A, B and C are in partnership sharing profits and losses in the proportions of 1/2, 1/3 and 1/6 respectively. On 31st January, 2024 they decide to dissolve the partnership, and the position of the firm on this date is represented by the following Balance Sheet

A, B and C are in partnership sharing profits and losses in the proportions of 1/2, 1/3 and 1/6 respectively. On 31st January, 2024 they decide to dissolve the partnership, and the position of the firm on this date is represented by the following Balance Sheet:

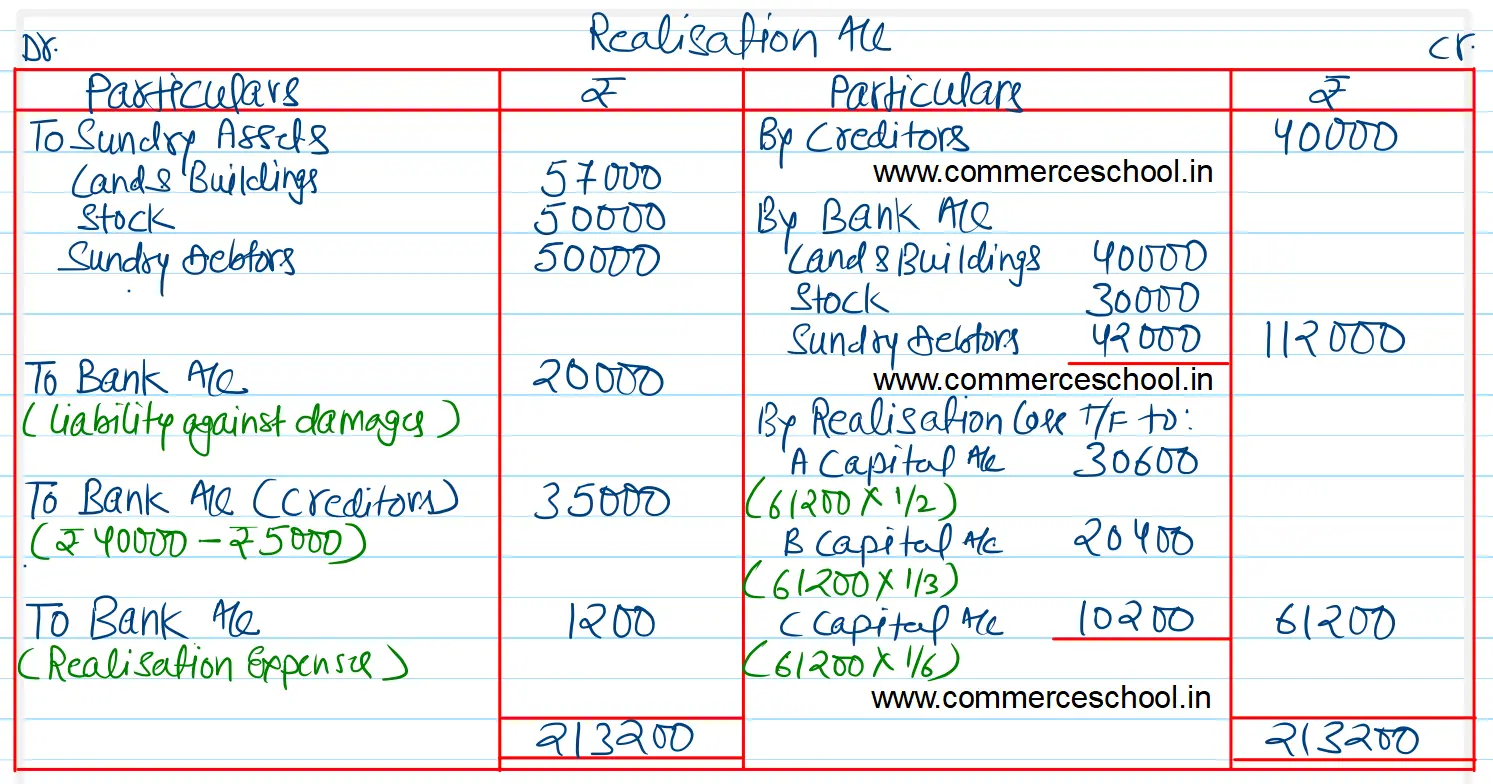

During the course of realisation, a liability under a suit for damages is settled at ₹ 20,000 as against ₹ 5,000 only provided for in the books of the firm.

