On 31st March, 2023 the Balance Sheet of Ram and Shyam who share profits and losses in the ratio of 3 : 2 was as follows:

On 31st March 2023 the Balance Sheet of Ram and Shyam who share profits and losses in the ratio of 3 : 2 was as follows:

| Liabilities | ₹ | Assets | ₹ | |

| Creditors

General Reserve Employee’s Provident Fund Capitals: Ram Shyam |

70,000 25,000 55,000 1,50,000 1,00,000 |

Cash at Bank

Debtors Stock Machinery |

1,62,500

|

25,000 1,50,000 82,500 1,42,500 |

| 4,00,000 | 4,00,000 |

They decided to admit Mahesh on 1st April, 2023 for 1/5th share which Mahesh acquired wholly from Shyam on the following terms:

i) Mahesh shall bring ₹ 25,000 as his share of premium for goodwill.

ii) A debtor whose dues of ₹ 7,500 were written off as bad debt paid ₹ 5,000 in settlement.

iii) A claim of ₹ 12,500 on account of workmen’s compensation was to be provided for.

iv) Machinery was undervalued by ₹ 5,000. Stock was valued 10% more than its market value.

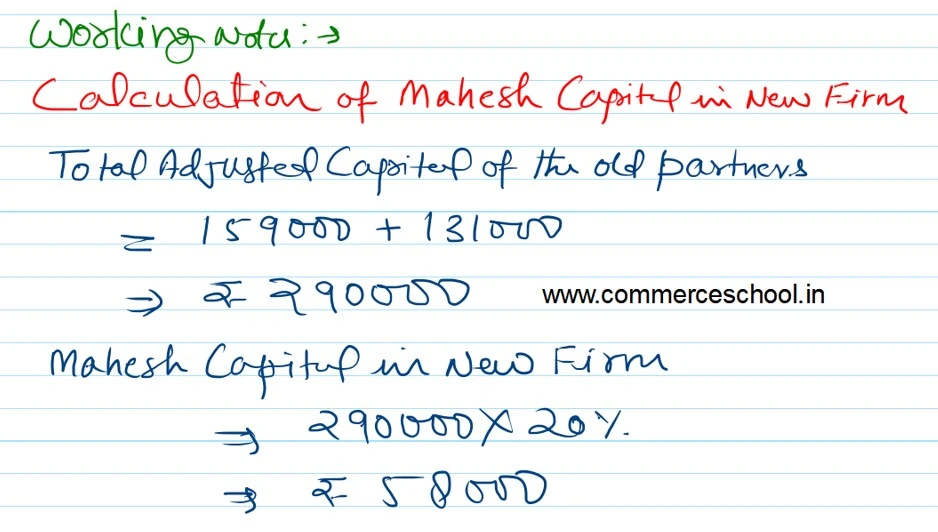

v) Mahesh was to bring in capital equal to 20% of the combined capitals of Ram and Shyam after all adjustments.

