Aan and Shaan were partners sharing profits in the ratio of 3 : 2. Their Balance Sheet as at 31st March, 2023 was as under:

Aan and Shaan were partners sharing profits in the ratio of 3 : 2. Their Balance Sheet as at 31st March, 2023 was as under:

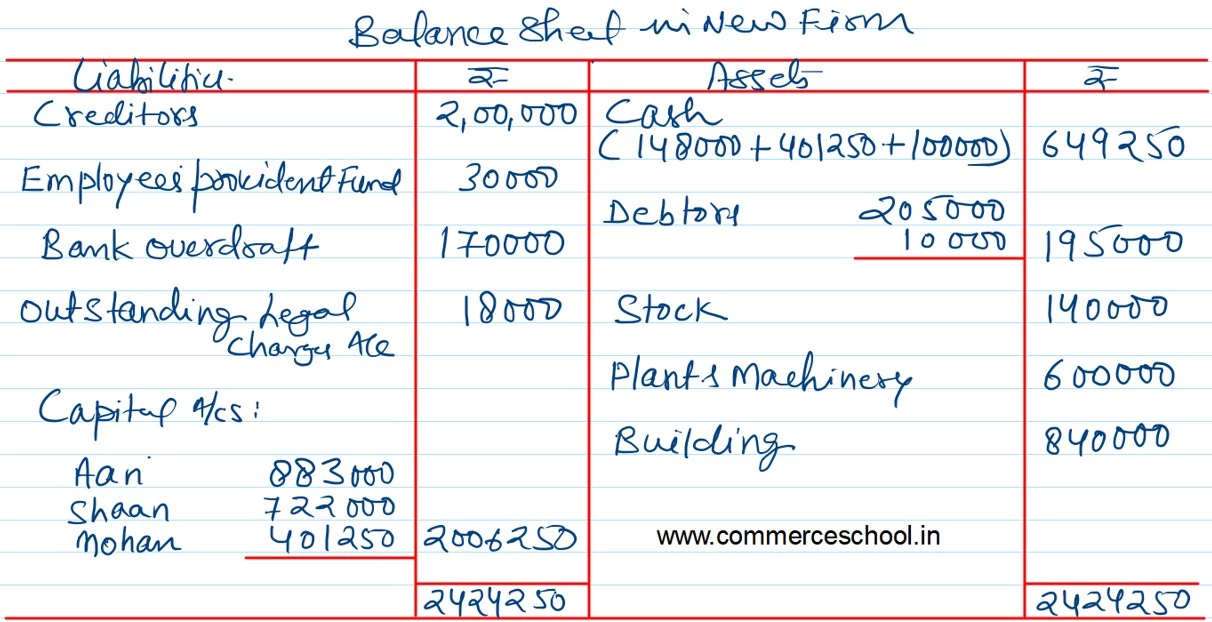

| Liabilities | ₹ | Assets | ₹ | |

| Creditors

Employee’s Provident Fund Bank Overdraft Reserve Capital A/cs: Aan’s Shaan’s |

2,00,000 30,000 1,70,000 1,50,000

7,00,000 6,00,000 |

Cash

Debtors Stock Plant and Machinery Building |

2,05,000

|

1,48,000 2,02,000 2,00,000 6,00,000 7,00,000 |

| 18,50,000 | 18,50,000 |

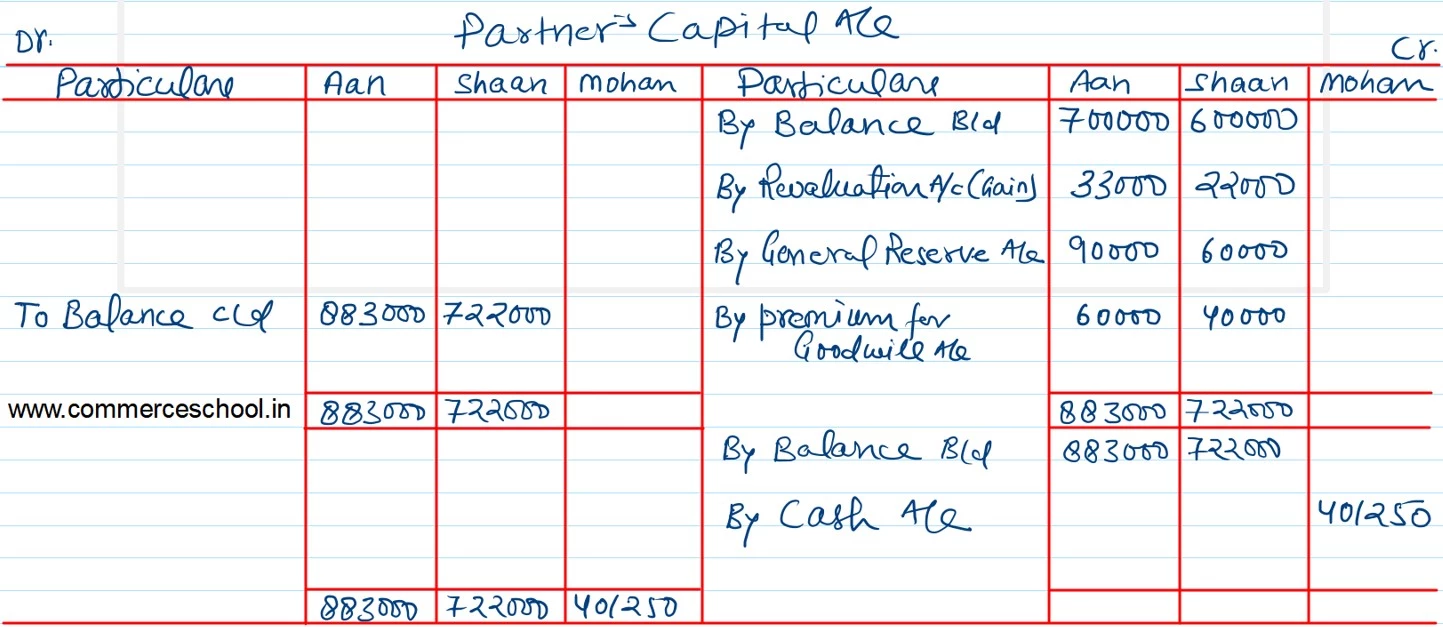

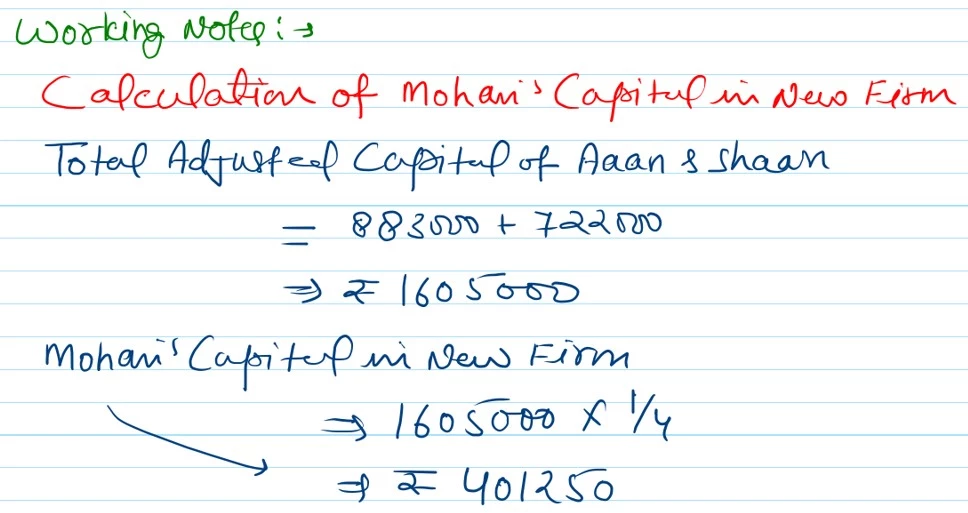

They agreed to admit Mohan for 1/4th share on the above date subject to the following terms:

