A, B and C sharing profits and losses in the ratio of 3 : 2 : 1 agreed to dissolve their partnership firm on 31st March, 2024. A was asked to realise the assets and pay off liabilities

A, B and C sharing profits and losses in the ratio of 3 : 2 : 1 agreed to dissolve their partnership firm on 31st March, 2024. A was asked to realise the assets and pay off liabilities. He had to bear the realisation expenses for which he was promised a lump sum amount of ₹ 3,000 Their financial position on that date was as follows:

Information:

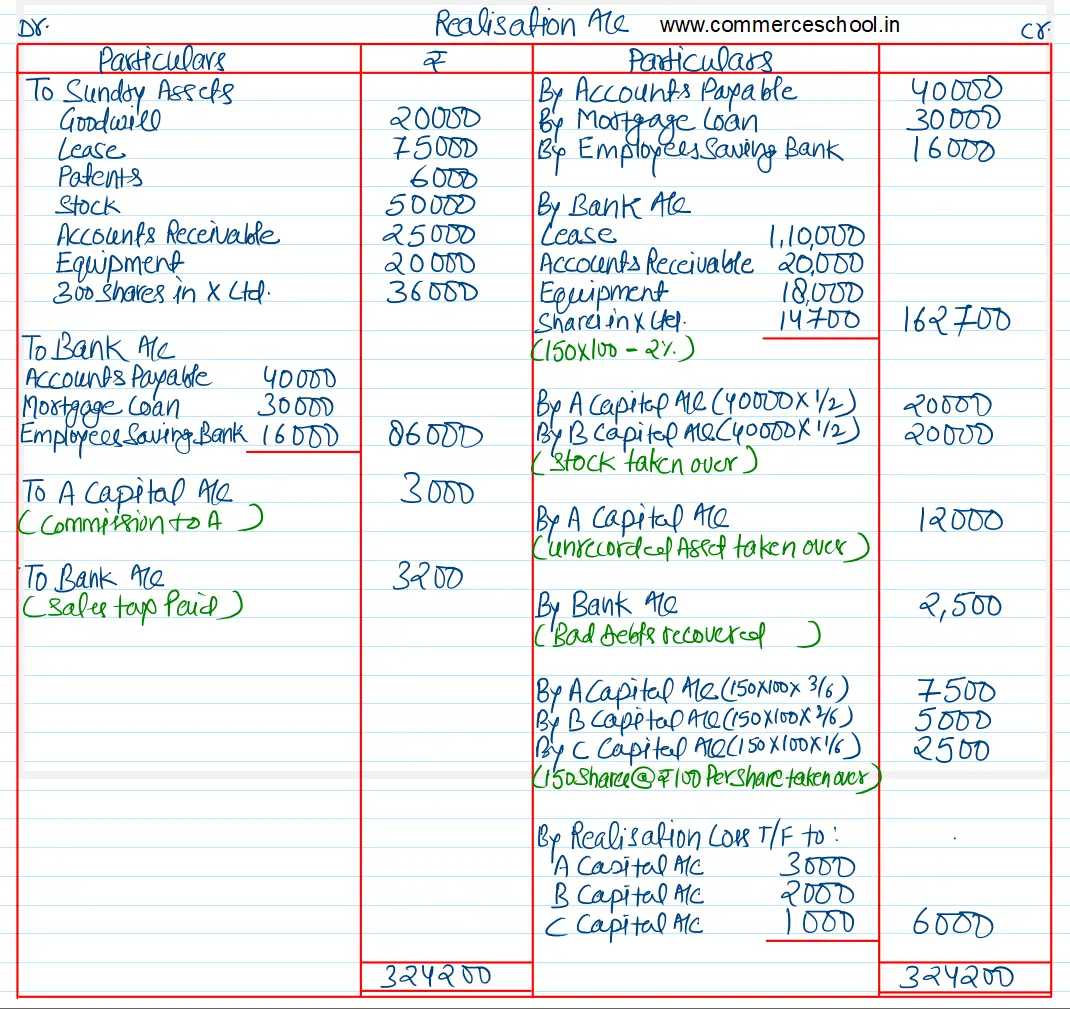

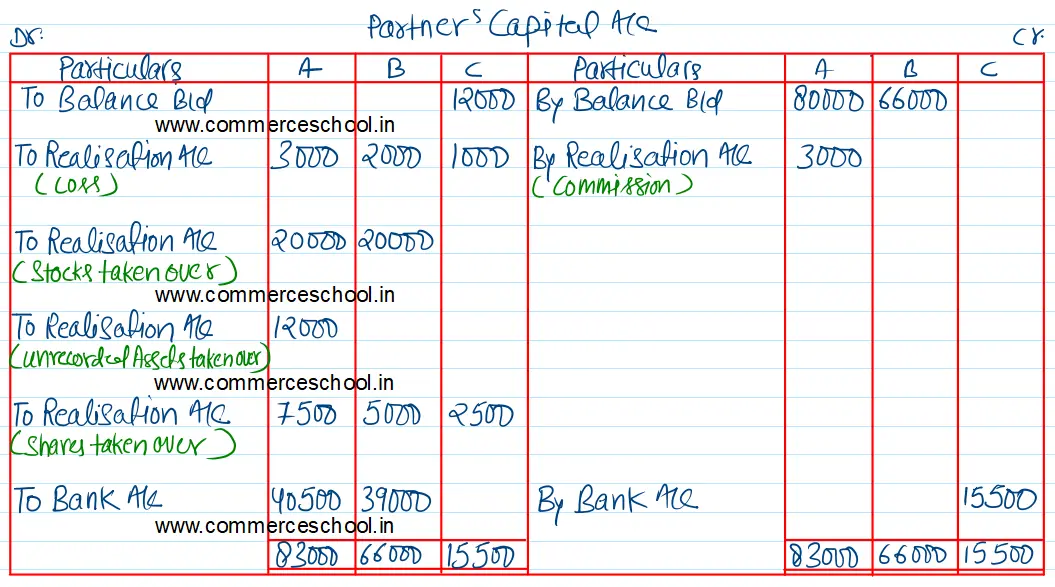

(i) Stock was valued at ₹ 40,000 and this was taken over by A and B equally. Lease realised ₹ 1,10,000; Equipments at ₹ 18,000; and Accounts Receivable at ₹ 20,000 and other assets proved valueless.

(2) Actual realisation expenses paid by A amounted to ₹ 1,800.

(3) There was an unrecorded asset of ₹ 10,000 which was taken over by A at ₹ 12,000.

(4) A bill of ₹ 3,200 due for sales tax was received during the course of realisation and this was also paid.

