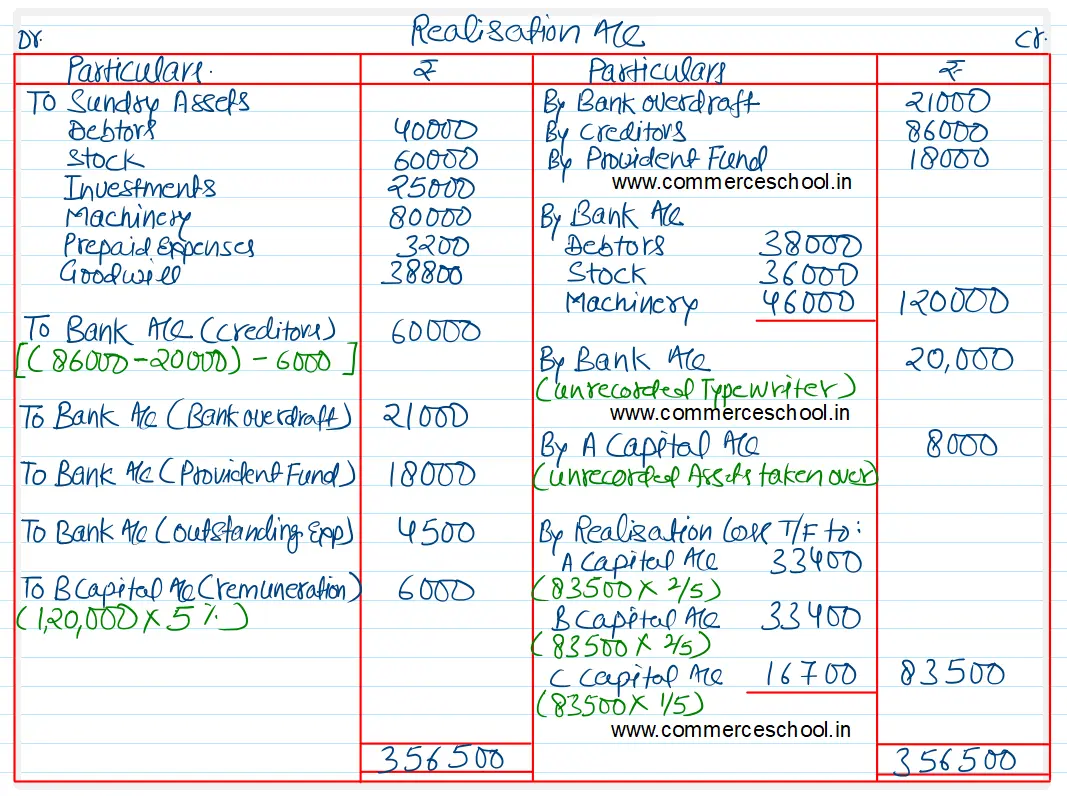

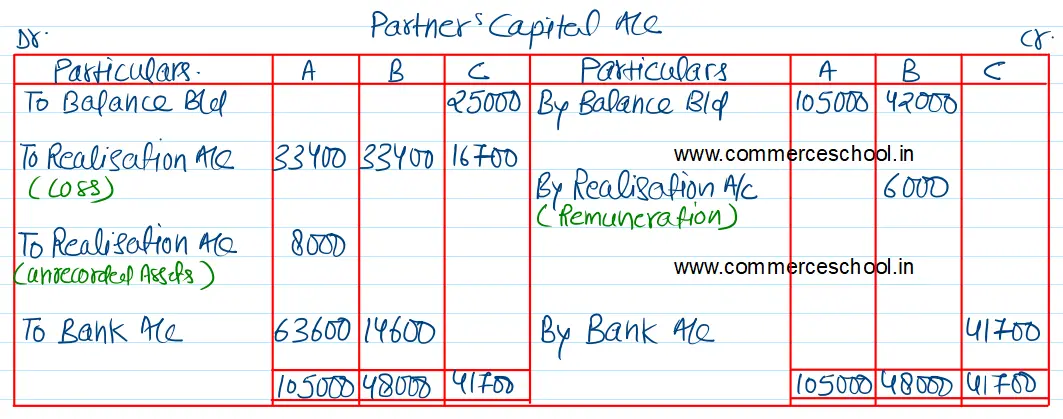

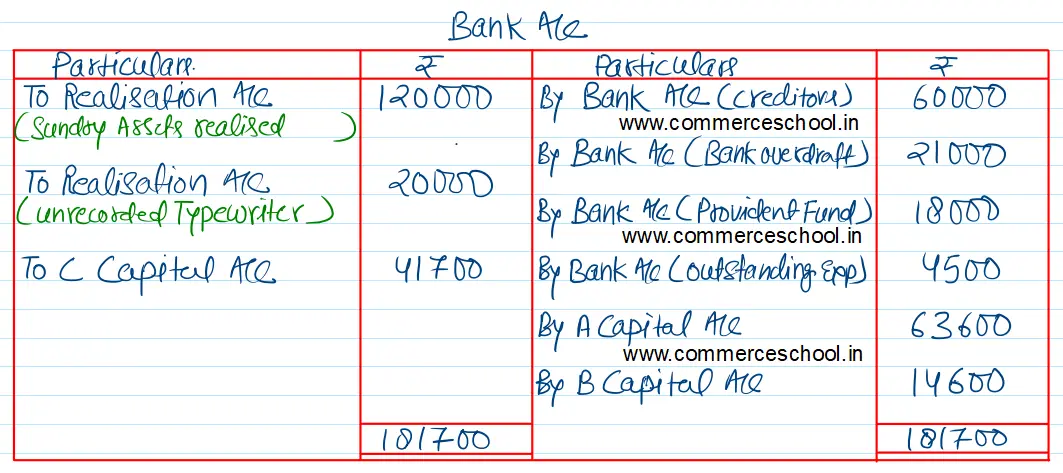

A, B and C were partners in a firm sharing profits & losses in the ratio of 2 : 2 : 1. The Balance Sheet of the firm at the date of dissolution was as follows:

A, B and C were partners in a firm sharing profits & losses in the ratio of 2 : 2 : 1. The Balance Sheet of the firm at the date of dissolution was as follows:

You are informed that:

(i) They appointed B to realise the assets. He is to receive 5% of the amounts realised from Debtors, Stock and Machinery, and is to bear all expenses of realisation.

(2) Bad Debts amounted to ₹ 2,000; Stock realised ₹ 36,000 and Machinery realised ₹ 46,000. There was an unrecorded asset of ₹ 10,000 which was taken over by A at ₹ 8,000.

(3) Market value of Investments was ascertained to be ₹ 20,000, and one of the creditors agreed to accept the Investments at this value, Remaining creditors were paid at a discount of ₹ 6,000.

(4) An office typewriter, not shown in the books of accounts, realised ₹ 20,000.

(5) There were outstanding expenses amounting to ₹ 6,000. These were settled for ₹ 4,500. Expenses of realisation met by B amounted to ₹ 2,000.

Prepare necessary accounts.

[Ans. Loss on Realisation ₹ 83,500; C brings in ₹ 41,700; Final Payment to A ₹ 63,600; and B ₹ 14,600. Total of Bank A/c ₹ 181,700.]

| Liabilities | ₹ | Assets | ₹ |

| Bank Overdraft | 21,000 | Debtors | 40,000 |

| Creditors | 86,000 | Stock | 60,000 |

| Provident Fund | 18,000 | Investments | 25,000 |

| Capital Accounts: A B | 1,05,000 42,000 | Machinery | 80,000 |

| Prepaid Expenses | 3,200 | ||

| Goodwill | 38,800 | ||

| C’s Capital Account | 25,000 | ||

| 2,72,000 | 2,72,000 |

Anurag Pathak Answered question