Leena and Rohit are partners in a firm sharing profits in the ratio of 3 : 2. On 31st March, 2018, their Balance Sheet was as follows:

Leena and Rohit are partners in a firm sharing profits in the ratio of 3 : 2. On 31st March, 2018, their Balance Sheet was as follows:

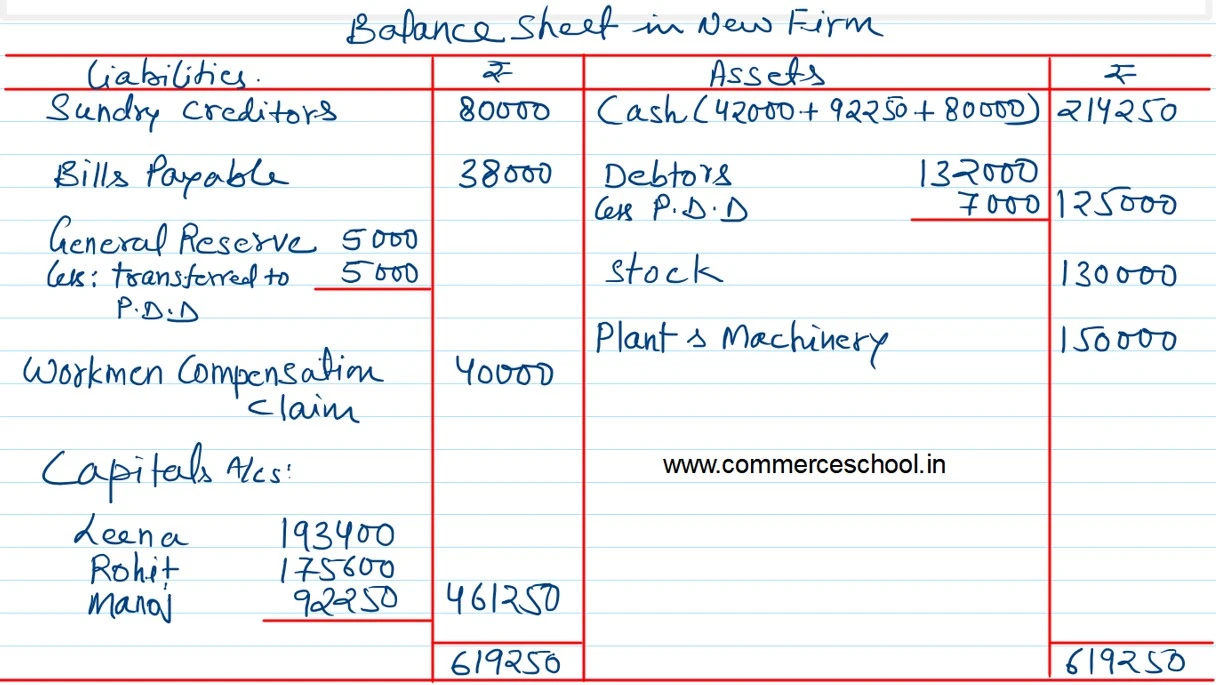

| Liabilities | ₹ | Assets | ₹ | |

| Sundry Creditors

Bills Payable General Reserve Capitals: Leena Rohit |

80,000 38,000 50,000 1,60,000 1,40,000 |

Cash

Debtors Stock Plant and Machinery |

1,32,000 2,000 |

42,000 1,30,000 1,46,000 1,50,000 |

| 4,68,000 | 4,68,000 |

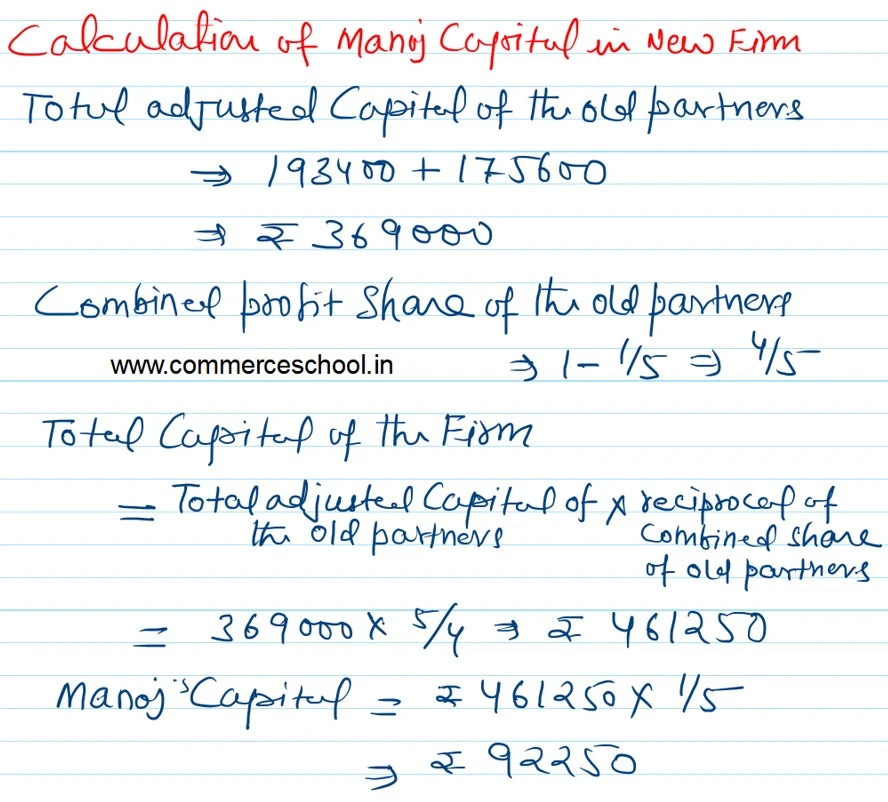

