Amit and Anil are partners sharing profits and losses in the ratio of 2 : 1. Their Balance Sheet as on 31st March, 2023 was as follows:

Amit and Anil are partners sharing profits and losses in the ratio of 2 : 1. Their Balance Sheet as on 31st March, 2023 was as follows:

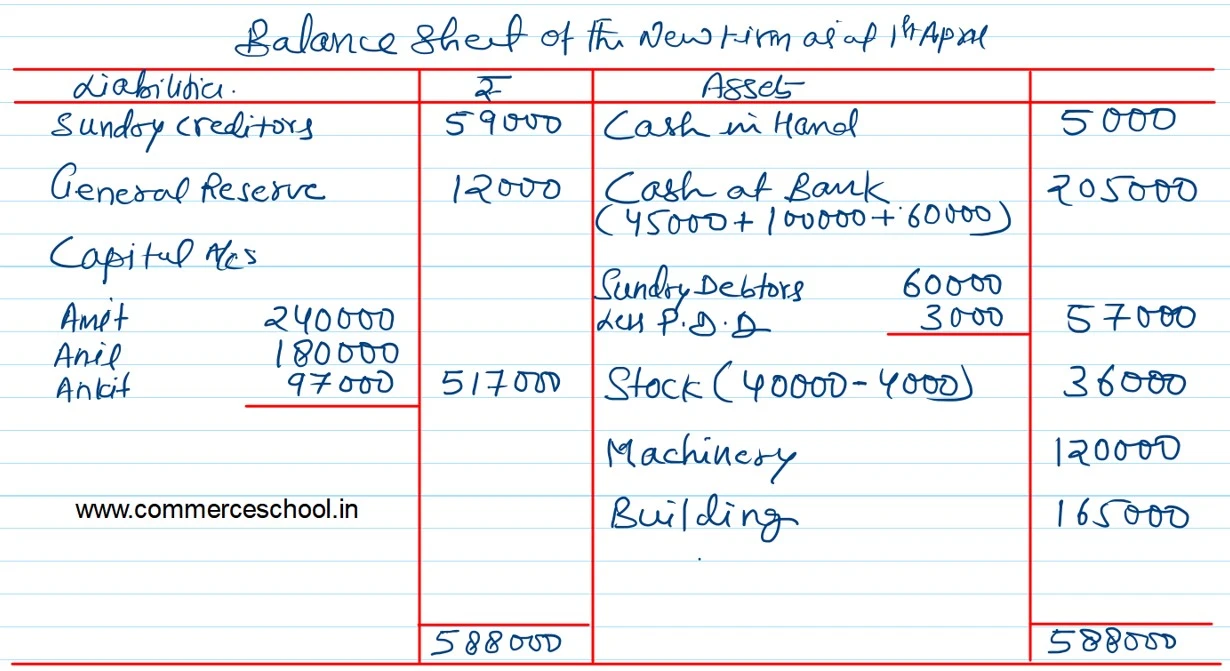

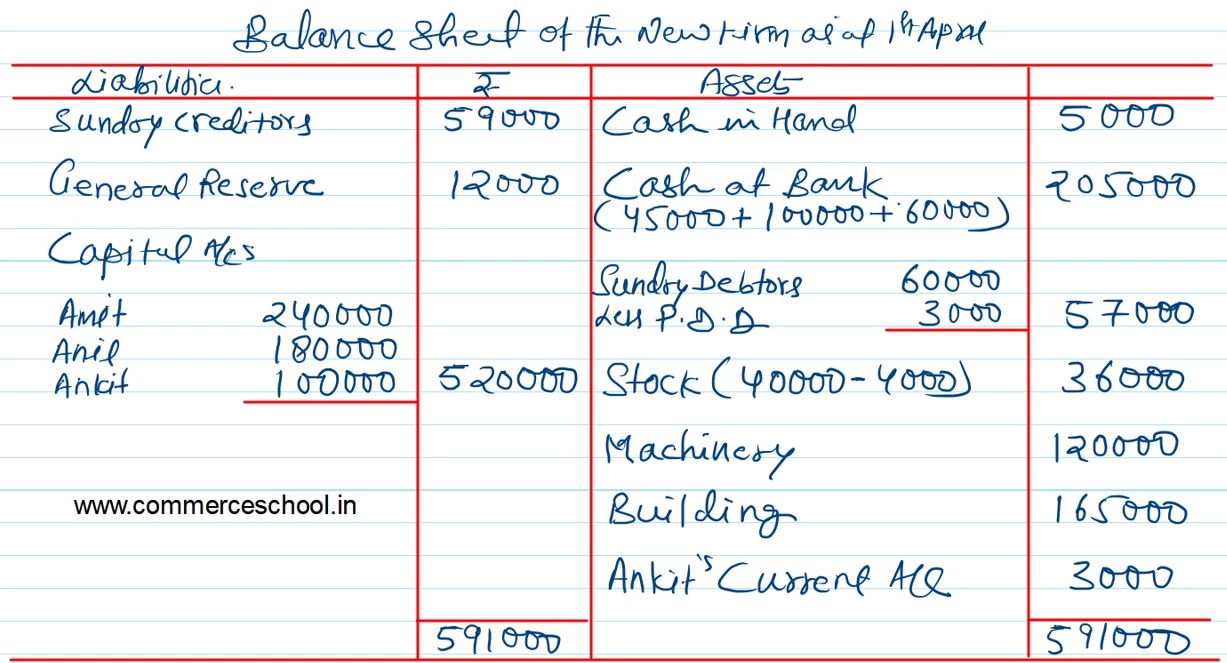

