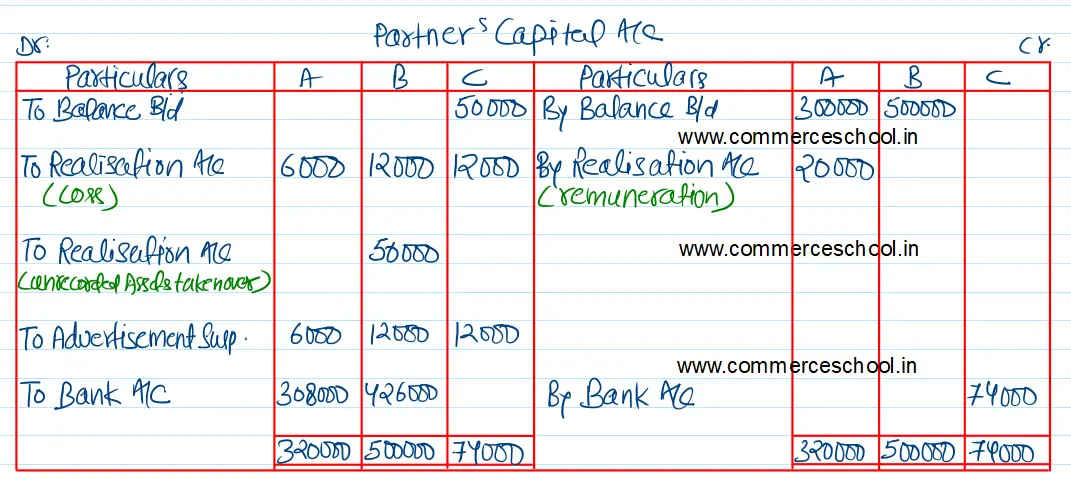

A, B and C shared profits in the ratio of 1 : 2 : 2. Following is their Balance Sheet on the date of dissolution:

A, B and C shared profits in the ratio of 1 : 2 : 2. Following is their Balance Sheet on the date of dissolution:

| Liabilities | ₹ | Assets | ₹ |

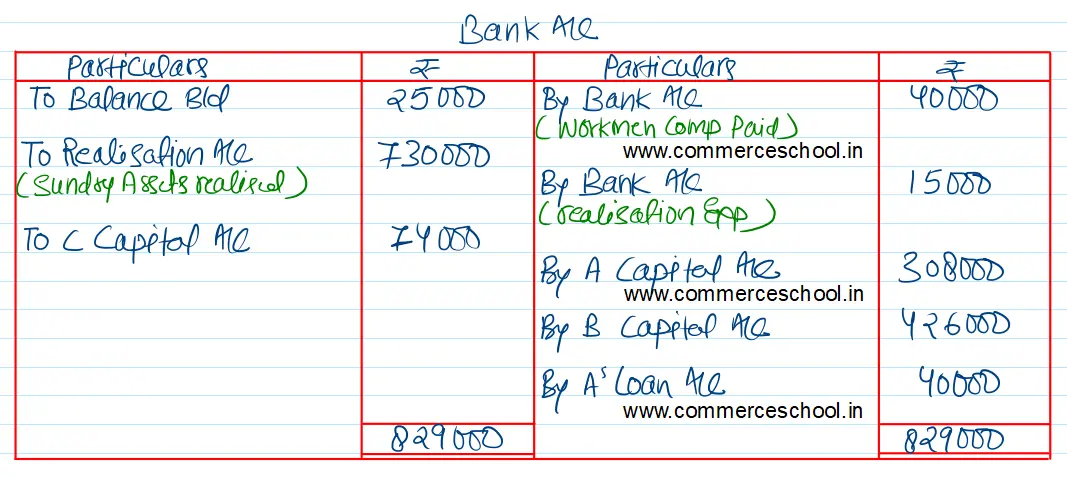

| Sundry Creditors | 2,50,000 | Cash at Bank | 25,000 |

| Bills Payable | 25,000 | Debtors 4,00,000 Less: Provision for Doubtful Debts Stock 20,000 | 3,80,000 |

