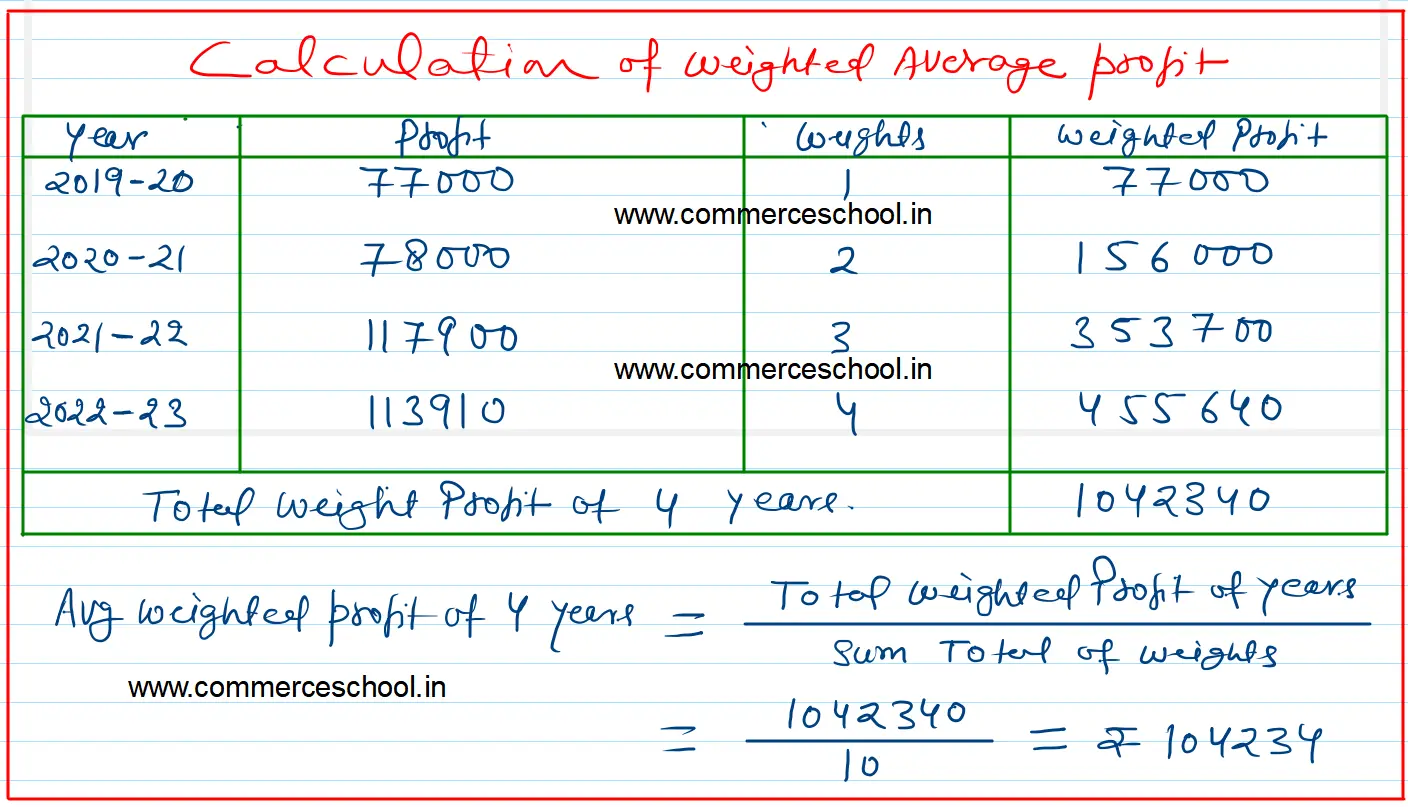

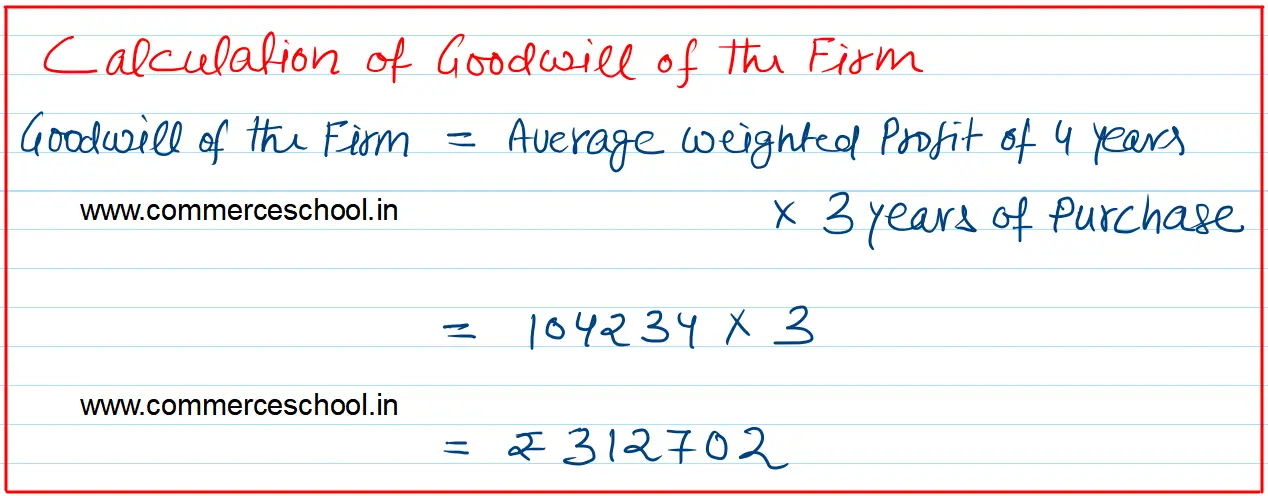

Calculate the goodwill of a firm on the basis of three year’s purchase of the weighted average profit of the last four financial years. The appropriate weights to be used and profits are:

Calculate the goodwill of a firm on the basis of three year’s purchase of the weighted average profit of the last four financial years. The appropriate weights to be used and profits are:

| Year | Profits (₹) |

| 2019 – 20 | 1,01,000 |

| 2020 – 21 | 1,24,000 |

| 2021 – 22 | 1,00,000 |

| 2022 – 23 | 1,40,000 |

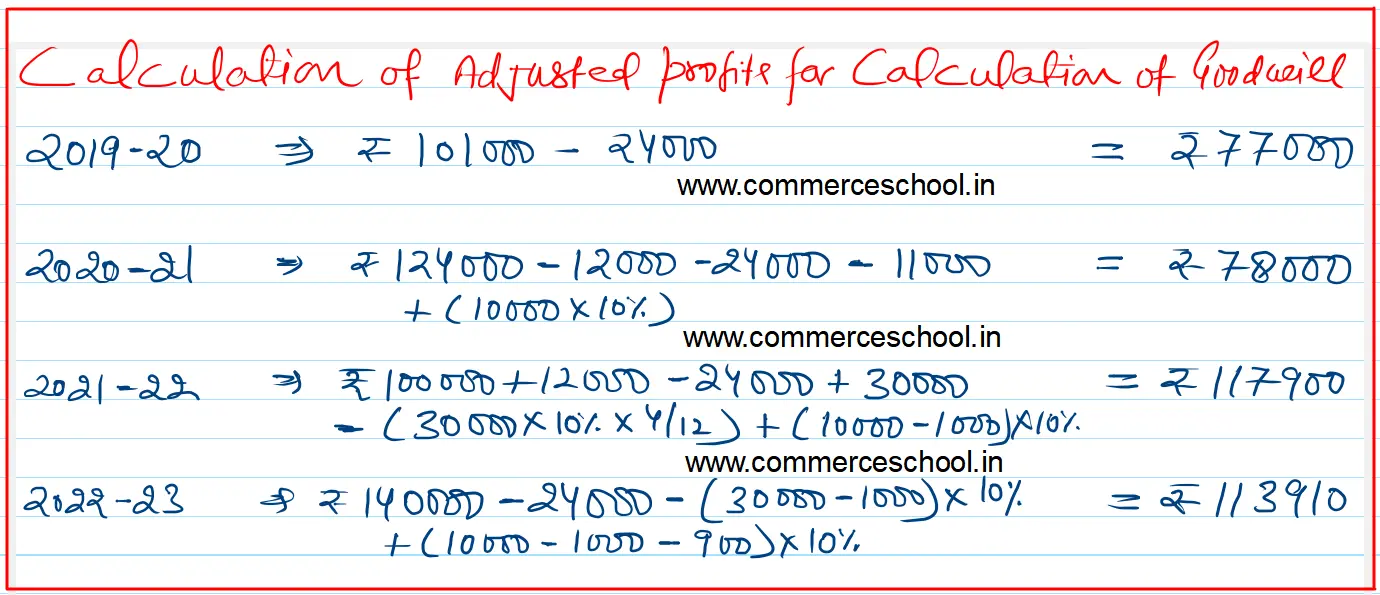

On a scrutiny of the accounts, the following information was taken:

i) On 1st December, 2021, a major repair was made in respect of the plant incurring ₹ 30,000 which was charged to revenue. The said sum is agreed to be capitalised for goodwill calculation subject to adjustment of depreciation of 10% p.a. on Reducing Balance Method.

ii) The closing stock for the year ended 31st March, 2021 was overvalued by ₹ 12,000.

iii) To cover management cost, an annual charge of ₹ 24,000 should be made for the purpose of goodwill valuation.

iv) On 1st April 2020, a machine having a book value of ₹ 10,000 was sold for ₹ 11,000 but the proceeds were wrongly credited to Profit & Loss Account. No effect has been given to rectify the same. Depreciation is charged on machine @ 10% p.a. on Reducing balance Method.