Show an Accounting Equation for the following transactions: D. Mahapatra commenced business with cash ₹ 50,000 and ₹ 1,00,000 by cheque

Show an Accounting Equation for the following transactions:

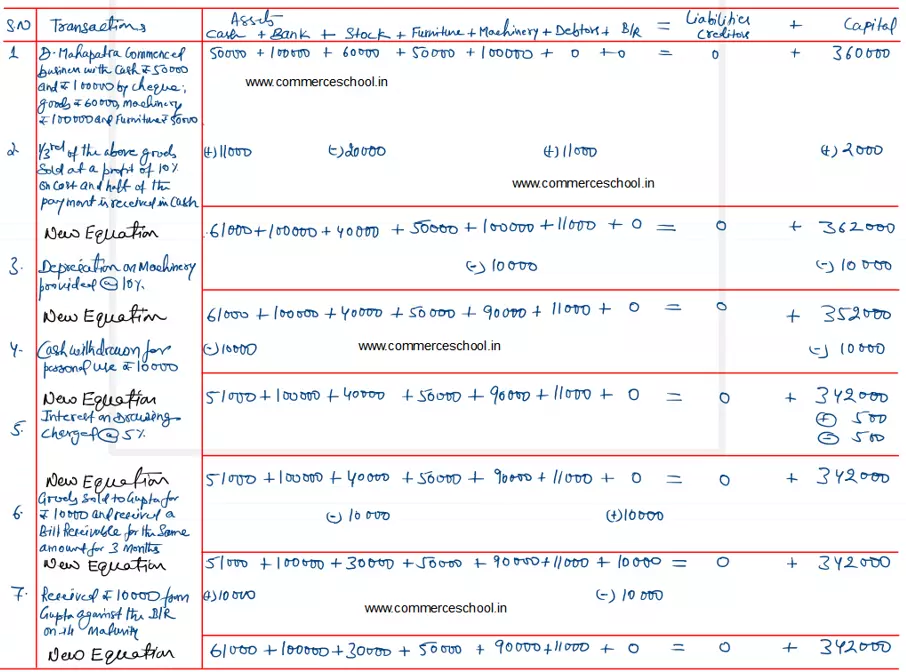

(i) D. Mahapatra commenced business with cash ₹ 50,000 and ₹ 1,00,000 by cheque; goods ₹ 60,000; machinery ₹ 1,00,000 and furniture ₹ 50,000.

(ii) 1/3rd of the above goods sold at a profit of 10% on cost and half of the payment is received in cash.

(iii) Depreciation on machinery provided @ 10%

(iv) Cash withdrawn for personal use ₹ 10,000.

(v) Interest on drawings charged @ 5%.

(vi) Goods sold to Gupta for ₹ 10,000 and received a Bill Receivables for the same amount for 3 months.

(vii) Received ₹ 10,000 from Gupta against the Bills Receivables on its maturity.

[Assets: Cash ₹ 61,000 + Bank ₹ 1,00,000 + Stock (goods) ₹ 30,000 + Machinery ₹ 90,000 + Furniture ₹ 50,000 + Debtors ₹ 11,000 = Liabilities: Nil + Capital: ₹ 3,42,000.]

[Hints: 1. Opening Capital ₹ 3,60,000 = Cash ₹ 50,000 + Bank ₹ 1,00,000 + Stock ₹ 60,000 + Machinery ₹ 1,00,000 + Furniture ₹ 50,000. 2. Liabilities: Nil.]