i) Mohan to bring in capital equal to 1/4th of the total capital of Aan and Shaan after all adjustments including premium for goodwill.

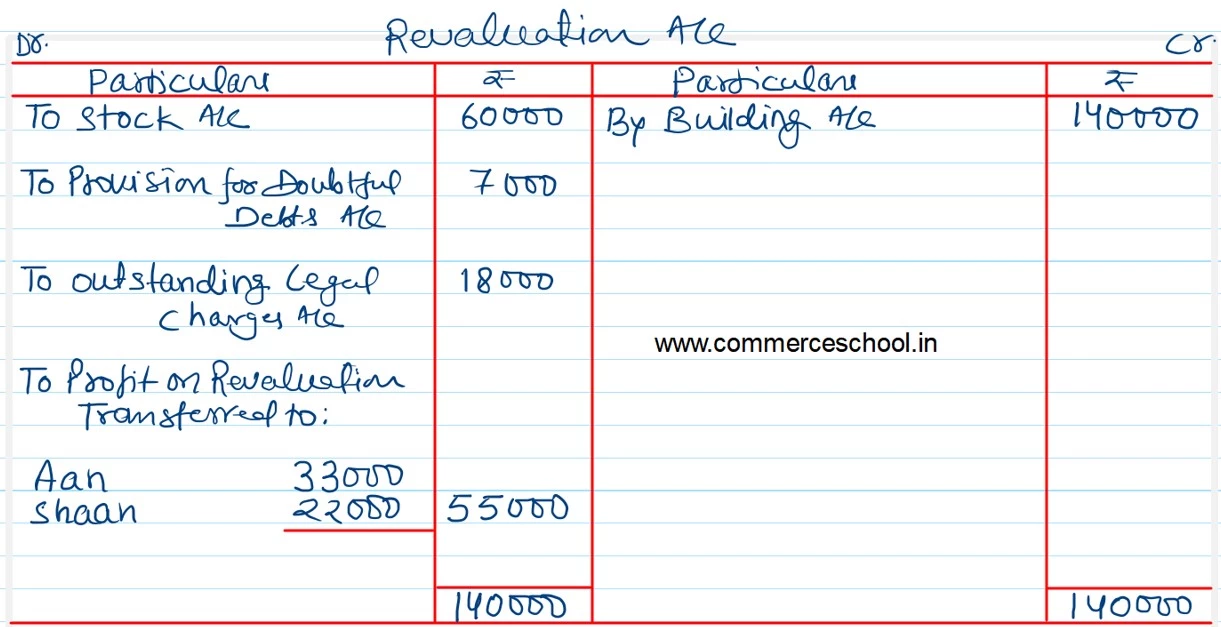

ii) Building to be appreciated by 20% and stock to be depreciated to 70%.

iii) Provision for Doubtful Debts on Debtors to be raised to ₹ 10,000.

iv) A provision be made for ₹ 18,000 for outstanding legal charges.

v) Mohan’s share of goodwill premium was calculated as ₹ 1,00,000.

Prepare the Revaluation Account, Partner’s Capital Account and the Balance sheet of the new firm.

[Ans: Gain on Revaluation – ₹ 55,000; Capital Accounts: Aan – ₹ 8,83,000; Shaan – ₹ 7,22,000; Mohan – ₹ 4,01,250; Total of Balance Sheet – ₹ 24,24,250.]