Angad and Bishan are equal partners of a firm, Balance Sheet of which is given below as at 31st March, 2023

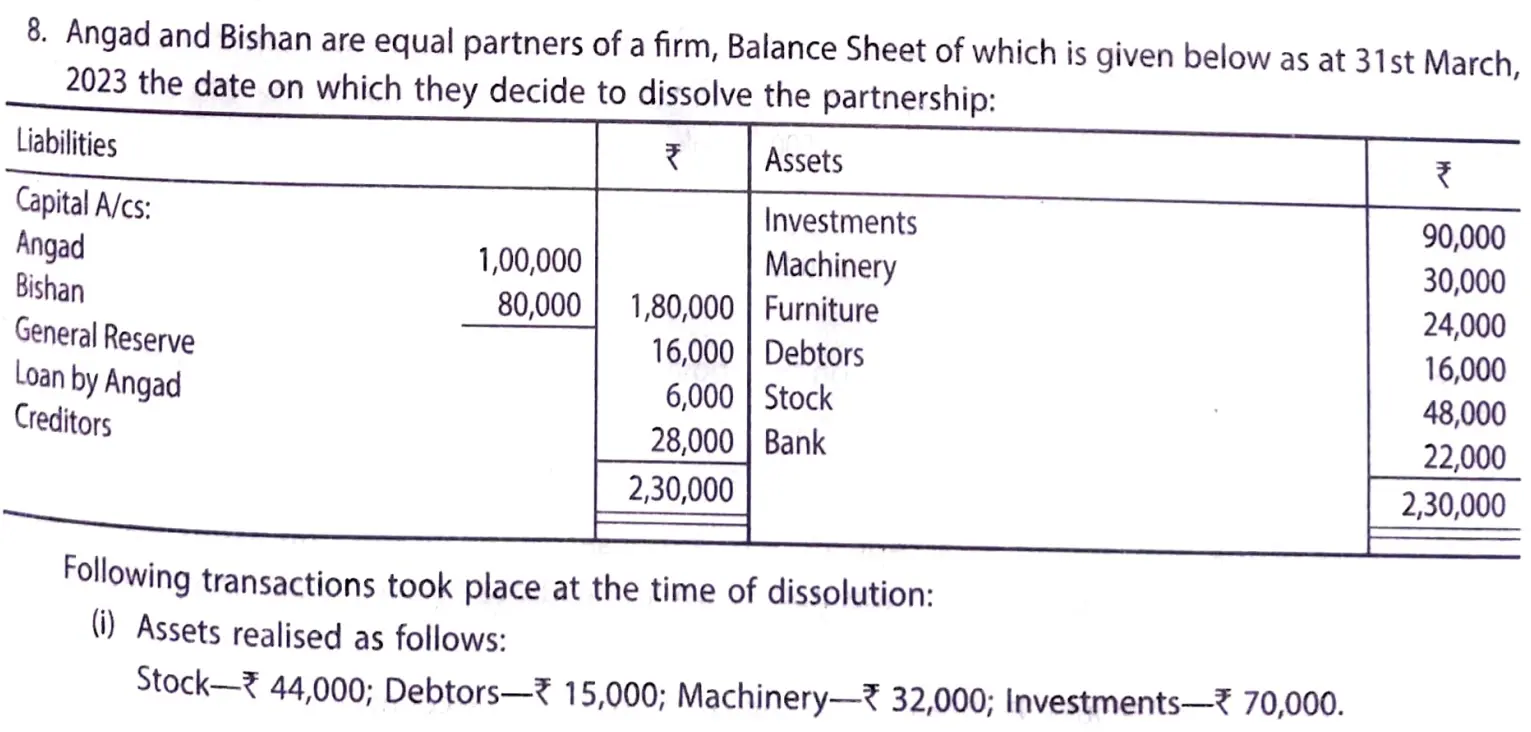

Angad and Bishan are equal partners of a firm, Balance Sheet of which is given below as at 31st March, 2023 the date on which they decide to dissolve the partnership:

| Liabilities | ₹ | Assets | ₹ | |

|

Capital A/cs: Angad Bishan General Reserve Loan by Angad Creditors |

1,00,000 80,000 |

1,80,000 16,000 6,000 28,000 |

Investments Machinery Furniture Debtors Stock Bank |

90,000 30,000 24,000 16,000 48,000 22,000 |

| 2,30,000 | 2,30,000 |

Following transactions took place at the time of dissolution:

