Disha, Mohit and Nandan are partners. They decide to dissolve their firm. Pass necessary Journal Entries for the following after various Assets (other than Cash and Bank)

Disha, Mohit and Nandan are partners. They decide to dissolve their firm. Pass necessary Journal Entries for the following after various Assets (other than Cash and Bank) and the third party liabilities have been transferred to Realisation Account:

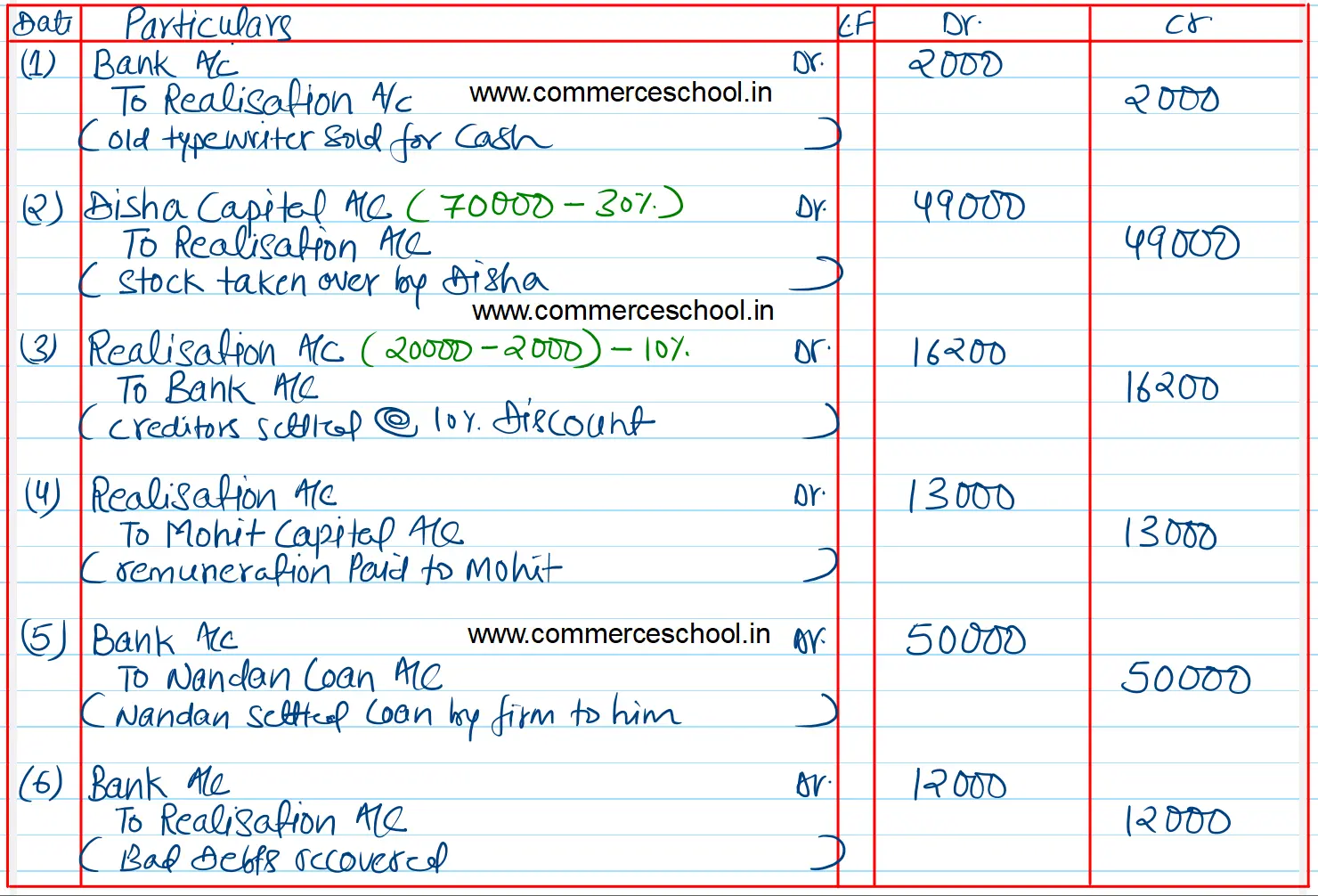

(a) An old typewriter which was not recorded in the books was sold for ₹ 2,000 whereas its expected value was ₹ 5,000.

(b) Stock of ₹ 70,000 was taken by Disha at a discount of 30%.

(c) Total creditors of the firm were ₹ 20,000. A creditor for ₹ 2,000 was untraceable and other creditors accepted payment allowing 10% discount.

(d) Mohit paid realisation expenses of ₹ 18,000 out of his private funds, who was to get remuneration of ₹ 13,000 for completing the dissolution process and was responsible to bear all the realisation expenses.

(e) Nandan had taken a loan of ₹ 50,000 from the firm, which was paid fully by him to the firm.

(f) ₹ 12,000 was recovered from a debtor which was written off as Bad Debts last year.