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors

General Reserve Capital A/cs: Amit Anil

|

58,000 12,000 1,80,000 1,50,000 |

Cash in Hand

Cash at Bank Sundry Debtors Stock Machinery Building |

5,000 45,000 60,000 40,000 1,00,000 1,50,000 |

| 4,00,000 | 4,00,000 |

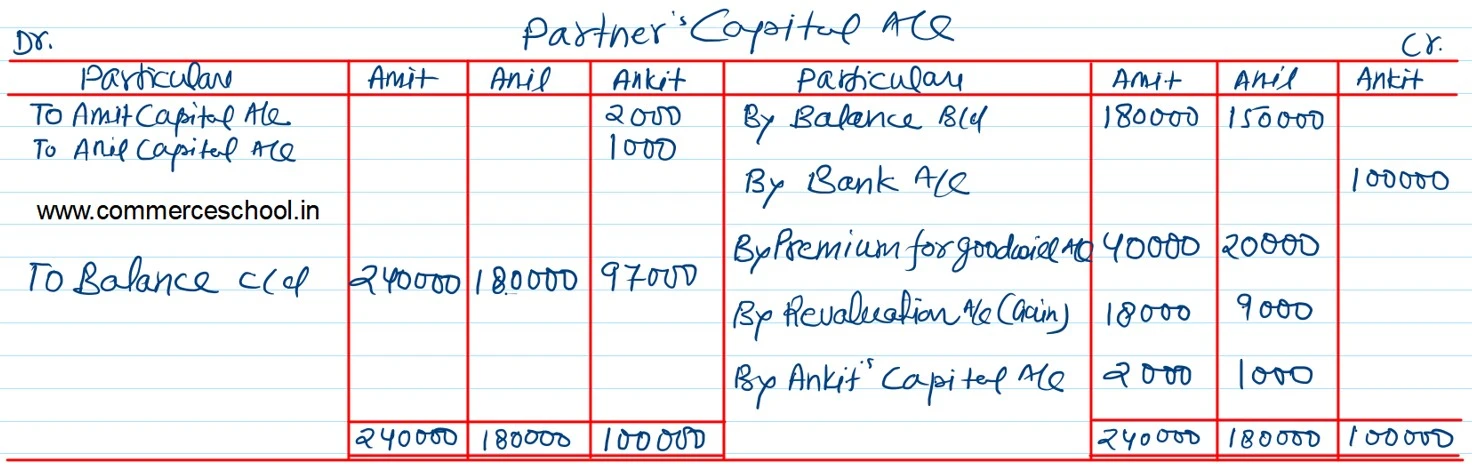

Ankit is admitted as a partner on the date of the Balance Sheet on the following terms:

