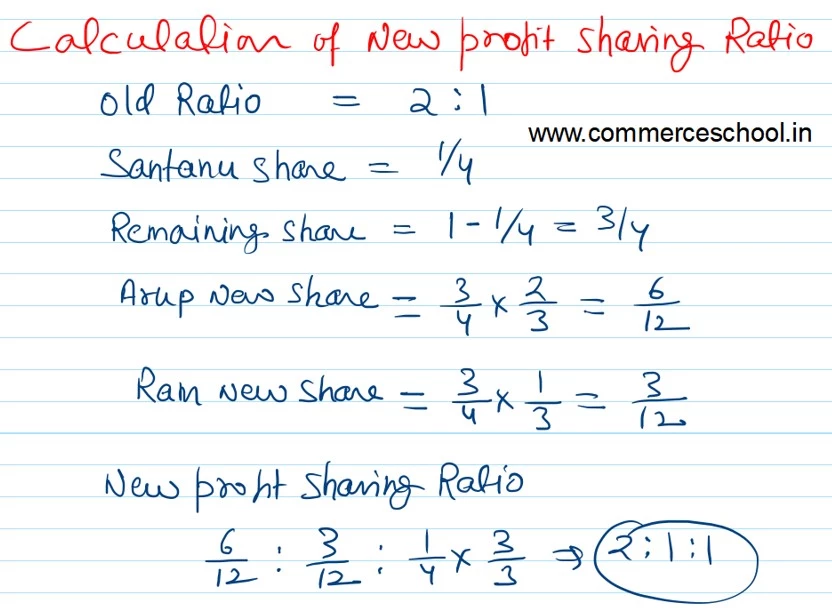

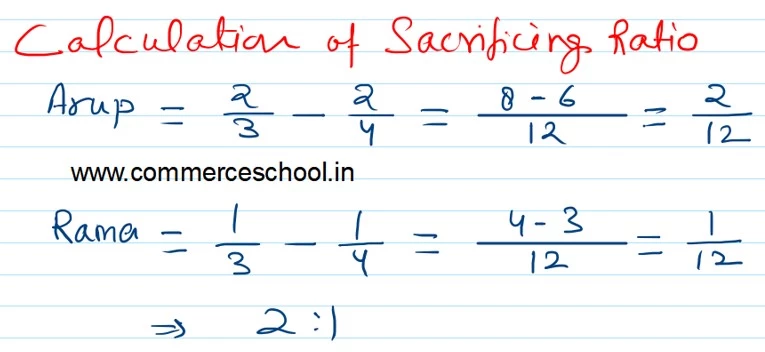

Arup and Rama are partners in a firm sharing profits in 2 : 1. They admitted Santanu for 1/4th share in profits on 1st April

