Balance Sheet of Amul Ltd. as at 31st March, 2022 is given below Share Capital ₹ 4,00,000 Reserves and Surplus ₹ 3,13,000

Balance Sheet of Amul Ltd. as at 31st March, 2022 is given below:

| Particulars | 31st March, 2023 (₹) | 31st March, 2022 (₹) |

| I. EQUITY AND LIABILITIES | ||

|

1. Shareholder’s Funds (a) Share Capital (b) Reserves and Surplus |

4,00,000 3,13,000 | 3,00,000 2,36,000 |

|

2. Current Liabilities (a) Other Current Liabilities (b) Short-term Provisions |

1,50,000 80,000 | 1,40,000 90,000 |

| Total | 9,43,000 | 7,66,000 |

| II. ASSETS | ||

|

1. Non-Current Assets (a) Property, Plant and Equipment and Intangible Assets: Property, Plant and Equipment (b) Non-Current Investments (Trade Investment) |

4,30,000 60,000 |

3,50,000 80,000 |

|

2. Current Assets (a) Inventories (b) Trade Receivables (c) Cash and Bank Balances |

2,63,000 1,50,000 40,000 |

2,00,000 1,06,000 30,000 |

| Total | 9,43,000 | 7,66,000 |

| Particulars | 31st March, 2023 (₹) | 31st March, 2022 (₹) |

