Angad, Raman and Harish were partners in a firm. They decided to dissolve their firm

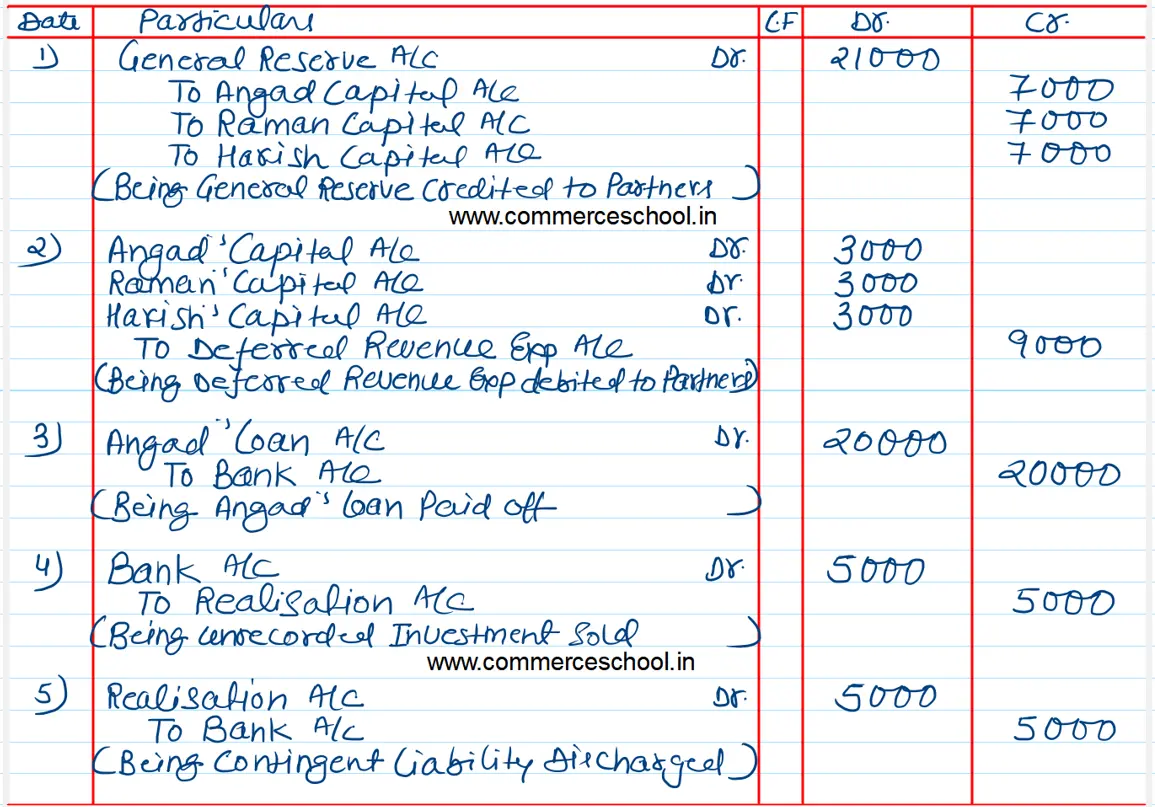

Angad, Raman and Harish were partners in a firm. They decided to dissolve their firm. Pass necessary Journal entries for the following after various assets (other than Cash and Bank) and third party liabilities have been transferred to Realisation Account.

(i) There was a balance of ₹ 21,000 in the General Reserve on the date of dissolution.

(ii) Deferred Revenue Advertisement Expenditure existed at ₹ 9,000.

(iii) Angad, one of the partner had given loan to the firm of ₹ 20,000. It was paid to him on the date of dissolution.

(iv) An unrecorded investment existed of ₹ 5,000.

(v) A contingent liability (not provided for) of ₹ 5,000 was discharged.

Anurag Pathak Changed status to publish February 10, 2024