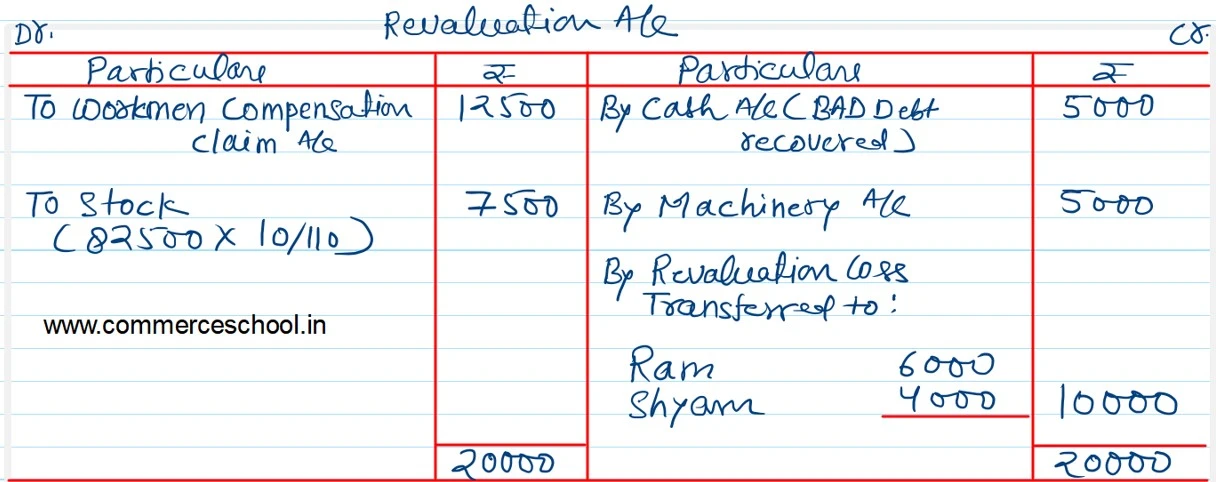

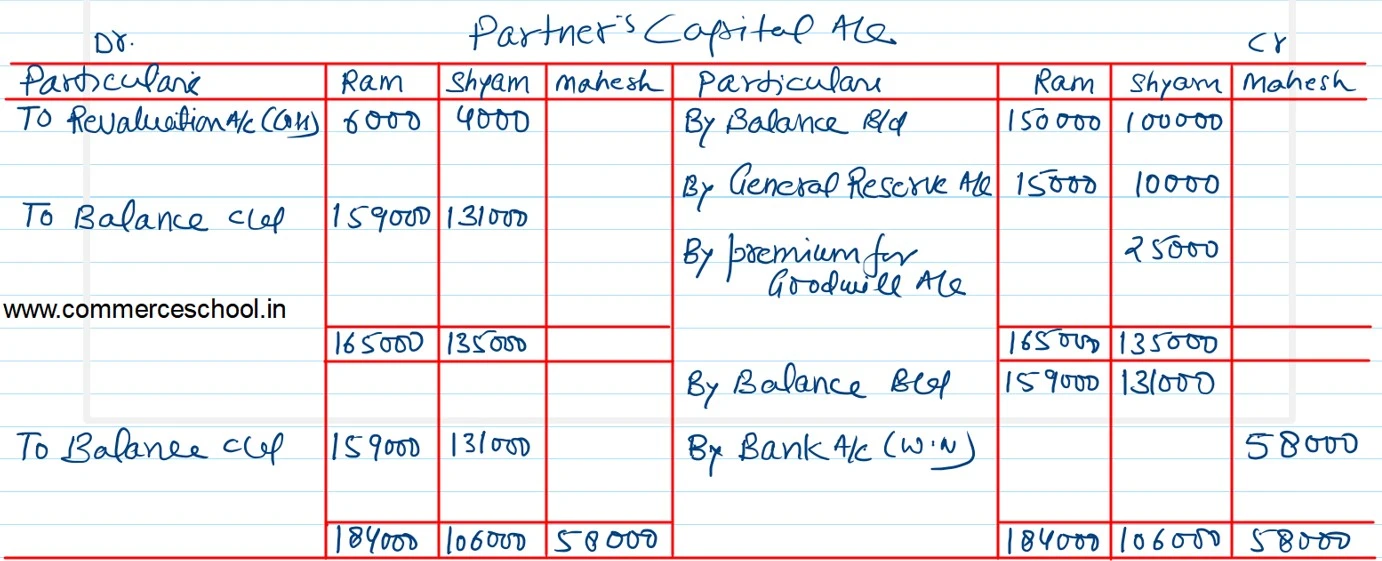

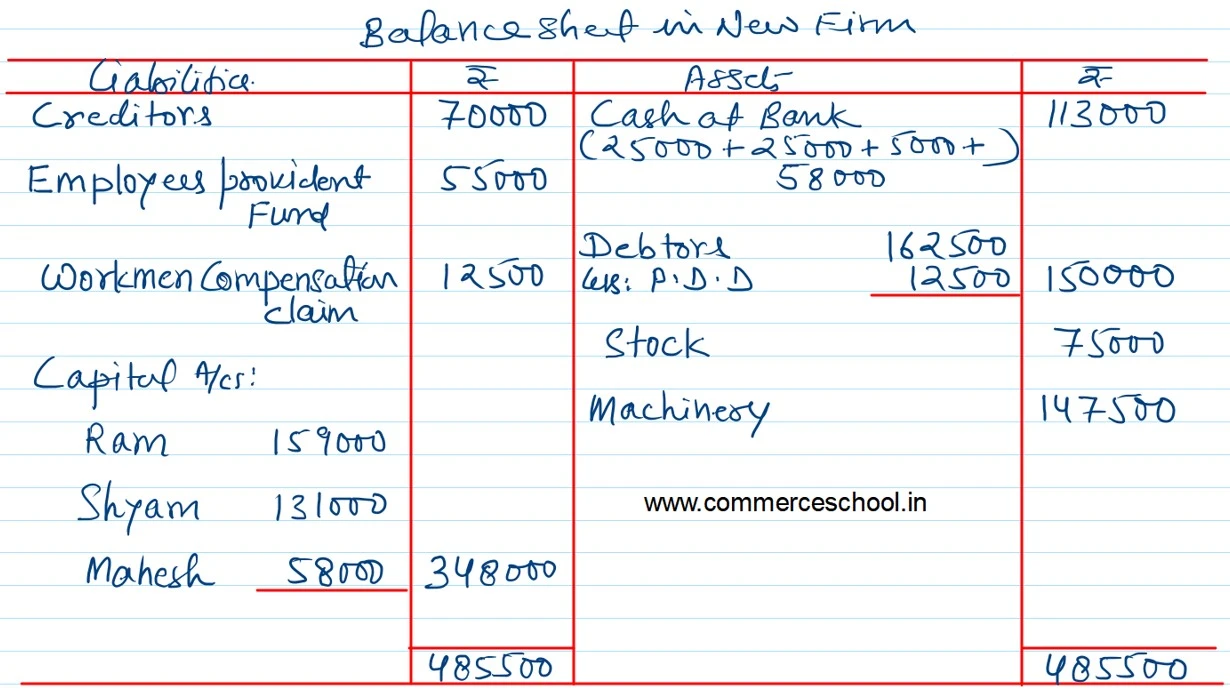

Prepare Revaluation Account, Partner’s Capital Accounts and Balance Sheet of the new firm.

[Ans: Loss on Revaluation – ₹ 10,000; Partner’s Capital Accounts: Ram – ₹ 1,59,000; Shyam – ₹ 1,31,000; Mahesh – ₹ 58,000; Balance Sheet Total – ₹ 4,85,500.]