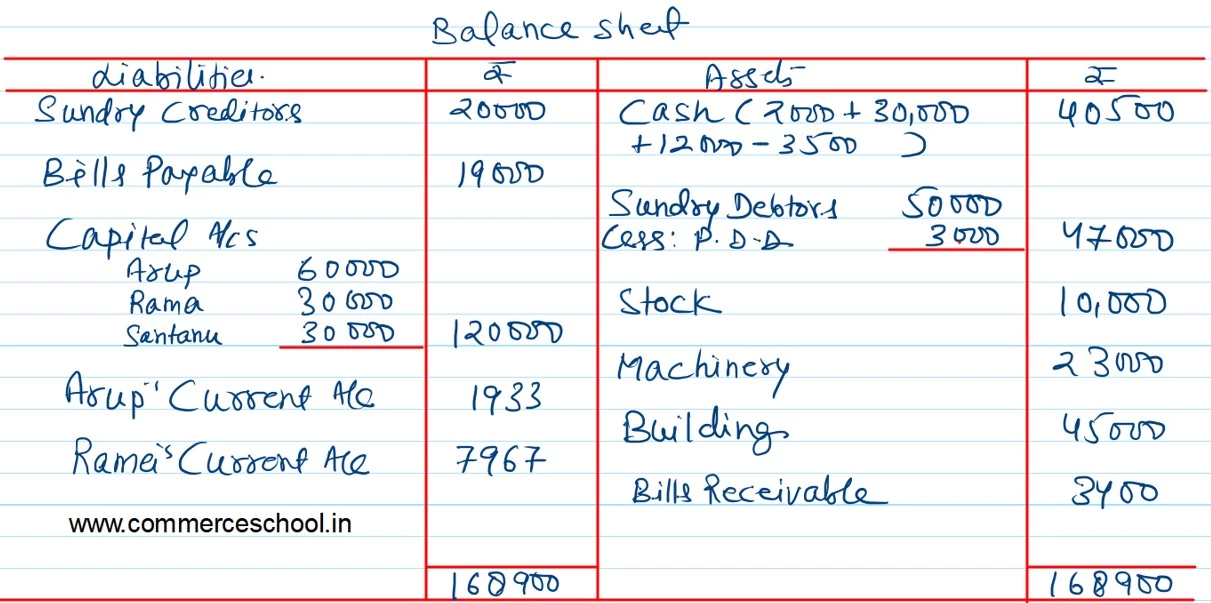

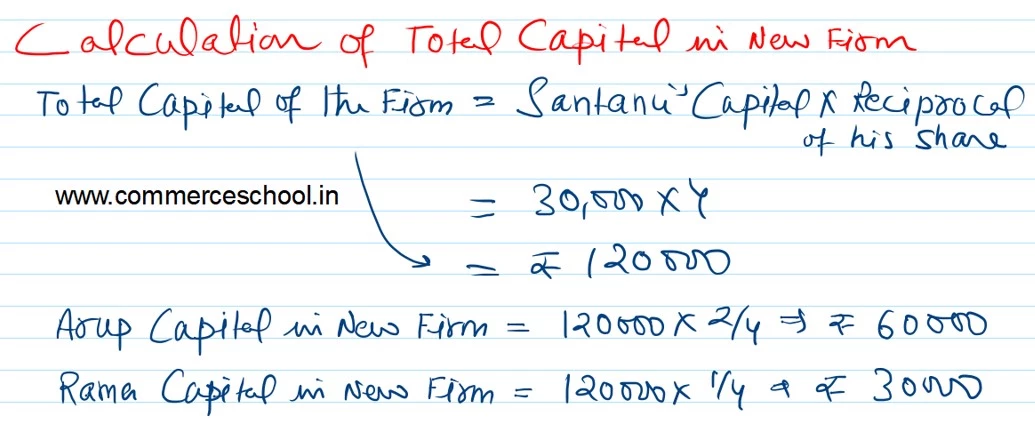

Arup and Rama are partners in a firm sharing profits in 2 : 1. They admitted Santanu for 1/4th share in profits on 1st April, 2023, Santanu was to bring ₹ 30,000 as capital and capital of Arup and Rama were to be adjusted in the profit sharing ratio on the basis of santanu’s capital. The Balance Sheet of Arup and Rama as at 31st March, 2023 (before Santanu’s admission) was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors

Bills Payable General Reserve Capital A/cs: Arup Rama |

20,000

19,000 6,000 50,000 32,000 |

Cash

Sundry Debtors Stock Machinery Building |

2,000

50,000 10,000 25,000 40,000 |

| 1,27,000 | 1,27,000 |

Other terms of agreement were:

(i) Santanu will bring ₹ 12,000 for his share of goodwill.

(ii) Building was valued at ₹ 45,000 and Machinery at ₹ 23,00.

(iii) Provision of Doubtful Debts was created @ 6% on Sundry Debtors

(iv) Vishal a Customer whose account was written off as bad debts promised to pay ₹ 3,400 by issuing promissory note in settlement of his full debt of ₹ 5,000.

(v) Revaluation expenses paid by firm ₹ 3,500.

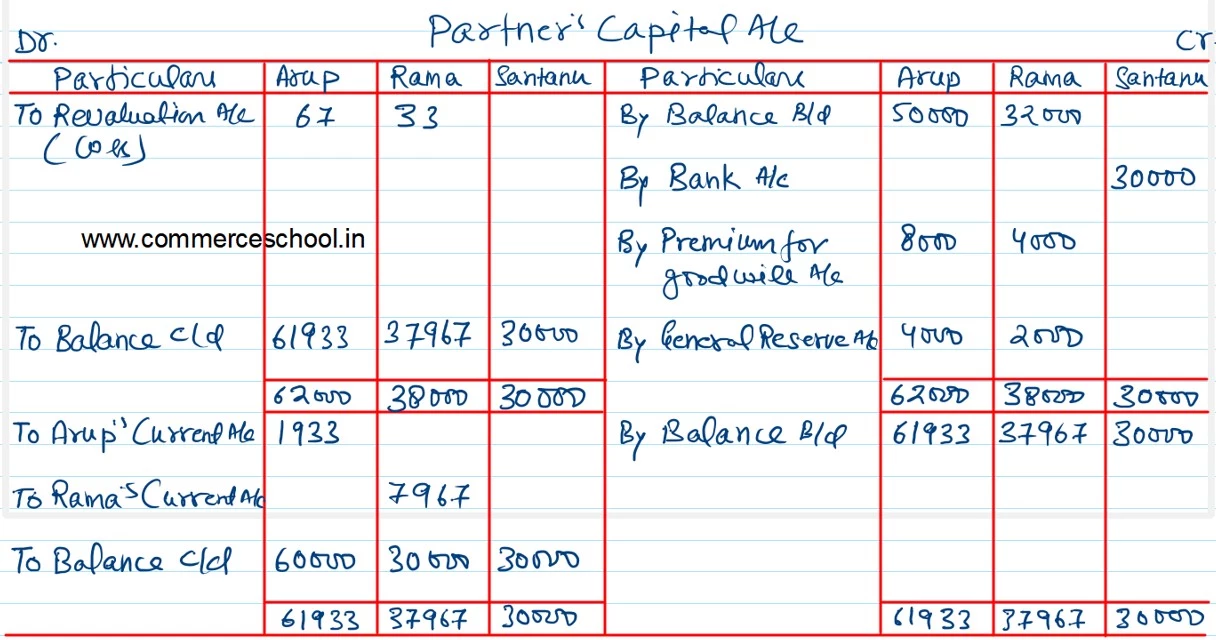

(vi) Capital Accounts of Arup and Rama were adjusted by opening Current Accounts.

Prepare Revaluation Account, Partner’s Capital Accounts and Balance Sheet after Shantanu’s admission.