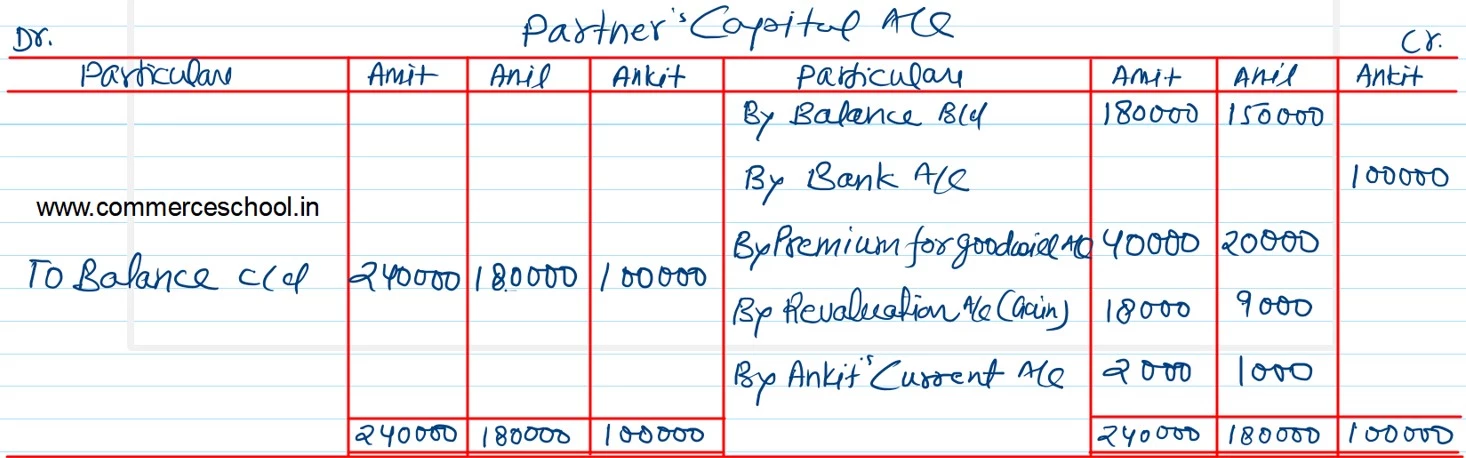

a) Ankit will bring in ₹ 1,00,000 as his capital and ₹ 60,000 as his share of goodwill for 1/4th share in profits.

