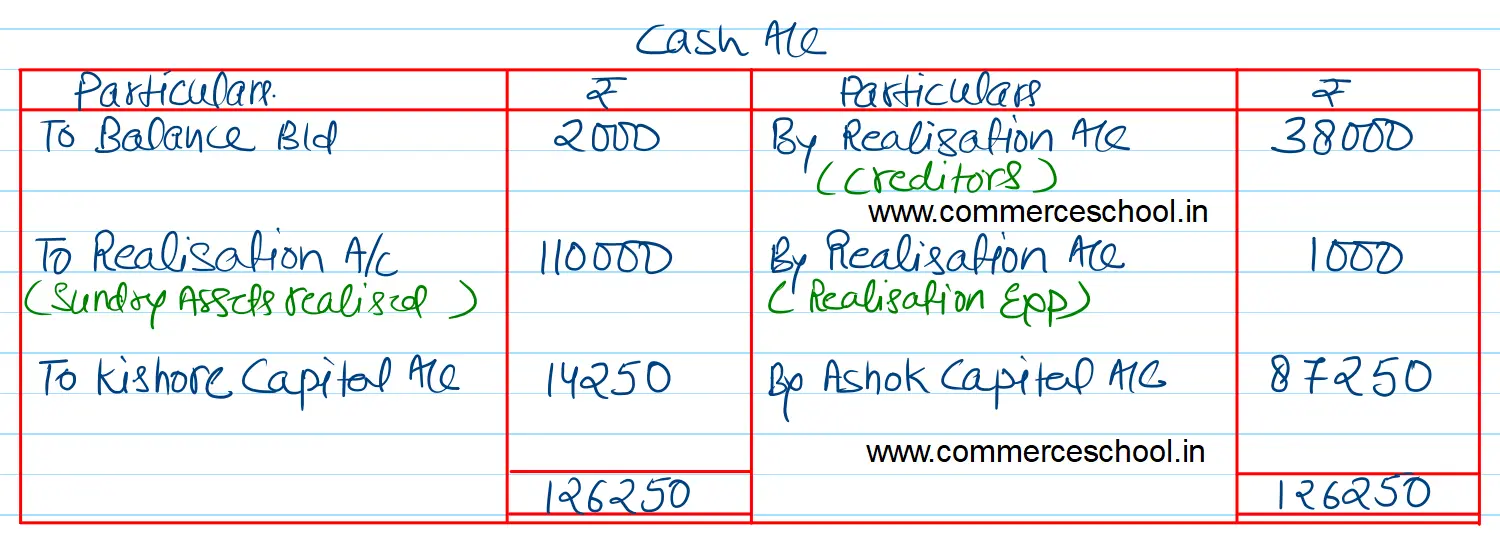

Ashok and Kishore were in partnership sharing profits in the ratio of 3 : 1. They agreed to dissolve the firm. The assets (other than cash of ₹ 2,000) of the firm realised ₹ 1,10,000

Ashok and Kishore were in partnership sharing profits in the ratio of 3 : 1. They agreed to dissolve the firm. The assets (other than cash of ₹ 2,000) of the firm realised ₹ 1,10,000. The liabilities and other particulars of the firm on that date were as follows:-