| Workmen Compensation Reserve | 30,000 | Stock | 20,000 |

| A’s Loan | 1,00,000 | Machinery | 3,00,000 |

| Capital Accounts: A B | 3,00,000 5,00,000 | Land & Buildings | 4,00,000 |

| Advertisement Suspense Account | 30,000 | ||

| Capital Account: C | 50,000 | ||

| 12,05,000 | 12,05,000 |

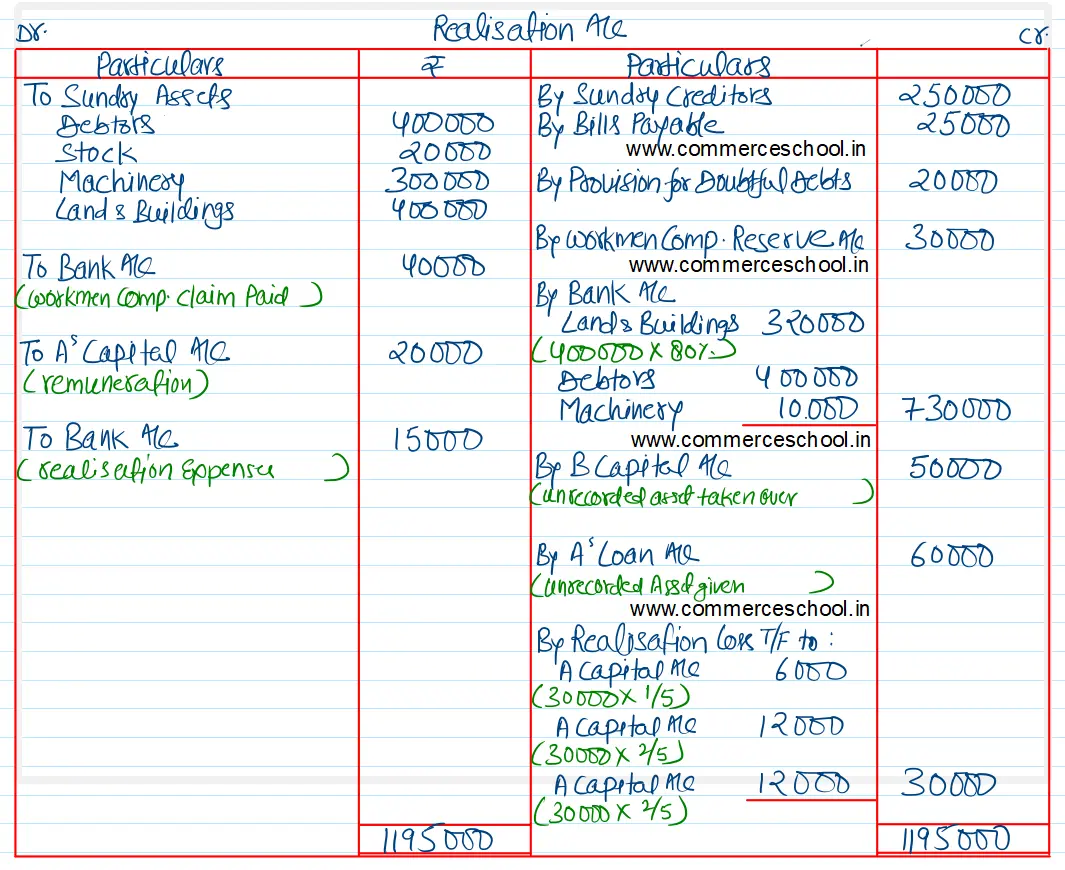

Information:-

(i) Land & Buildings were sold at 80% of the book value.

(ii) Stock was given to bills payable in full settlement.

(iii) Sundry Creditors accepted machinery and paid ₹ 10,000 to the firm.

(iv) Debtors were all good.

(v) An unrecorded asset estimated at ₹ 60,000 was taken over by partner B at ₹ 50,000.

(vi) Firm had to pay ₹ 40,000 as Workmen Compensation.

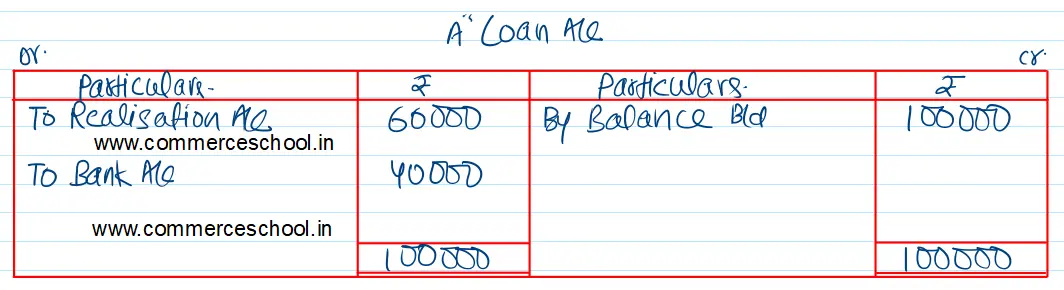

(vii) A’s Loan was settled by giving his an unrecorded asset of ₹ 75,000 at ₹ 60,000 and the balance in cash.

(viii) Partner A is to be paid remuneration of ₹ 20,000 for dissolution work. Realisation expenses of ₹ 15,000 were paid by the firm.

Prepare necessary accounts.

[Ans. Loss on Realisation ₹ 30,000; C brings in ₹ 74,000; Final Payments to A ₹ 3,08,000 and B ₹ 4,26,000; Total of Bank Account ₹ 8,29,000.]