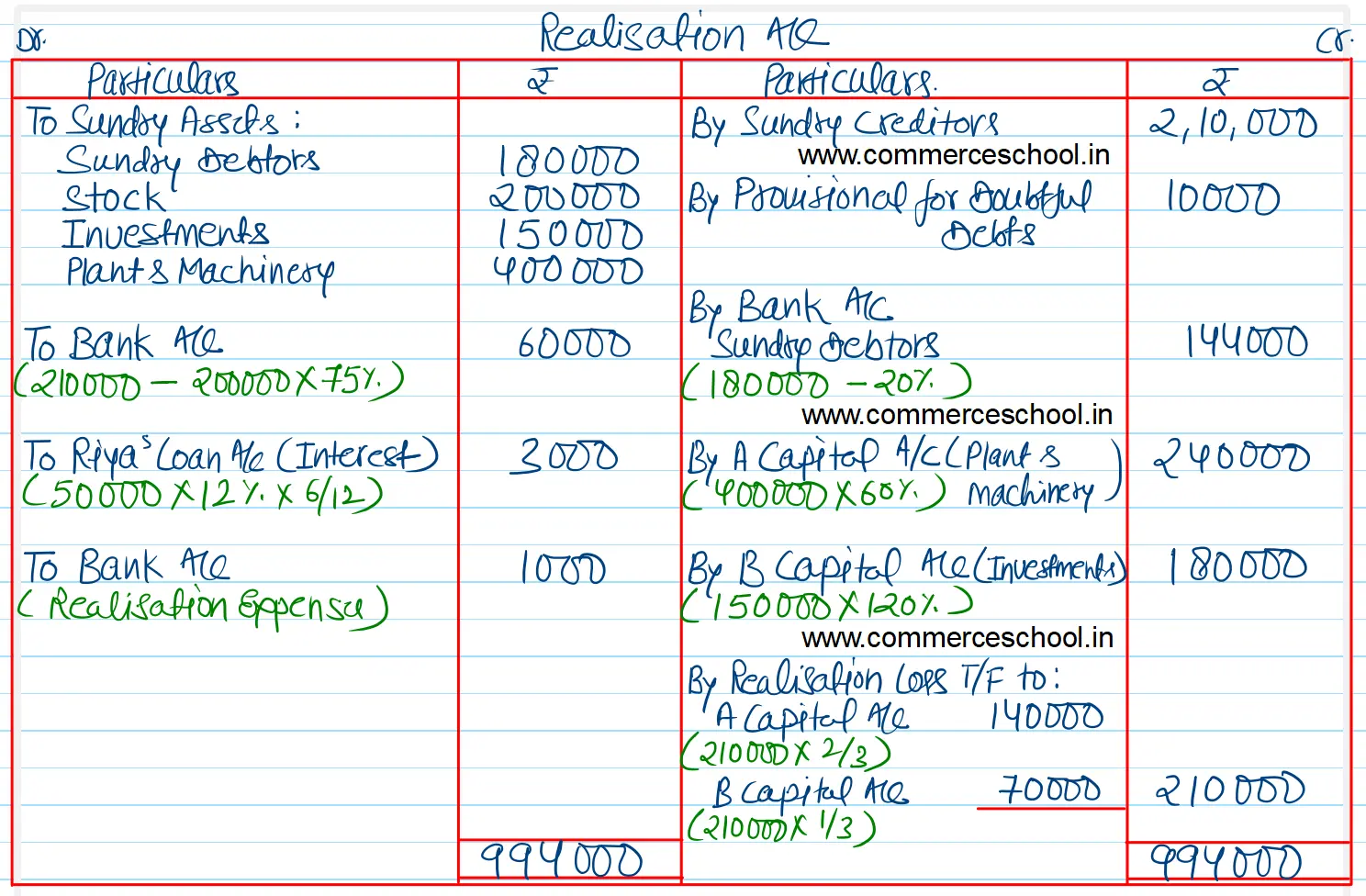

Partners decide to dissolve the firm on the above date. Assets and liabilities realised as follows:

(i) Plant & Machinery was taken over by A at 60% of the book value.

(ii) Investments were taken over by B at 120%.

(iii) Sundry Creditors were paid off by giving them stock at 75% of the books value and the balance in cash.

(iv) Debtors realised 20% less of the amount due from them.

