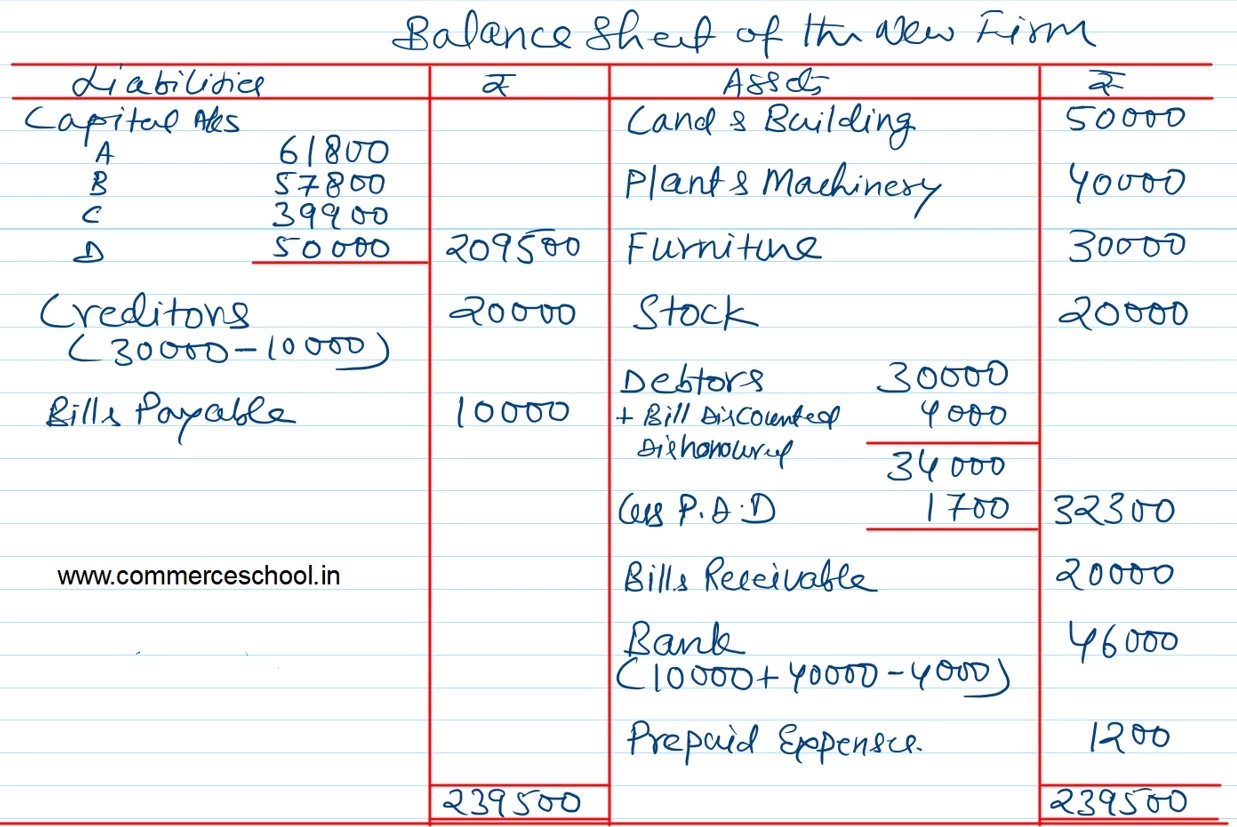

A, B and C are partners sharing profits and losses in the ratio of 3 : 2 : 1. Their Balance Sheet as at 31st March, 2023 is as follows:

A, B and C are partners sharing profits and losses in the ratio of 3 : 2 : 1. Their Balance Sheet as at 31st March, 2023 is as follows:

| Liabilities | ₹ | Assets | ₹ | |

| Capital A/cs:

A B C Creditors Bills Payable |

60,000 60,000 40,000

|

1,60,000 30,000 10,000 |

Land and Building

Plant and Machinery Furniture Stock Debtors Bills Receivable Bank |

50,000 40,000 30,000 20,000 30,000 20,000 10,000 |

| 2,00,000 | 2,00,000 |

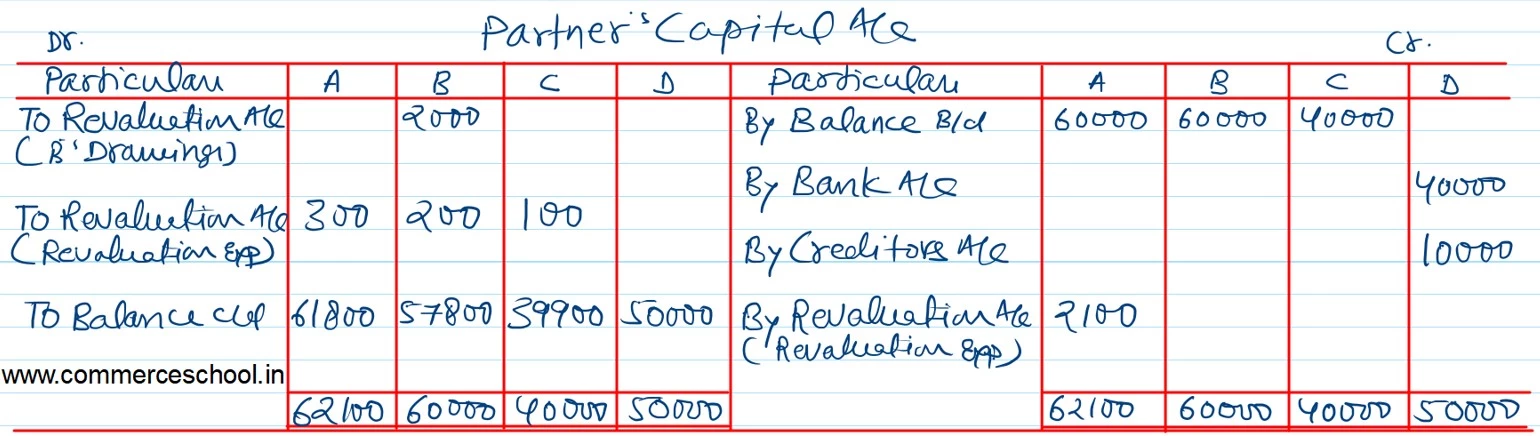

D is admitted as a partner on 1st April, 2023. His capital is to be ₹ 50,000.

