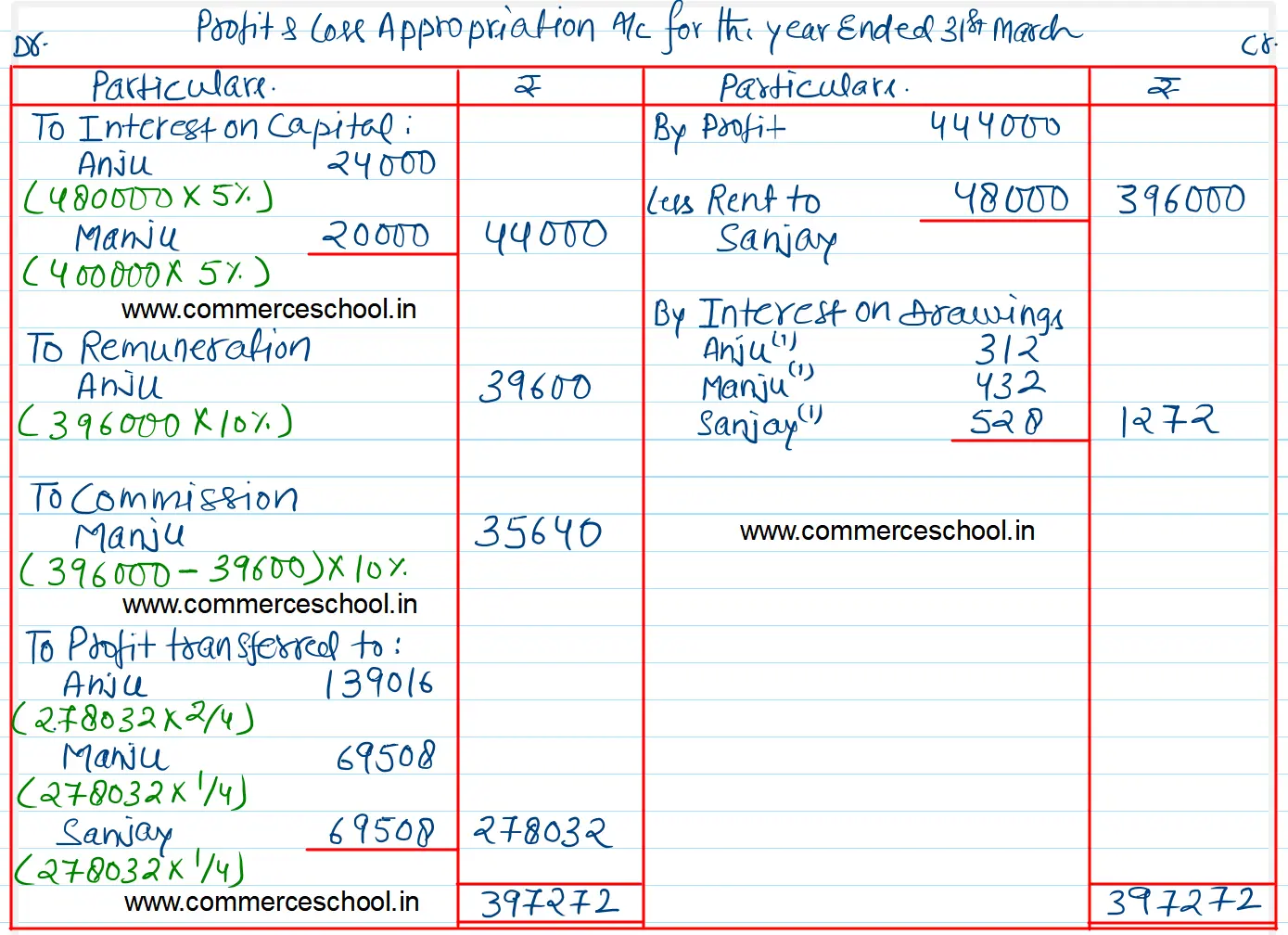

Anju, Manju, and Sanjay are in partnership with capitals as on 1st April 2022 of ₹ 4,80,000 (credit), ₹ 4,00,000 (credit), and ₹ 32,000 (Debit) respectively. They share profits in the ratio of 2 : 1 : 1

Anju, Manju, and Sanjay are in partnership with capitals as on 1st April 2022 of ₹ 4,80,000 (credit), ₹ 4,00,000 (credit), and ₹ 32,000 (Debit) respectively. They share profits in the ratio of 2 : 1 : 1.