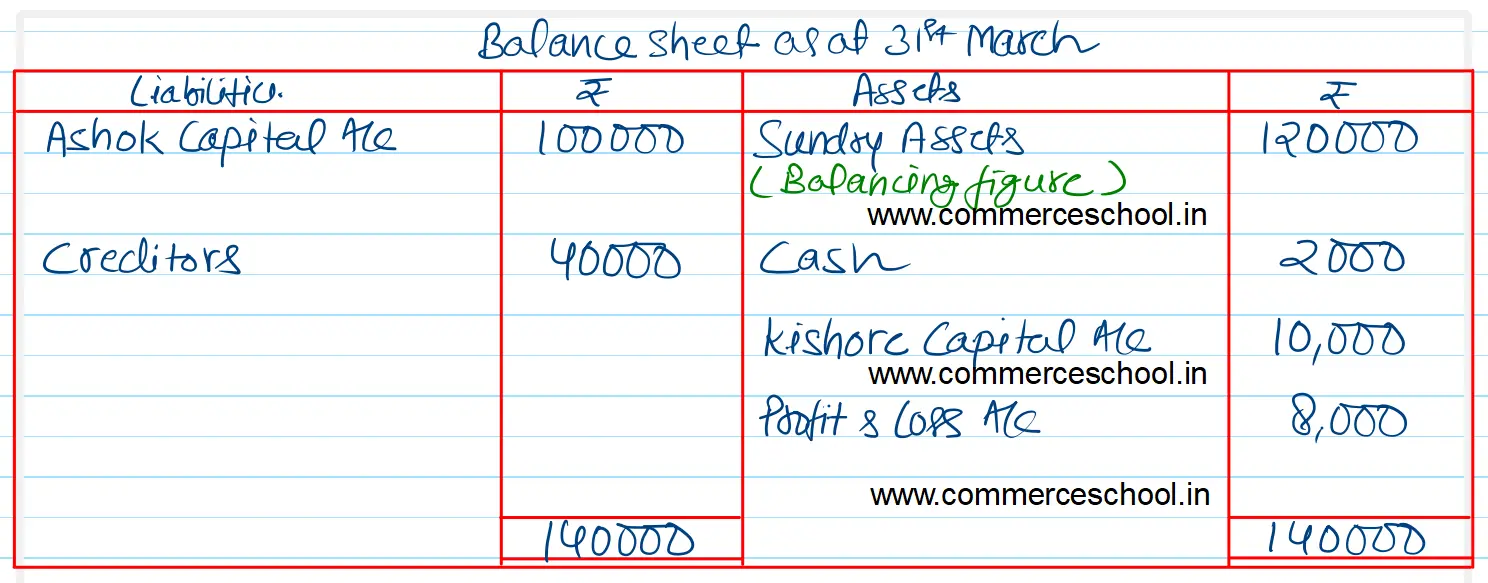

| ₹ | |

| Creditors | 40,000 |

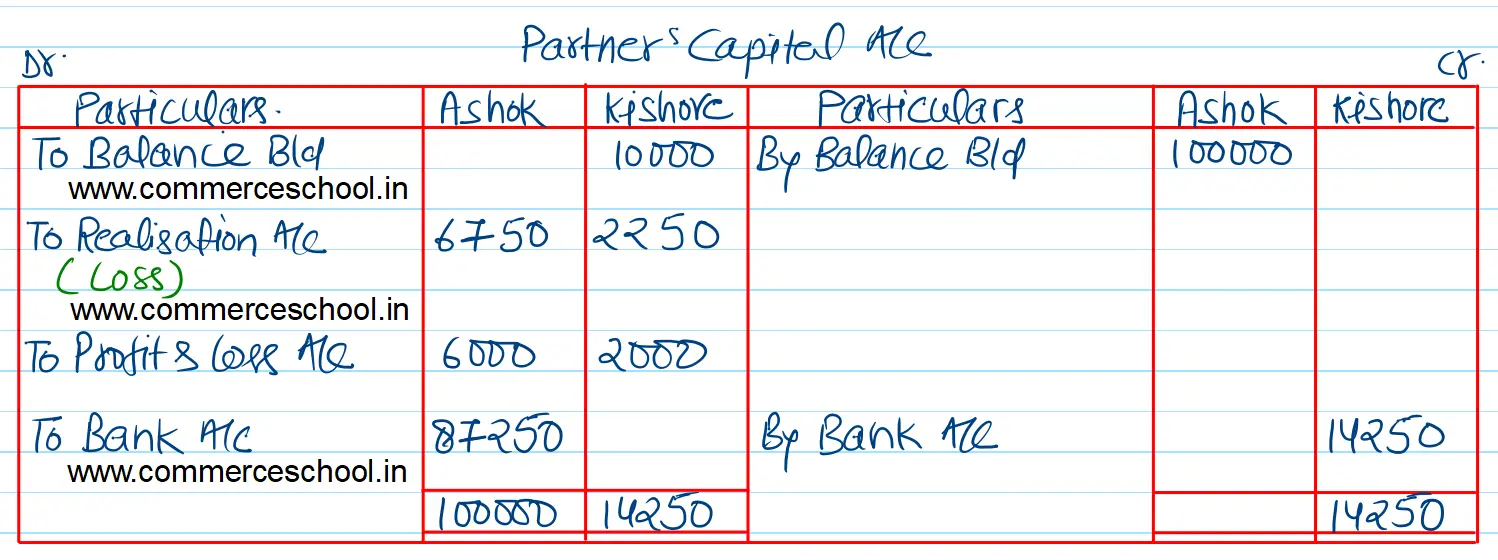

| Ashok’s Capital | 1,00,000 |

| Kishor’s Capital | 10,000 (Dr.) |

| Profit & Loss Account | 8,000 (Dr.) |

| Realisation Expenses were | 1,000 |

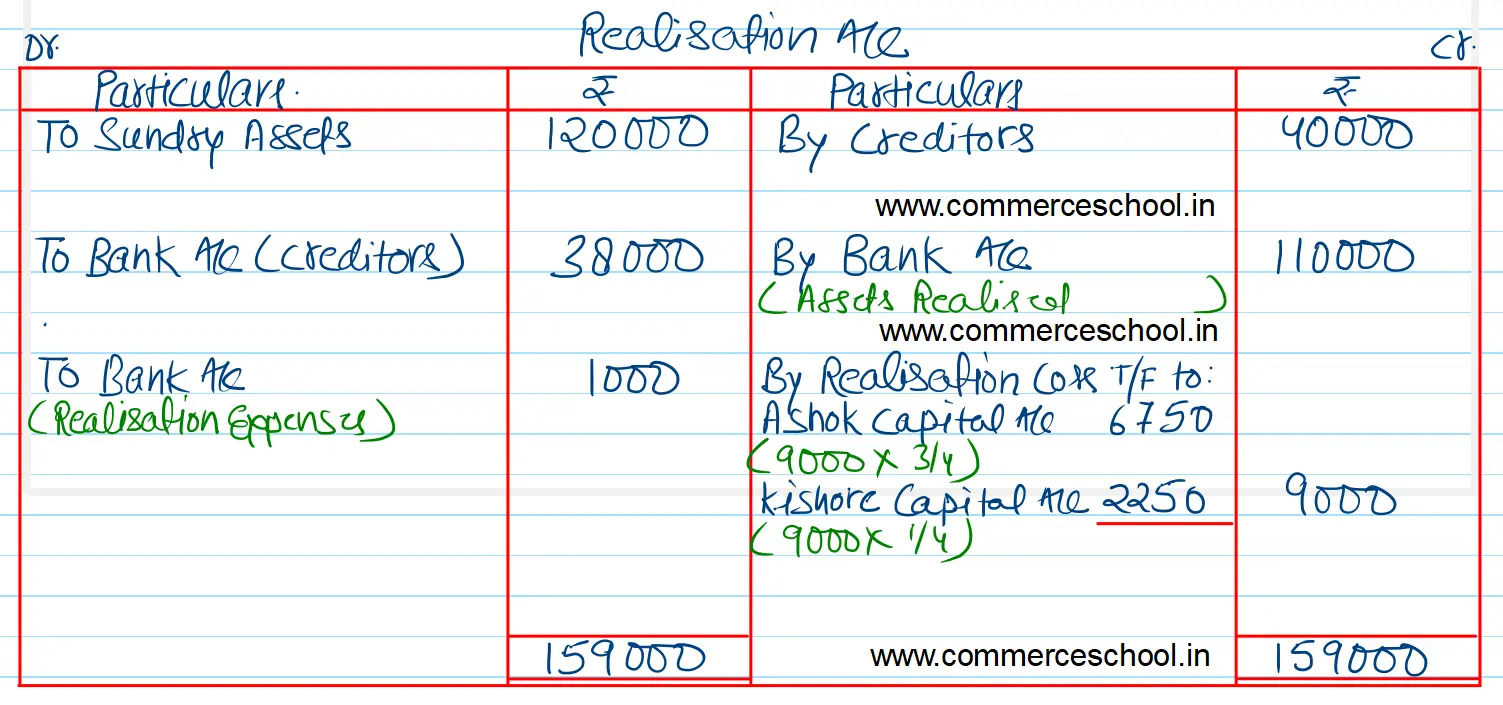

Creditors were settled in full settlement at ₹ 38,000. Prepare Realisation and Cash Account. [Ans. Book value of Assets (other than cash) ₹ 1,20,000.

[Loss on Realisation ₹ 9,000. Final Settlement: Kishore brings in ₹ 14,250 and Ashok is paid ₹ 87,250; Total of Cash A/c ₹ 1,26,250.]

Anurag Pathak Answered question