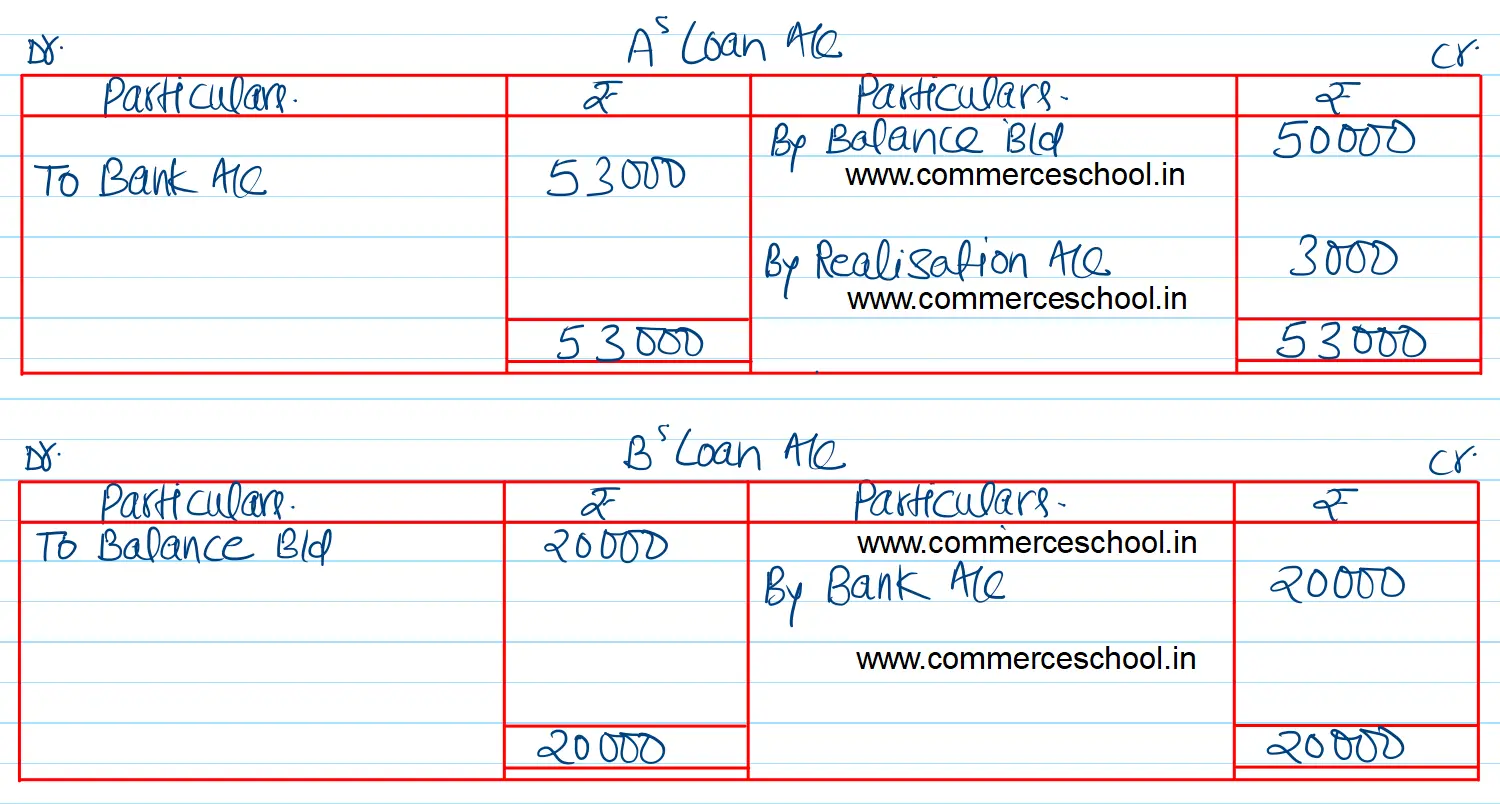

(v) A’s loan was paid off with interest for six months.

(vi) Realisation expenses amounted to ₹ 1,000.

You are required to prepare:

(a) Realisation Account

(b) A’s Loan Account and B’s Loan Account.

(c) Partner’s Capital Accounts, and

(d) Bank Account.

[Ans. Loss on Realisation ₹ 2,10,000; Final Payment to A ₹ 80,000 and B ₹ 30,000; Total of Bank Account ₹ 2,24,000.]