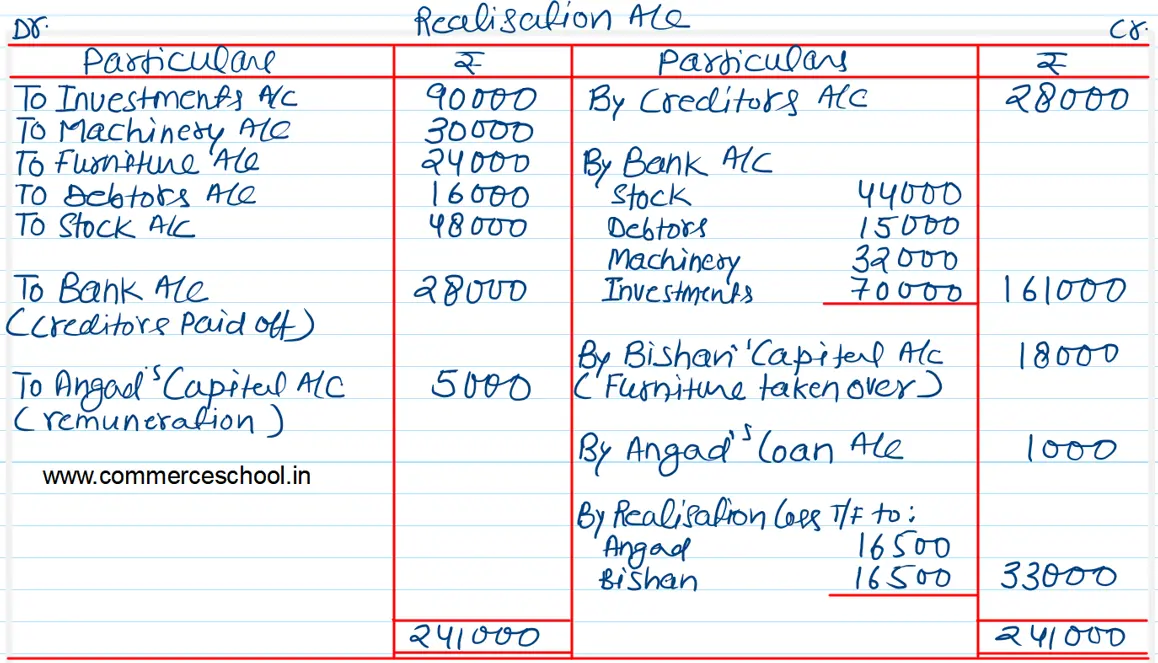

(i) Assets realised as follows:

Stock – ₹ 44,000; Debtors – ₹ 15,000; Machinery – ₹ 32,000; Investments – ₹ 70,000.

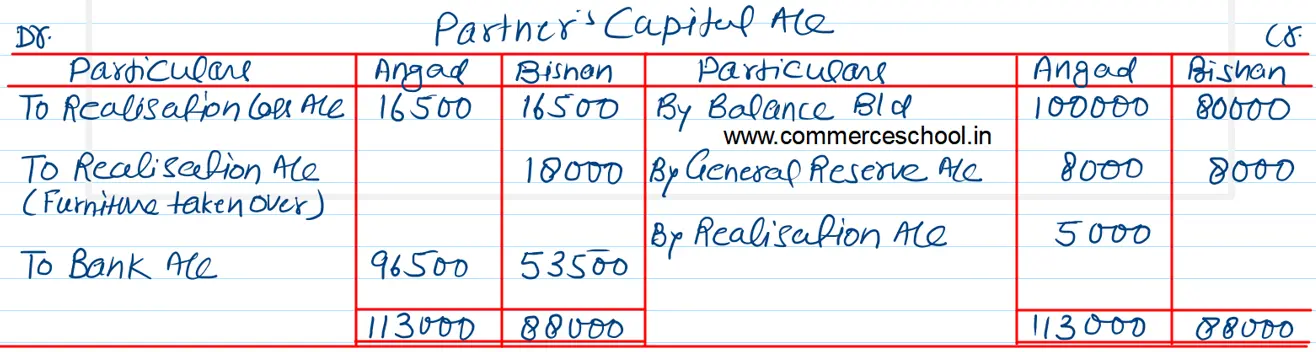

(ii) Bishan took Furniture at ₹ 18,000.

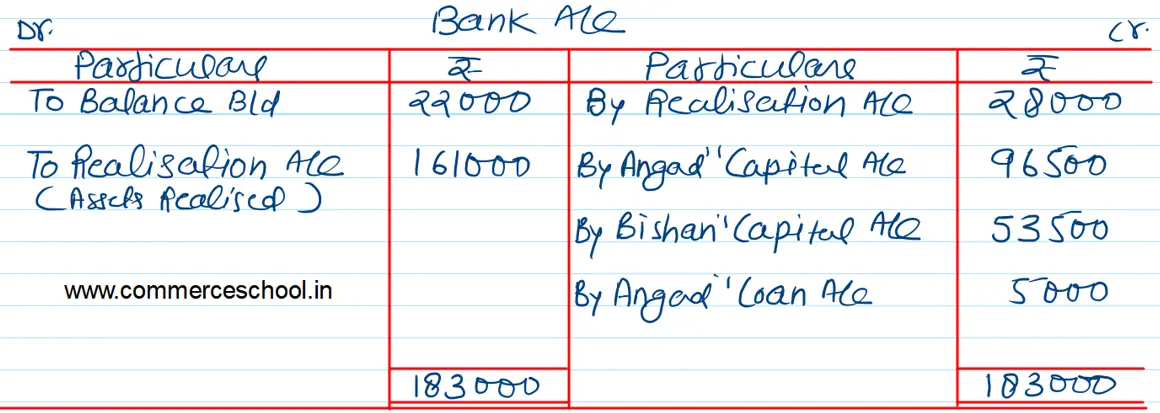

(iii) Angad agreed to accept ₹ 5,000 in settlement of his Loan Account.

(iv) Angad was entitled to receive ₹ 5,000 as remuneration for completing the dissolution work and was to bear the realisation expenses. The expenses of realisation ₹ 6,000 were paid by Angad.

Prepare Realisation Account, Capital Accounts of Partners, Angad’s Loan Account and Bank Account.