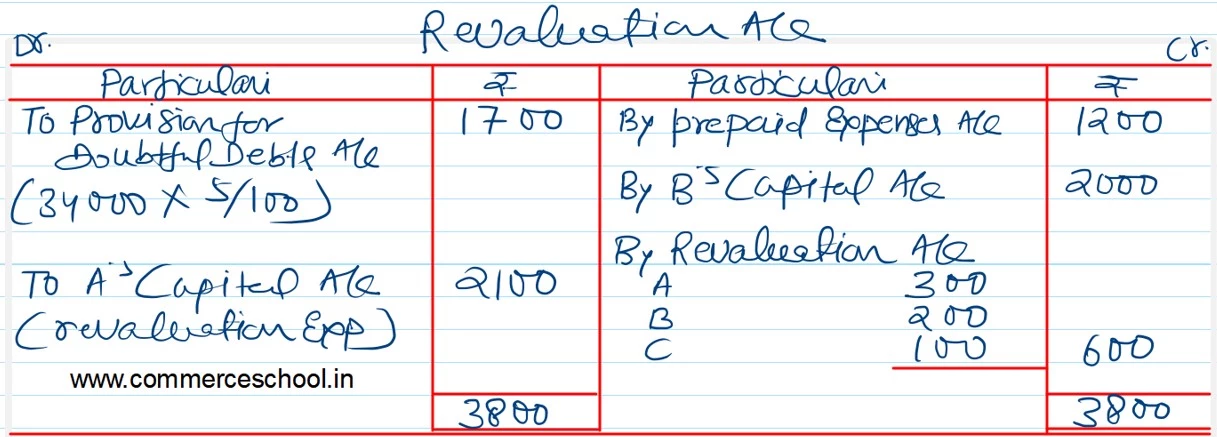

Following adjustments are agreed on D’s admission.

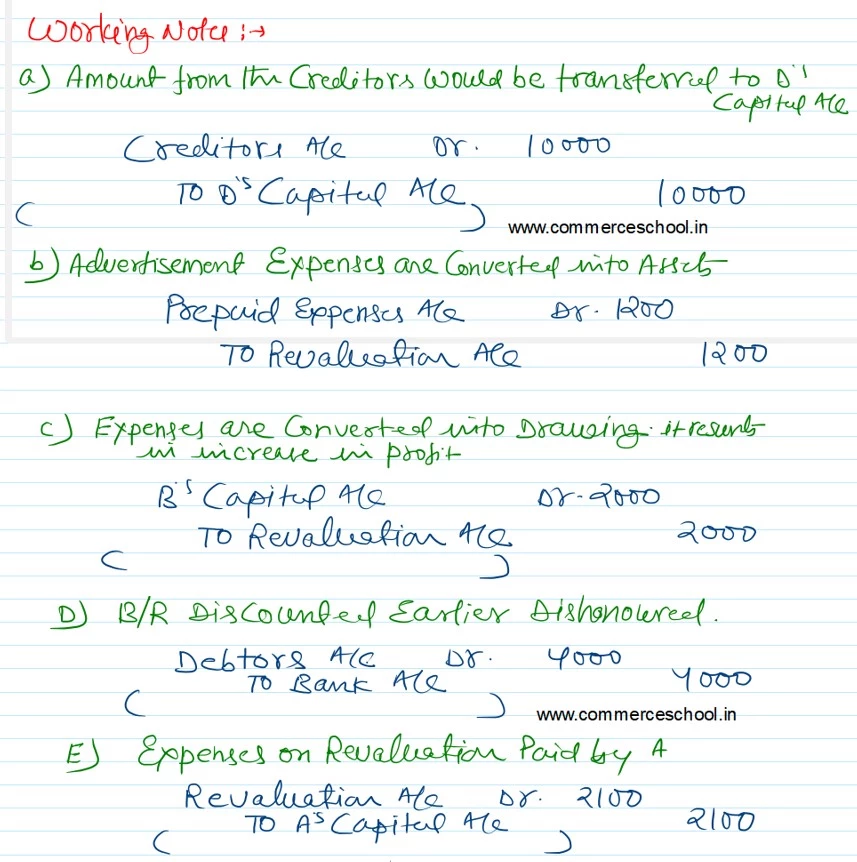

a) Out of the creditors, ₹ 10,000 is due to D, it will be adjusted against his capital.

b) Advertisement Expenses of ₹ 1,200 are to be carried forward as Prepaid Expenses.

c) Expenses debited in the Profit & Loss Account includes ₹ 2,000 paid for B’s personal expenses.

d) A Bill of Exchange of ₹ 4,000 which was previously discounted with the bank, was dishonoured on 31st March, 2023 but entry was not passed for dishonour.

e) Provision for Doubtful Debts @ 5% is to be created against Debtors.

f) Expenses on Revaluation of ₹ 2,100 is paid by A.

Prepare necessary Ledger Account and Balance Sheet after D’s admission.