Alfa, Beta and Gama are in partnership sharing profits in the ratio of 5 : 3 : 2. Their Balance Sheet on 1st April, 2022, the day Beta decided to retire from firm, was as follows:

Alfa, Beta and Gama are in partnership sharing profits in the ratio of 5 : 3 : 2. Their Balance Sheet on 1st April, 2022, the day Beta decided to retire from firm, was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Alfa’s Capital

Beta’s Capital Gama’s Capital General Reserve Sundry Creditors |

3,00,000 2,00,000 2,00,000 1,00,000 1,00,000 |

Building

Machinery Investments Debtors Stock Cash at bank |

2,50,000 1,50,000 2,50,000 1,00,000 50,000 1,00,000 |

| 9,00,000 | 9,00,000 |

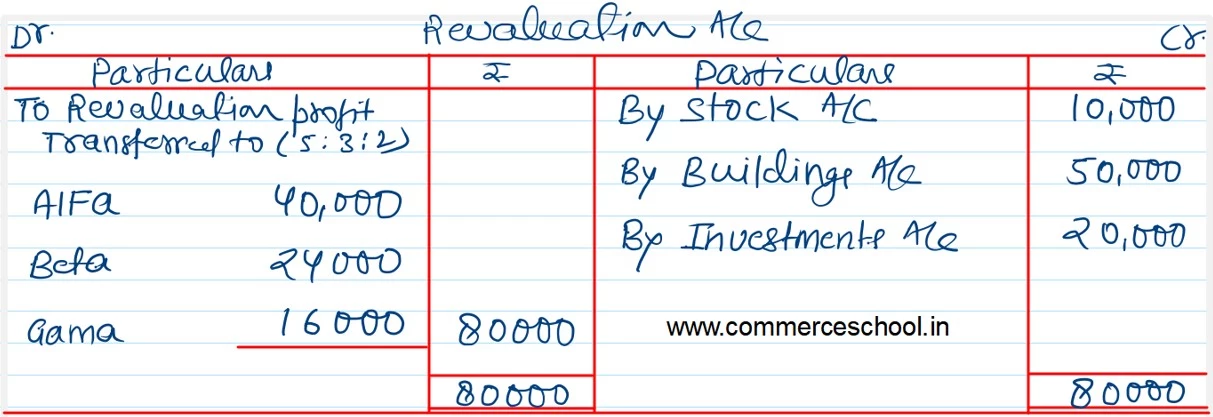

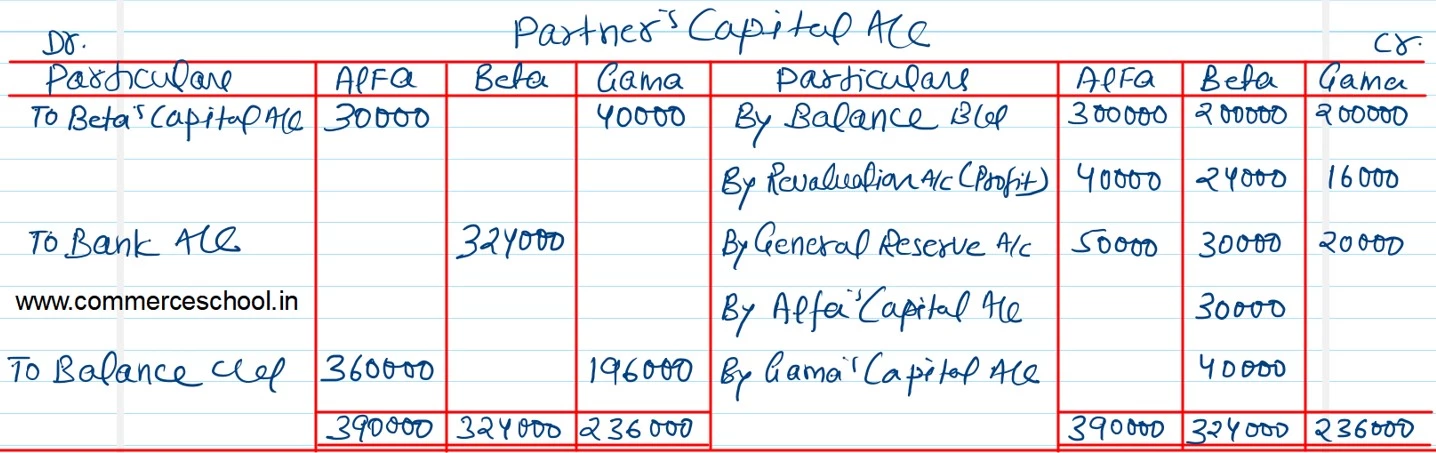

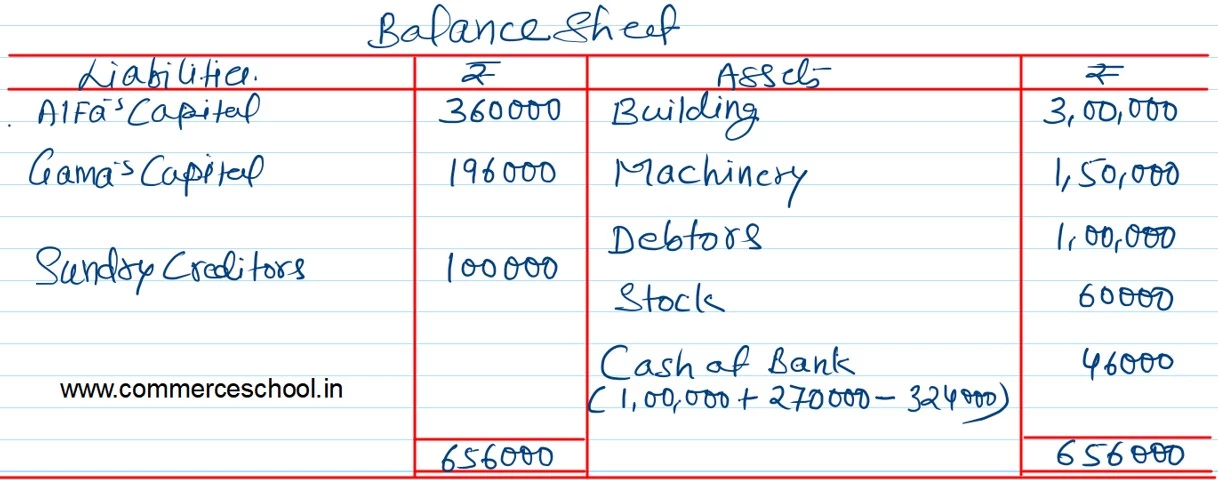

The terms of retirement were:

i) Beta takes goodwill from Alfa for ₹ 30,000 and from Gama for ₹ 40,000 for foregoing his share of profits.

ii) Stock to be appreciated by 20% and building by ₹ 50,000.

iii) Investments were sold for ₹ 2,70,000.

iv) Beta is paid by bank draft.

Prepare Revaluation Account, Partner’s Capital Accounts and Balance Sheet of the new firm.