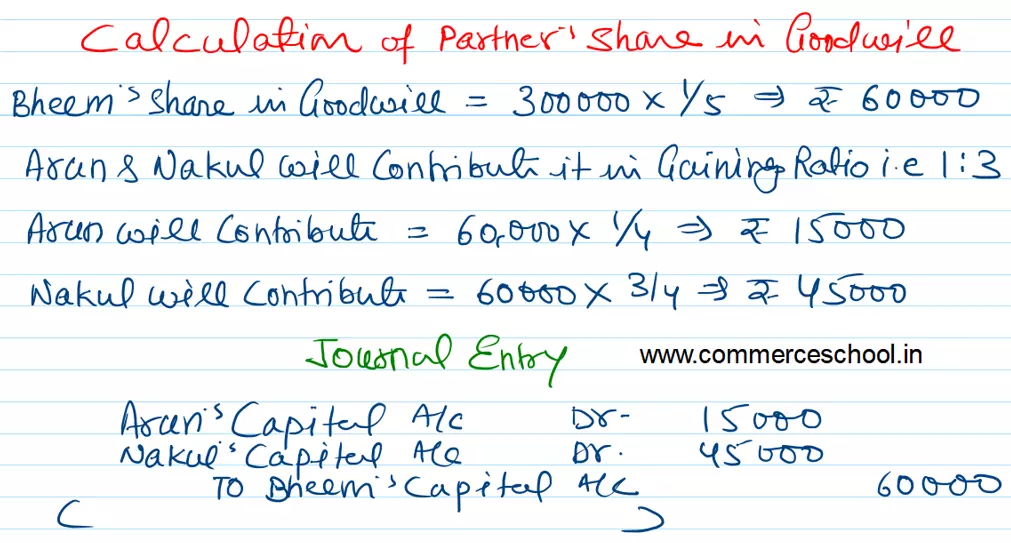

Arun, Bhim and Nakul are partners in a firm sharing profits in the ratio of 1 : 1 : 3. Their Capital Accounts showed the following balances on 1st April, 2020:

Arun, Bhim and Nakul are partners in a firm sharing profits in the ratio of 1 : 1 : 3. Their Capital Accounts showed the following balances on 1st April, 2020:

Arun – ₹ 2,00,000; Bhim – ₹ 1,50,000 and Nakul – ₹ 4,50,000.

Firm closes its accounts every year on 31st March, Bhim died on 31st March, 2021. In the event of death of any partner, the Partnership Deed provides for the following:

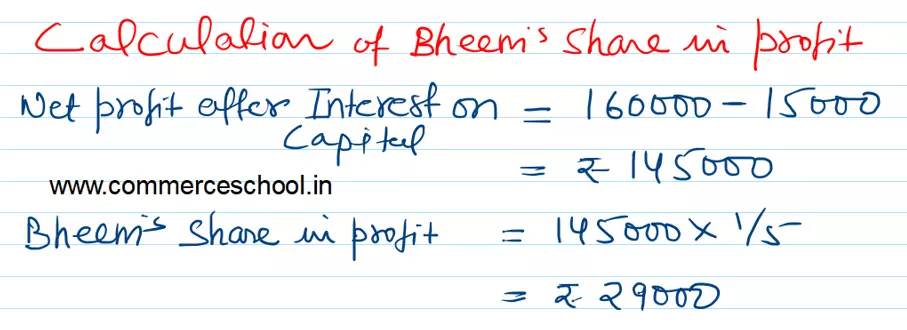

(i) Interest on capital will be allowed to deceased partner only from the first of day of the accounting year till the date of his death @ 10% p.a.

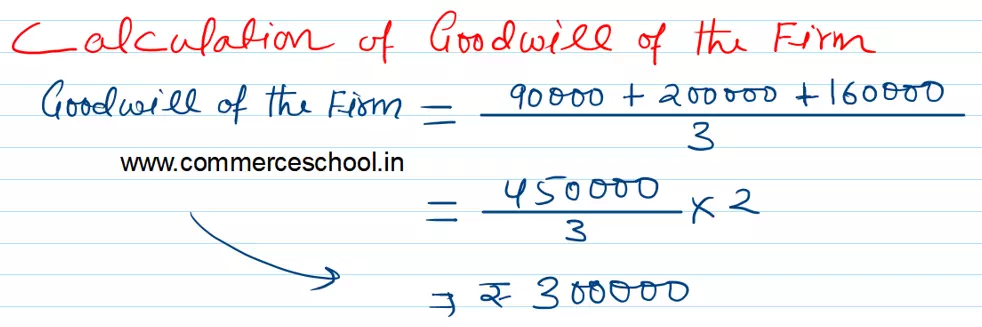

(ii) The deceased partner’s share in the Goodwill of the firm will be calculated on the basis of 2 year’s purchase of the average profit of the last three years. The Profits of the firm for the last three years ended 31st March, were: 2019 – ₹ 90,000; 2020 – ₹ 2,00,000 and 2021 – ₹ 1,60,000.

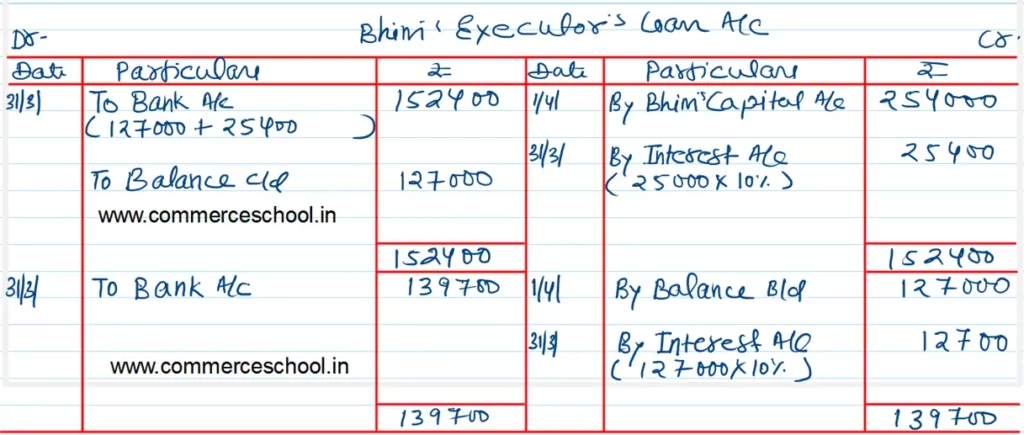

(iii) His share of profits till the date of Death: The profit of the firm for the year ended 31st March, 2021 was ₹ 1,60,000 before providing for interest on capital. Bhim’s Executor was paid the sum due in two equal annual installments with interest @ 10% p.a.

Prepare Bhim’s Capital Account as on 31st March, 2021 to be presented to his executor and his Executor’s Loan Account for the year ending 31st March, 2022 and 31st March, 2023.