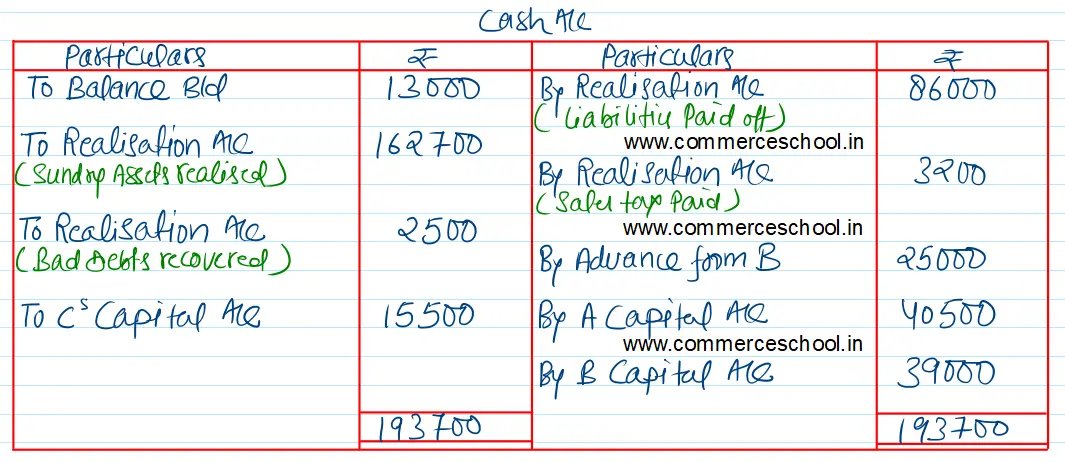

(5) Sunil, an old customer whose account was written off as bad in the previous year, paid ₹ 2,500 which is not included in the above stated accounts receivable.

(6) Market value of the Shares in X Ltd. is ₹ 100 per share. Half the shares were sold in the market subject to a commission of 2% and the balance half were divided by all the partners in their profit sharing ratio.

Prepare necessary accounts.

[Ans. Loss on Realisation ₹ 6,000; Cash brought in by C ₹ 15,500; Payment to A ₹ 40,500 and B ₹ 39,000; Total of Cash A/c ₹ 1,93,700.]

| Liabilities | ₹ | Assets | ₹ |

| Accounts Payable | 40,000 | Goodwill | 20,000 |

| Mortgage Loan | 30,000 | Lease | 75,000 |

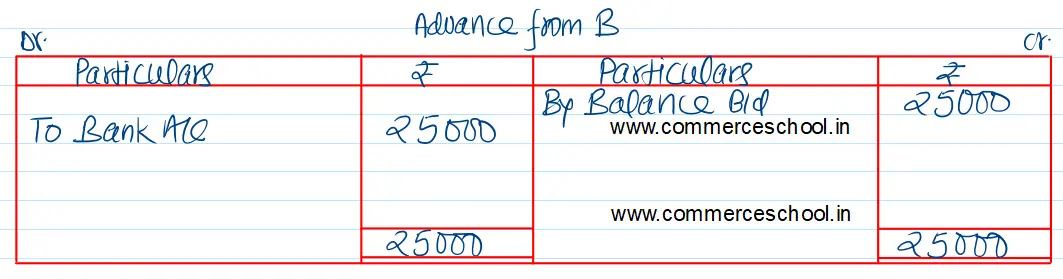

| Advance from B | 25,000 | Patents | 6,000 |

| Employee’s Saving Bank | 16,000 | Stock | 50,000 |

| Capitals: A B | 80,000 66,000 | Accounts Receivable | 25,000 |

| Equipment | 20,000 | ||

| 300 Shares in X Ltd. | 36,000 | ||

| Cash | 13,000 | ||

| C’s Capital | 12,000 | ||

| 2,57,000 | 2,57,000 |

Anurag Pathak Answered question