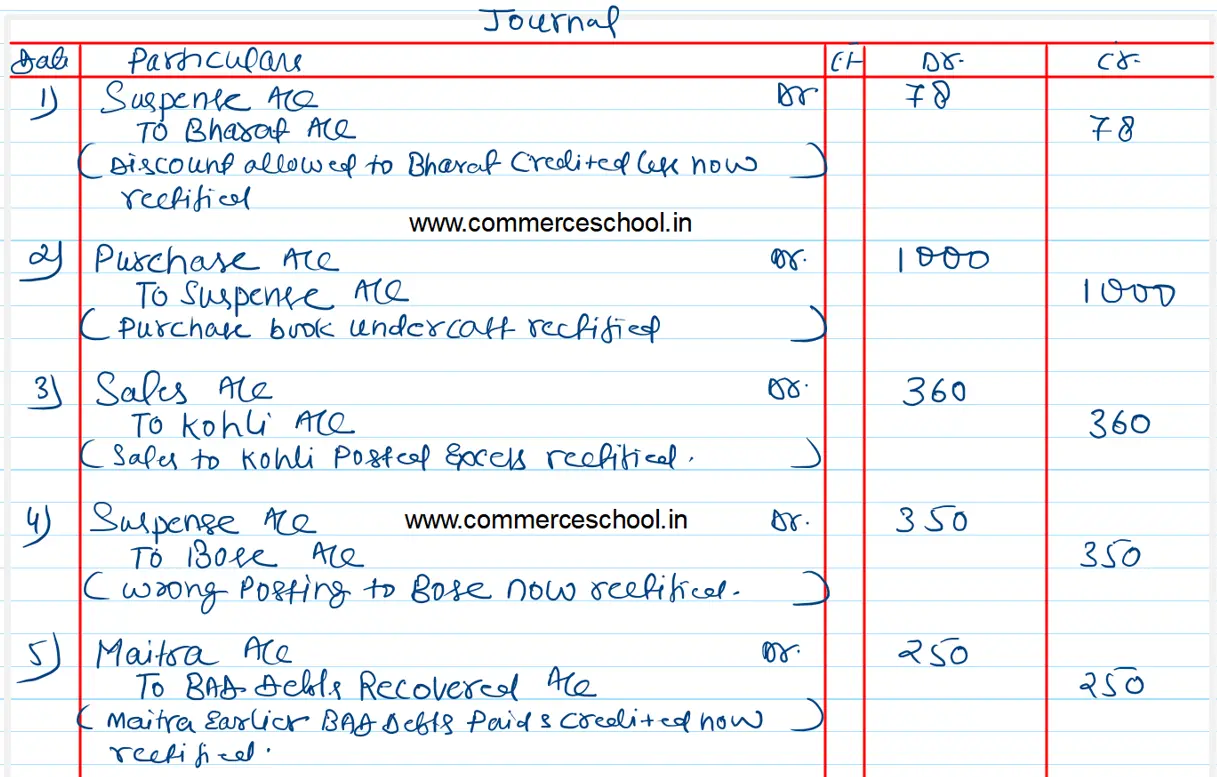

An accountant of a firm found that his Trial Balance was out (excess credit) by ₹ 742. He placed the amount in a Suspense Account and Subsequently found the following errors:

An accountant of a firm found that his Trial Balance was out (excess credit) by ₹ 742. He placed the amount in a Suspense Account and Subsequently found the following errors:

(i) A discount of ₹ 178 was allowed to Bharat but in his account only ₹ 100 is recorded.

(ii) The total of the Purchases Book was ₹ 1,000 short.

(iii) A sale of ₹ 375 to Kohli was entered in the Sales Book as ₹ 735.

(iv) From the Purchases Book, Bose’s Account was debited with ₹ 175.

(v) Cash ₹ 250 received from Maitra against debt previously written off was credited to his account.

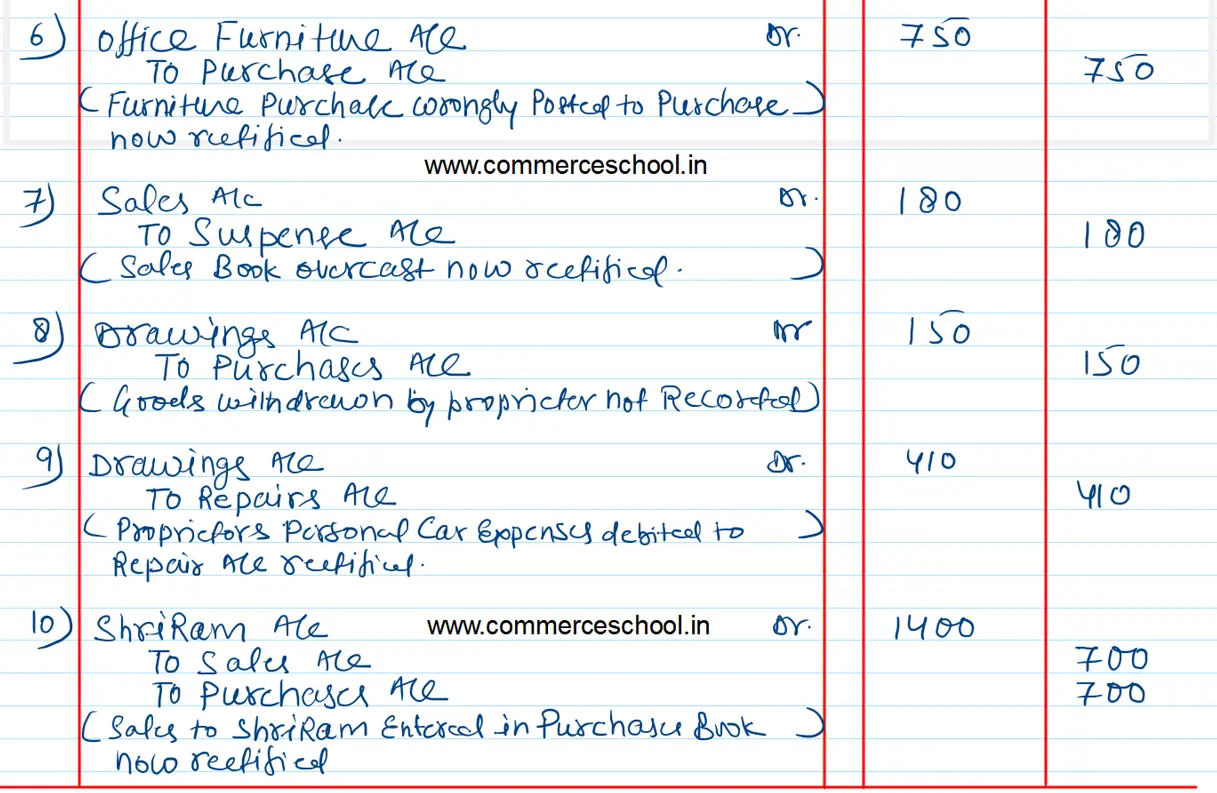

(vi) Purchase of office furniture worth ₹ 750 on credit from Delhi Furniture was entered in the Purchases Book.

(vii) While carrying forward the total of the Sales Book from one page to another the amount of ₹ 11,358 was written as ₹ 11,538.

(viii) The proprietor took goods of the value of ₹ 150 for his domestic consumption. No record of it has been made in the books.

(ix) Repairs bill of ₹ 410 for the proprietor’s personal car, has been paid by the firm and debited to the Repairs Account.

(x) A sale of ₹ 700 to Shriram has been entered in the Purchases Book.

Rectify the errors by means of suitable Journal entries and show the Suspense Account.