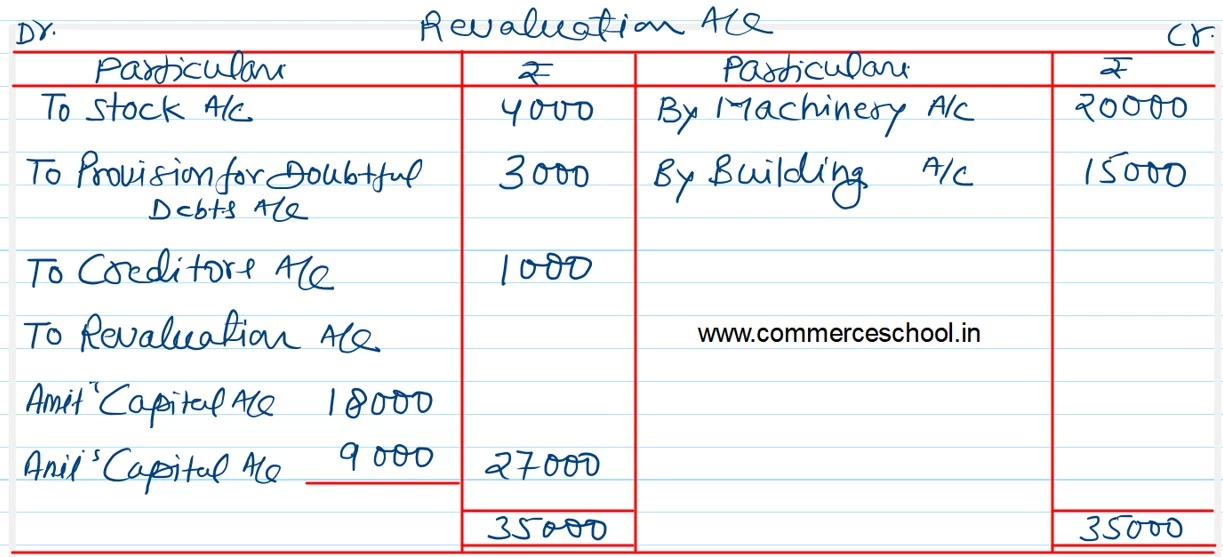

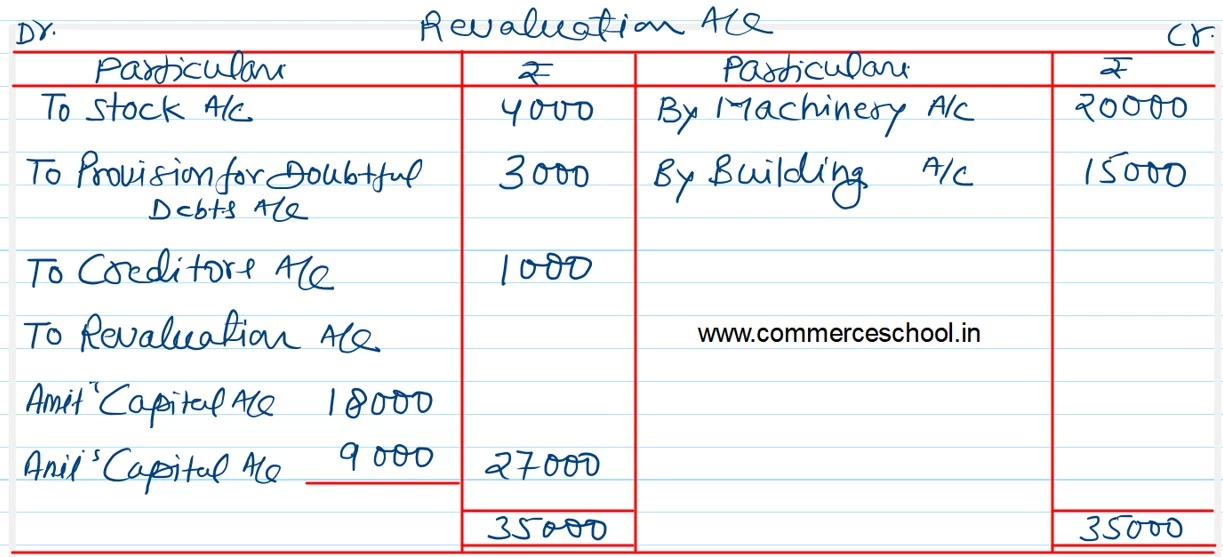

b) Machinery is to be appreciated t0 ₹ 1,20,000 and the value of Building is to be appreciated by 10%.

c) Stock is found overvalued by ₹ 4,000.