On the above date Manoj was admitted as a new partner for 1/5th share in the profits of the firm on the following terms:

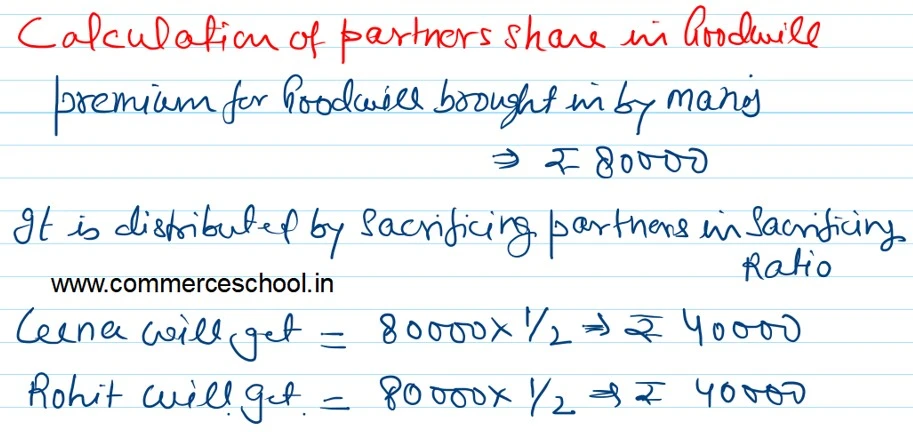

i) Manoj brought proportionate capital. He also brought his share of goodwill premium of ₹ 80,000 in cash.

ii) 10% of the general reserve was to be transferred to provision for doubtful debts.

iii) Claim on account of workmen’s compensation amounted to ₹ 40,000.

iv) Stock was overvalued by ₹ 16,000.

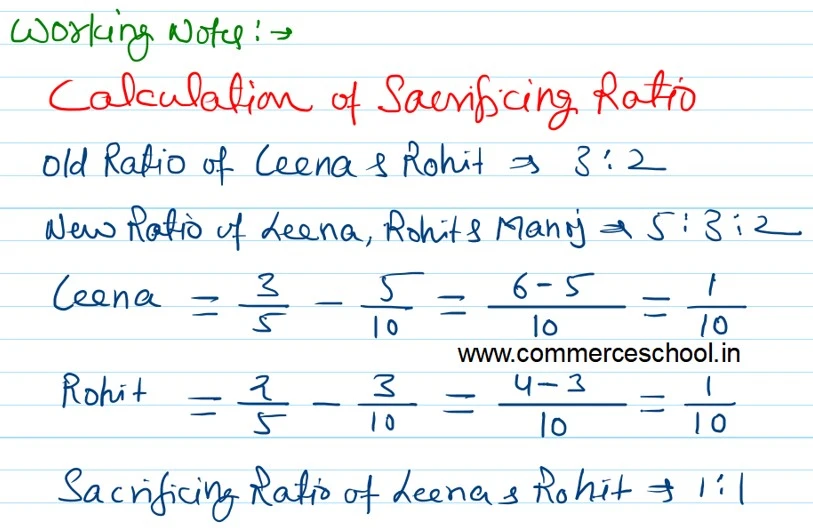

v) Leena, Rohit and Manoj will share future profits in the ratio 0f 5 : 3 : 2.