Their Partnership Deed provides for the following as follows:

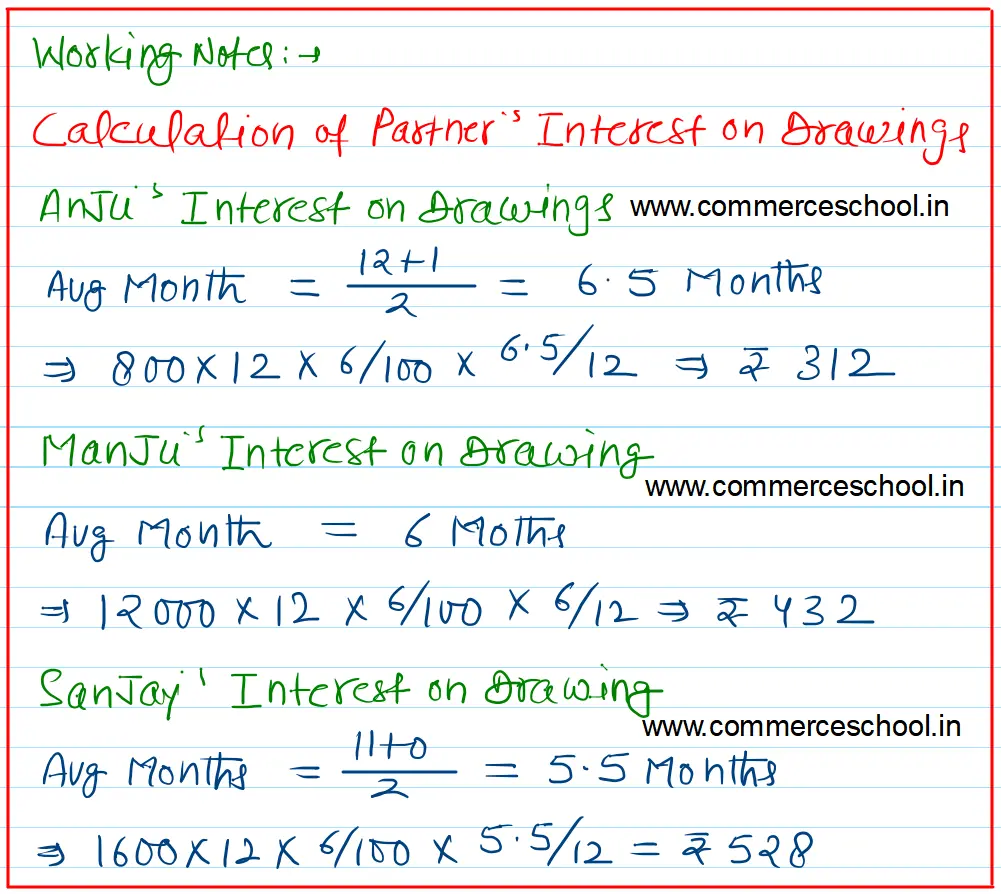

(i) Partners are to be allowed interest on capitals @ 5% p.a. and are to be charged interest on drawings @ 6% p.a.

(ii) Anju is to get a remuneration of 10% of the net profit for Customer Relationship Work.

(iii) Manju is to get a commission of 10% of the net profit after charging remuneration to Anju as per clause (ii) above.

(iv) Sajay is to get rent of ₹ 4,000 per month for the use of his premises by the firm.

During the financial year, Anju withdrew ₹ 800 in the beginning of every month, Manju ₹ 1,200 during the month and Sanjay ₹ 1,600 at the end of every month.

The profit of the firm for the year ended 31st March 2023 was ₹ 4,44,000.

You are required to draw the Profit and Loss Appropriation Account for the year ended 31st March 2023. (All calculations to be made to the nearest rupee)