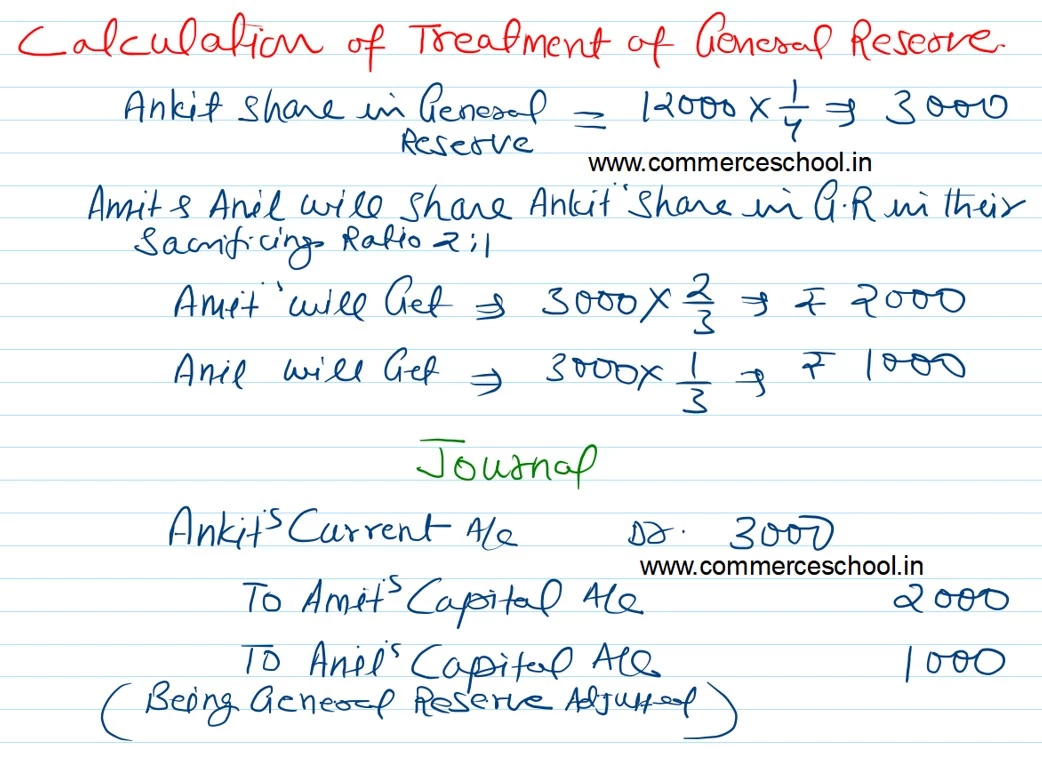

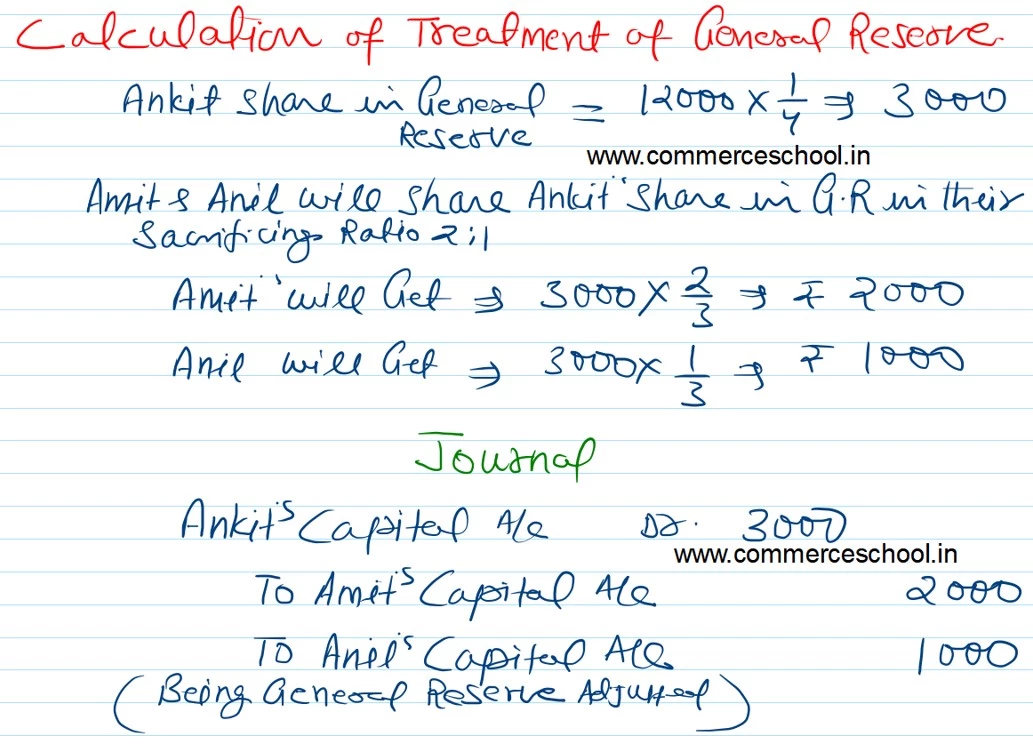

d) General Reserve will continue to appear in the books of the reconstituted firm at its original value.

e) A provision for Doubtful Debts is to be created at 5% of debtors

f) Creditors were unrecorded to the extent of ₹ 1,000.

Prepare Revaluation Account and partner’s Capital Accounts.

Solution:-

The Balance sheet is just given for your knowledge.

Note:- Here, the Student needs to write a note that as follows

Ankit would compensate the old partners through his current Account.

As, Question does not mention, how a new partner would compensate to old partners. he also can compensate through his capital account. The Capital balance would differ from Books answer as follows.

Alternative

The Balance sheet is just given for your knowledge.