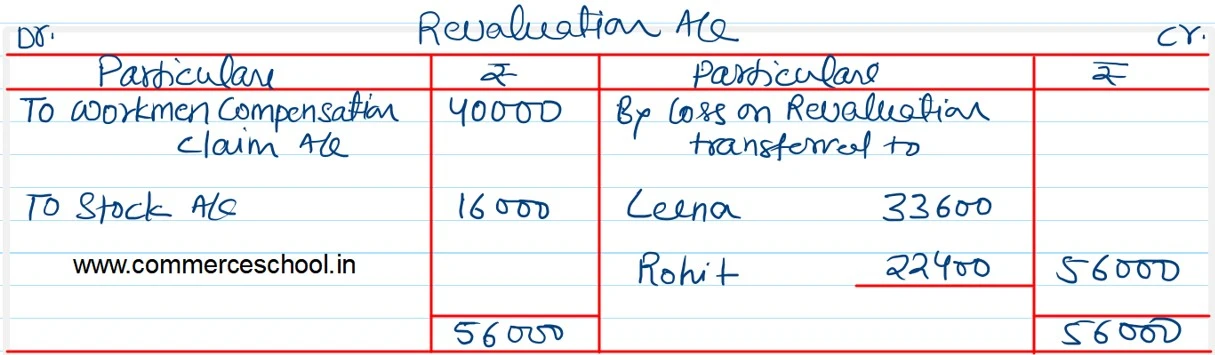

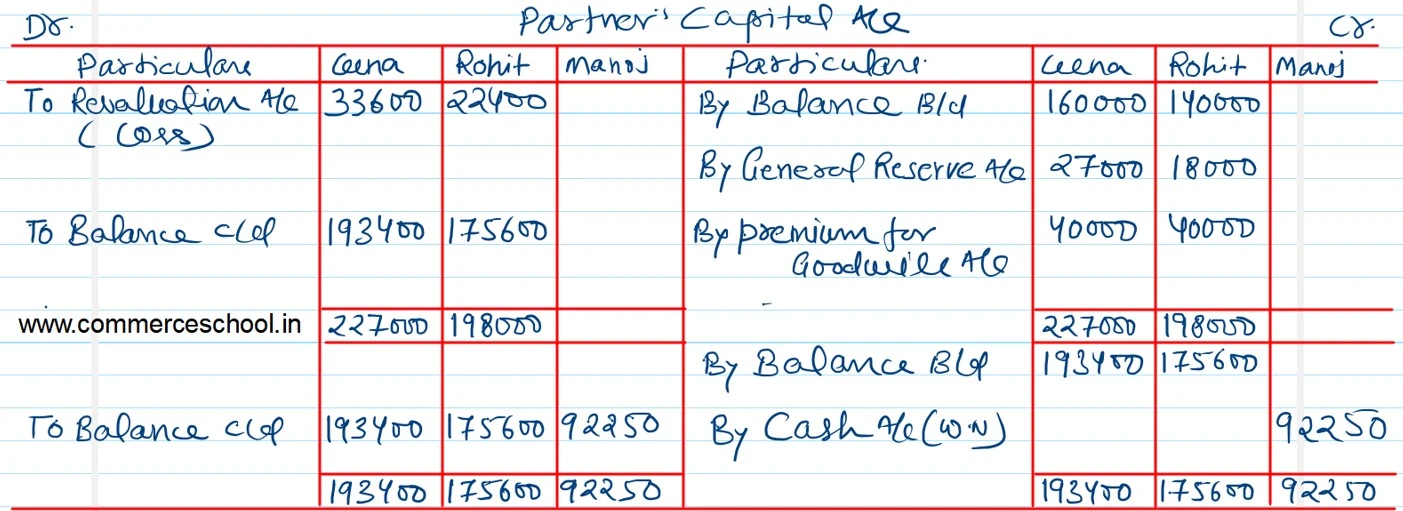

Prepare Revaluation Account, partner’s Capital accounts and the Balance Sheet of the reconstituted firm.

[Ans: Loss on Revaluation – ₹ 56,000; Partner’s Capital Accounts: Leena – ₹ 1,93,400; Rohit – ₹ 1,75,600; Manoj – ₹ 92,250; Balance Sheet Total – ₹ 6,19,250.]

2nd adjustment is considered 10% of general reserve ₹ 5,000 as provision for doubtful debts is deducted from general reserve and added to provision for doubtful debts and subtracted from debtors in the Balance Sheet. Rest 45,000 is distributed among partner’s in old ratio.

Why 2nd adjustment is ignored in this question

If provision for D.D