A, B and C entered into partnership on 1st July, 2023 to share profit and losses in the ratio of 5 : 3 : 2. A personally guaranteed that C’s share of profit after charging interest on capital @ 8% per annum

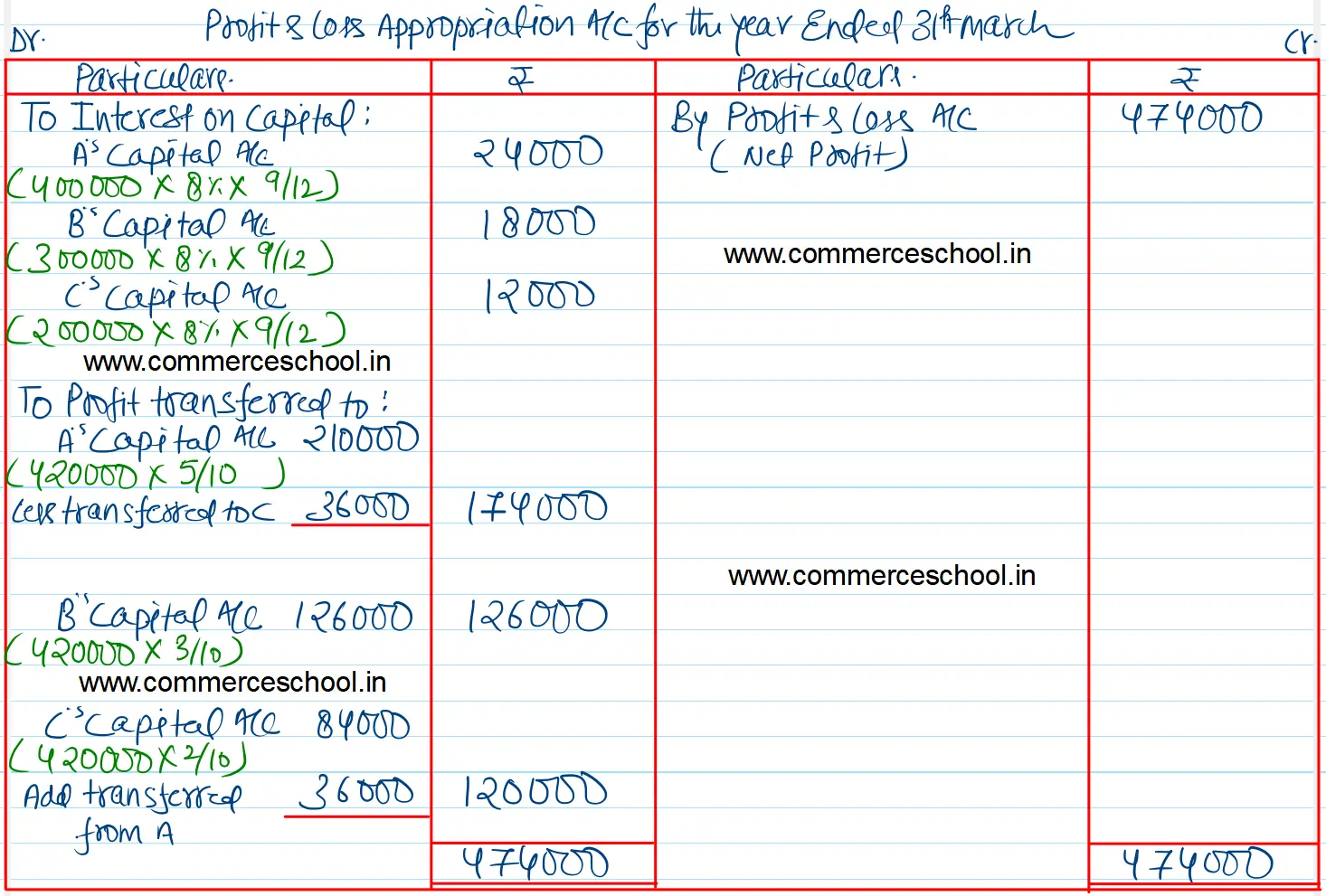

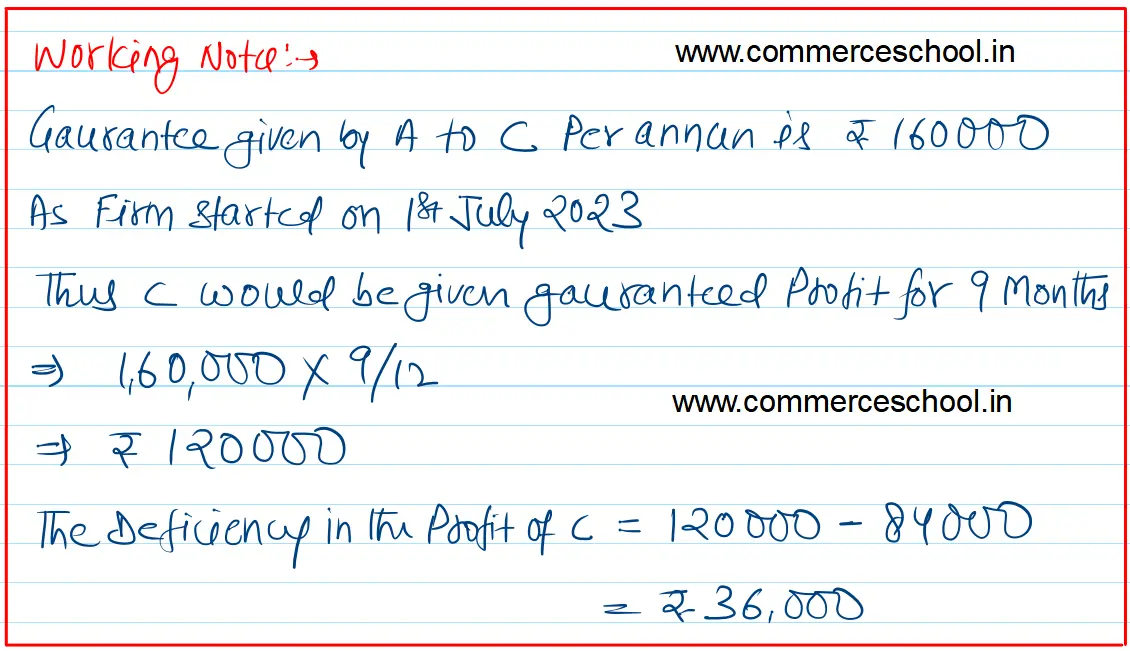

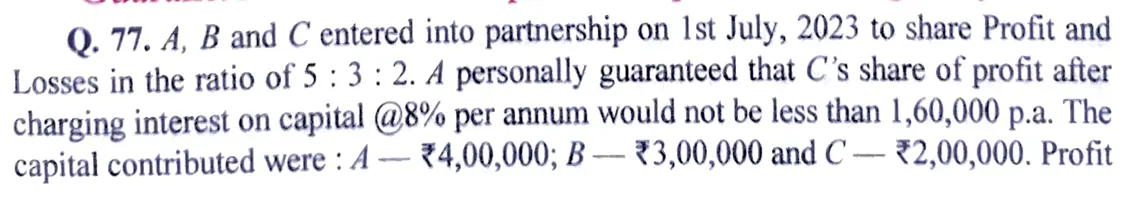

A, B and C entered into partnership on 1st July, 2023 to share profit and losses in the ratio of 5 : 3 : 2. A personally guaranteed that C’s share of profit after charging interest on capital @ 8% per annum would not be less than 1,60,000 p.a. The capital contributed were: A – ₹ 4,00,000; B – ₹ 3,00,000 and C – ₹ 2,00,000. Profit for the year ended on 31st March, 2024 was ₹ 4,74,000. Prepare Profit and Loss Appropriation Account.

[Ans. Share of Profit : A ₹ 1,74,000; B ₹ 1,26,000 and C ₹ 1,20,000.]

Anurag Pathak Answered question May 29, 2024