Partnership Deed of C and D, who are equal partners, has a clause that any partner may retire from the firm on the following terms by giving a six month notice in writing:

Partnership Deed of C and D, who are equal partners, has a clause that any partner may retire from the firm on the following terms by giving a six month notice in writing:

a) the amount standing to the credit of his Capital Account and Current Account.

b) his share of profit to the date of retirement, calculated on the basis of the average profit of the three preceding completed years.

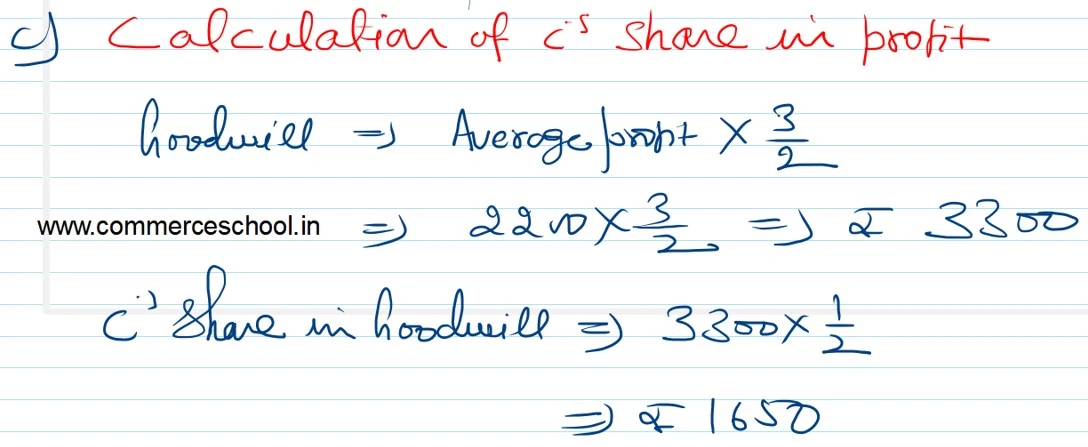

c) half the amount of the goodwill of the firm calculated at 1 and half times the average profit of the three preceding completed years.

C gave a notice on 31st March, 2022 to retire on 30th september, 2022, when the balance of his Capital Account was ₹ 6,000 and his Current Account (Dr.) ₹ 500. Profits for the three preceding completed years ended 31st March, were: 2020 – ₹ 2,800; 2021 – ₹ 2,201 and 2022 – ₹ 1,600.

Determine the amount due to C as per the partnership agreement.