|

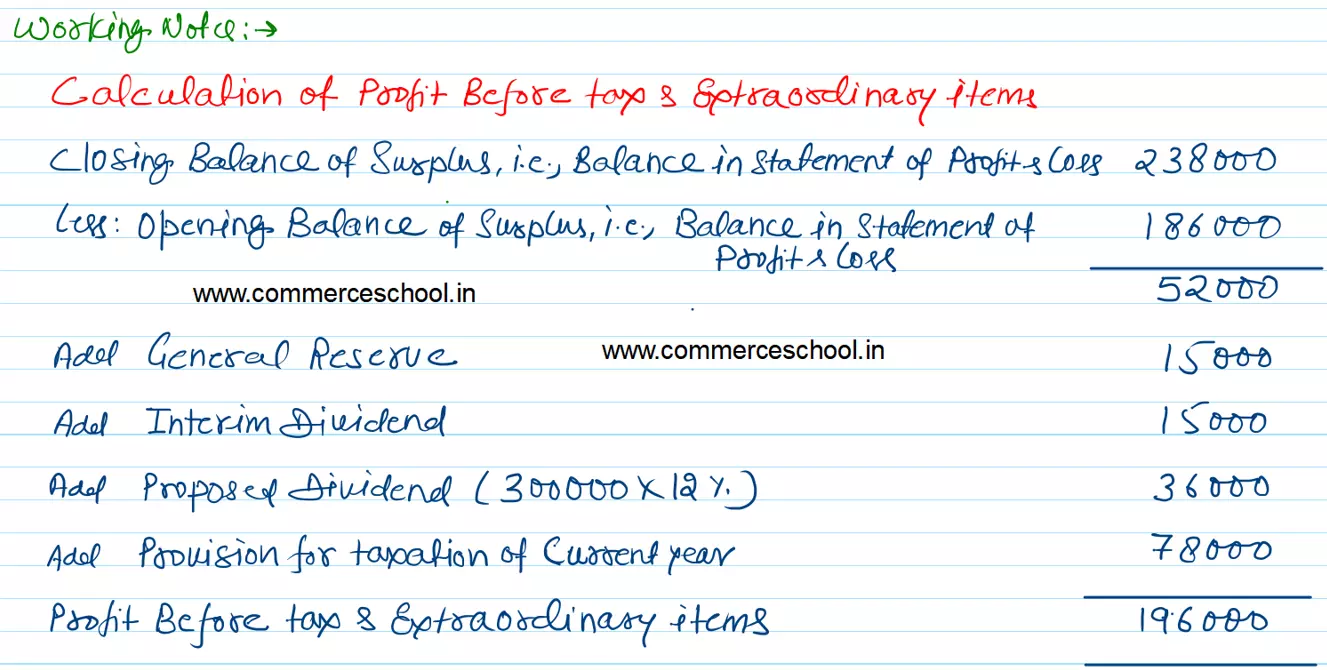

1. Reserves and Surplus Capital Reserve General Reserve Surplus, i.e., Balance in Statement of Profit & Loss |

10,000 65,000 2,38,000 |

– 50,000 1,86,000 |

| 3,13,000 | 2,36,000 | |

|

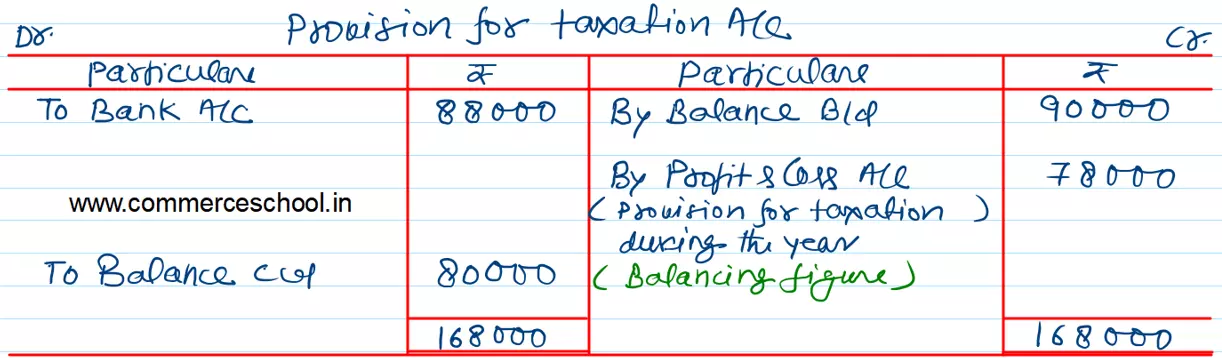

2. Short-term Provisions Provision for Tax |

80,000 | 90,000 |

|

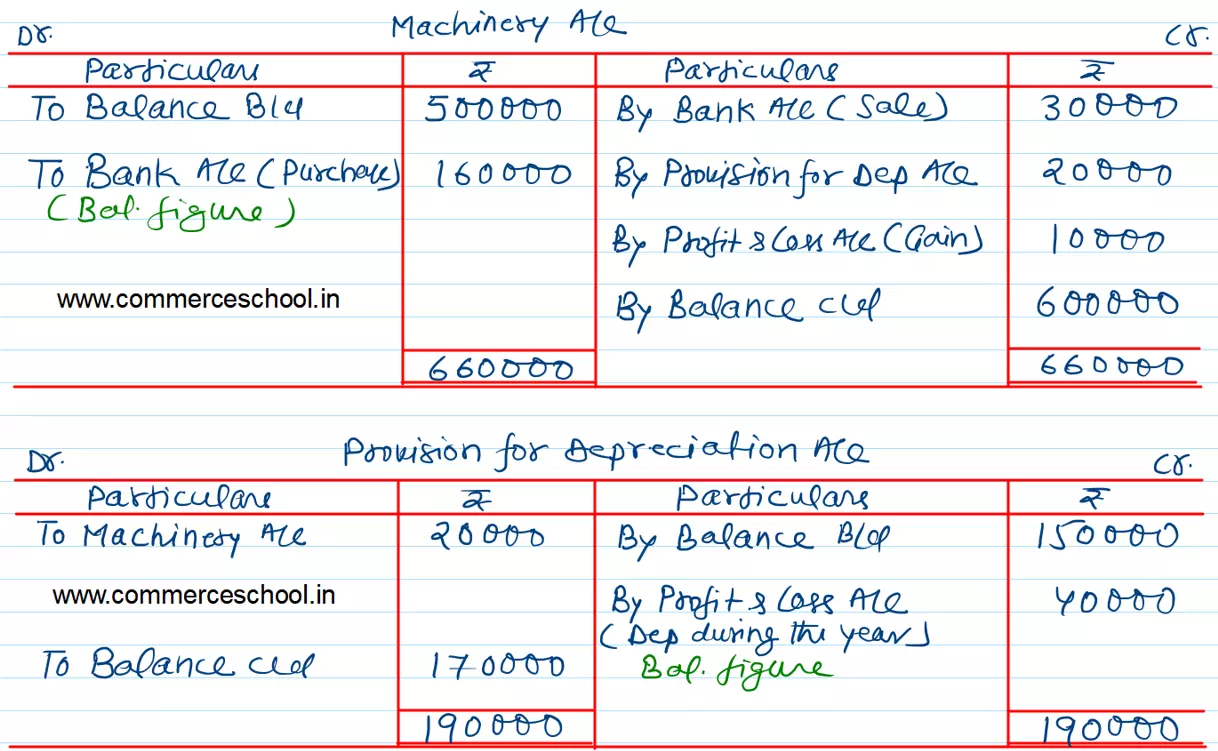

3. Property, Plant and Equipment Machinery (Cost) Less: Accumulated Depreciation |

6,00,000 1,70,000 |

5,00,000 1,50,000 |

| Total | 4,30,000 | 3,50,000 |

Note: Dividend has been proposed @ 12% for both the years on Closing Capital.

Additional Information:

- Sold one machine for ₹ 30,000 the cost of which was ₹ 60,000 and the depreciation provided thereon was ₹ 20,000.

- Sold some trade investment at a profit which was credited to Capital Reserve.

- Income tax paid during the year was ₹ 88,000.

- Paid an interim dividend of ₹ 15,000.

Prepare Cash Flow Statement showing the working notes clearly.