A, B and C were partners in a firm. A died on 31st March, 2018 and the Balance Sheet of the firm on that date was as under:

A, B and C were partners in a firm. A died on 31st March, 2018 and the Balance Sheet of the firm on that date was as under:

| Liabilities | ₹ | Assets | ₹ |

| Creditors

General Reserve Workmen’s Compensation Fund Profit & Loss Account Capitals: A B C |

7,000 9,000 10,000 6,000 40,000 30,000 20,000 |

Cash at Bank

Debtors Furniture Plant Patents |

12,000 32,000 30,000 40,000 8,000 |

| 1,22,000 | 1,22,000 |

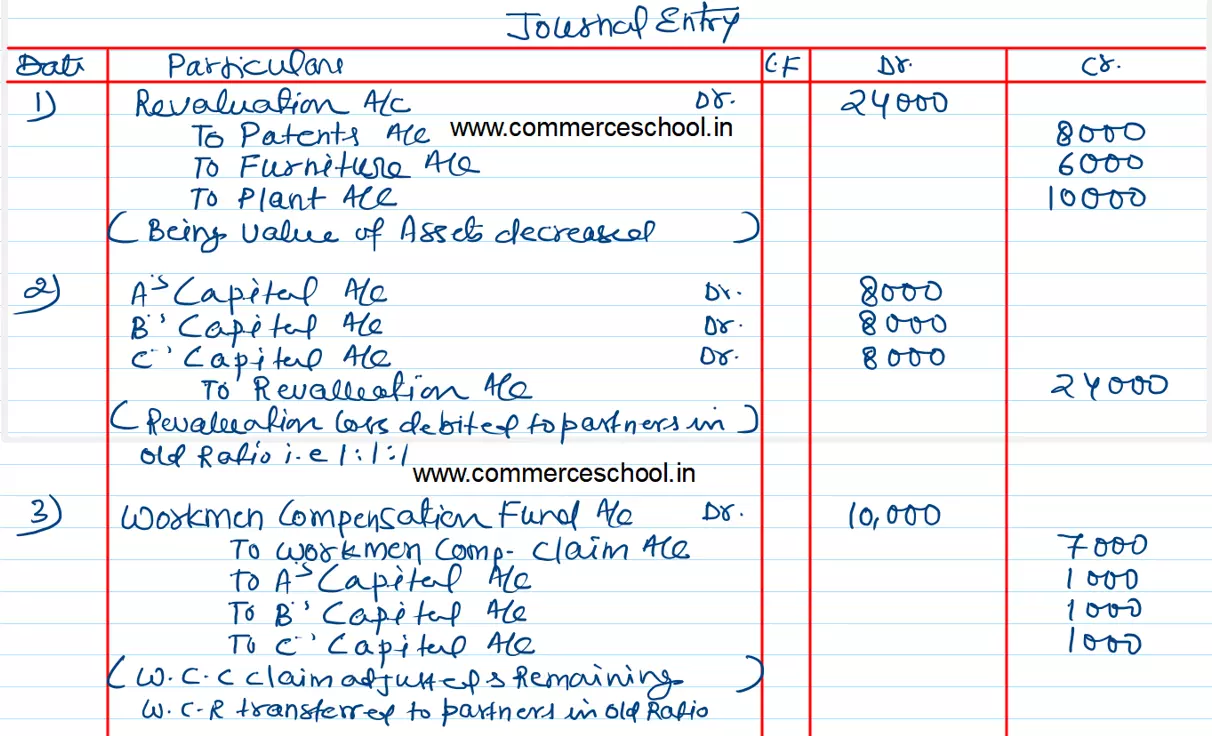

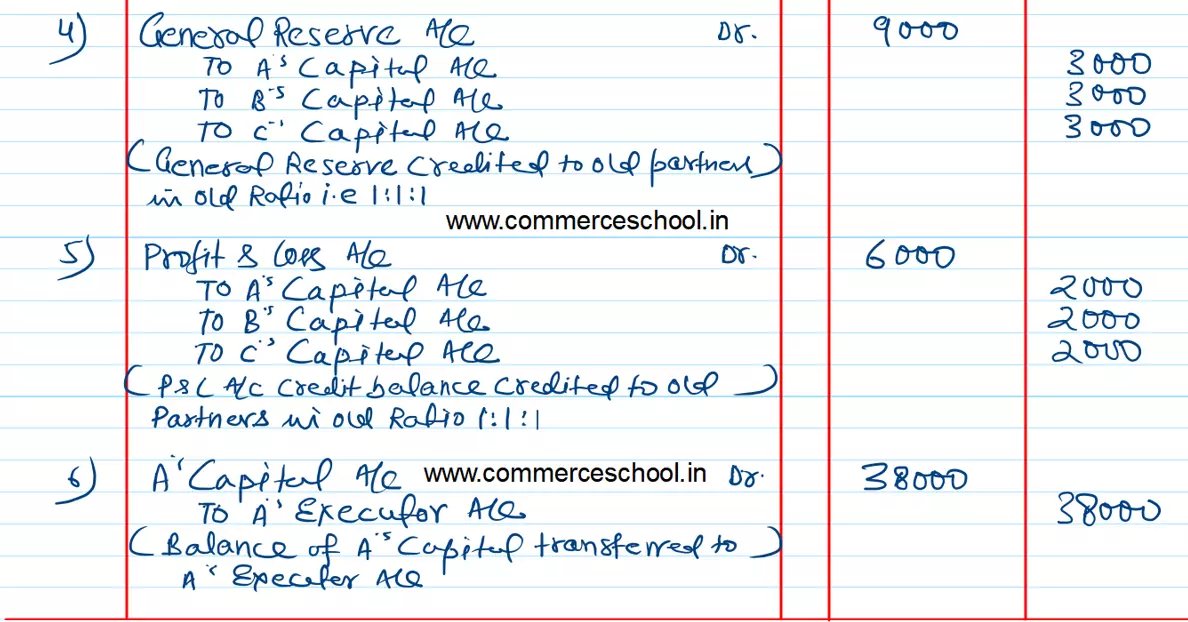

On A’s death it was found that patents were valueless, furniture was to be brought down to ₹ 24,000, plant was to be reduced by ₹ 10,000 and there was a liability of ₹ 7,000 on account of workmen’s compensation. pass the necessary Journal entries for the above at the time of A’s death.

[Ans.: Loss on Revaluation – ₹ 24,000. A’s Executor’s Account – ₹ 38,000.]

Anurag Pathak Changed status to publish July 26, 2023