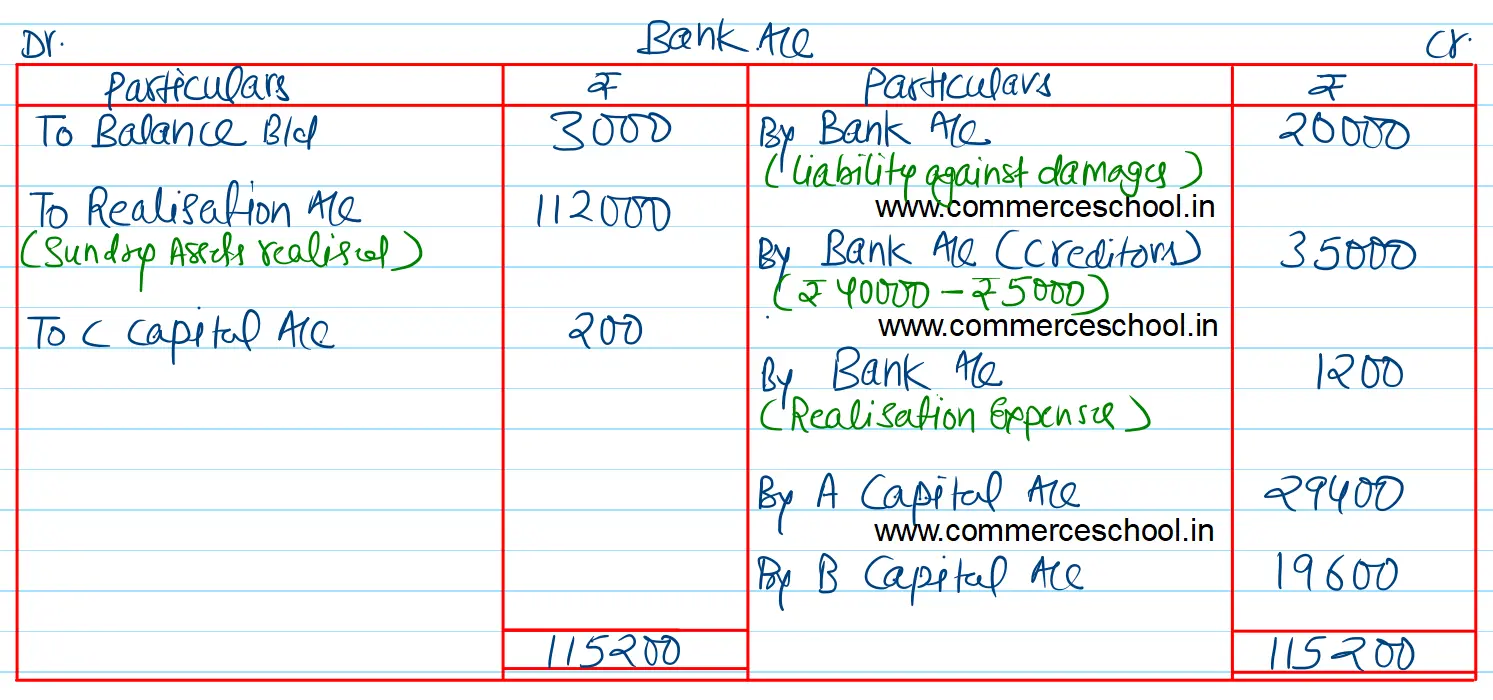

Land and Buildings were sold for ₹ 40,000 and the stock and Sundry Debtors realised ₹ 30,000 and ₹ 42,000 respectively. The expenses of realisation amounted to ₹ 1,200. You are required to prepare Realisation Account, Cash Account and Partners Capital Accounts in the books of the firm.

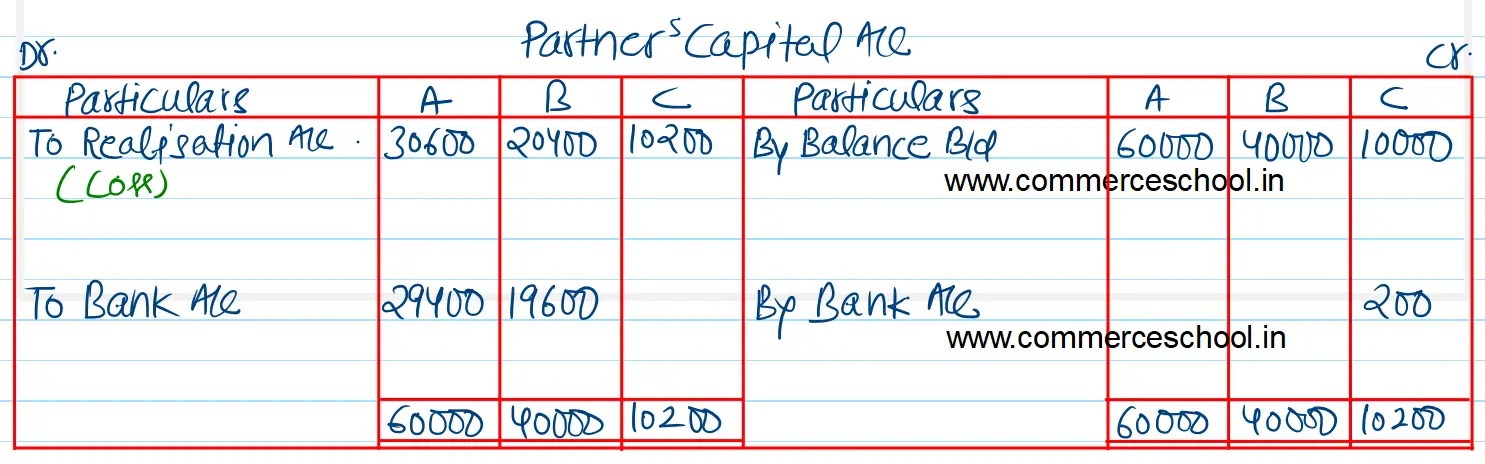

[Ans. Loss on Realisation ₹ 61,200; Cash paid to A ₹ 29,400; B ₹ 19,600 and Cash brought in by C ₹ 200; Total of Bank A/c ₹ 1,15,200.]

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 40,000 | Land and Buildings | 57,000 |

| Loan Account: A | 10,000 | Stock | 50,000 |

| Capital Accounts A B C | 60,000 40,000 10,000 | Sundry Debtors | 50,000 |

| Cash at Bank | 3,000 | ||

| 1,60,000 | 1,60,000 |

Anurag Pathak Answered question