E, F and G were partners in a firm sharing profits in the ratio of 2 : 2 : 1. On March 31, 2017, their firm was dissolved. On the date of dissolution, the Balance Sheet of the firm was as follows:

E, F and G were partners in a firm sharing profits in the ratio of 2 : 2 : 1. On March 31, 2017, their firm was dissolved. On the date of dissolution, the Balance Sheet of the firm was as follows:

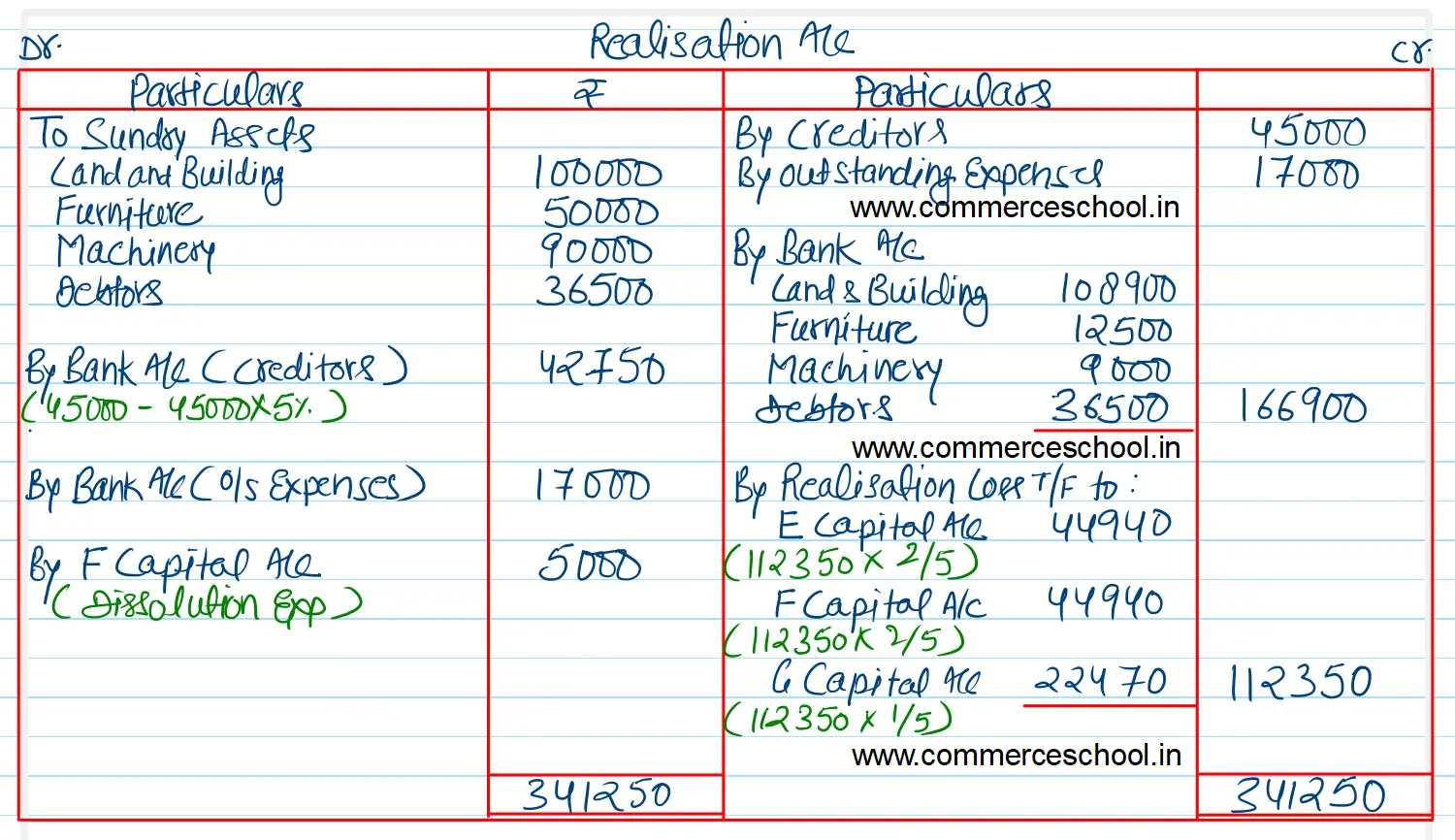

F was appointed to undertake the process of dissolution for which he was allowed a remuneration of ₹ 5,000. F agreed to bear the dissolution expenses. Assets realized as follows:

(i) The Land & Building was sold for ₹ 1,08,900.

(ii) Furniture was sold at 25% of book value.

(iii) Machinery was sold as scrap for ₹ 9,000.

(iv) All Debtors were realised at full value.

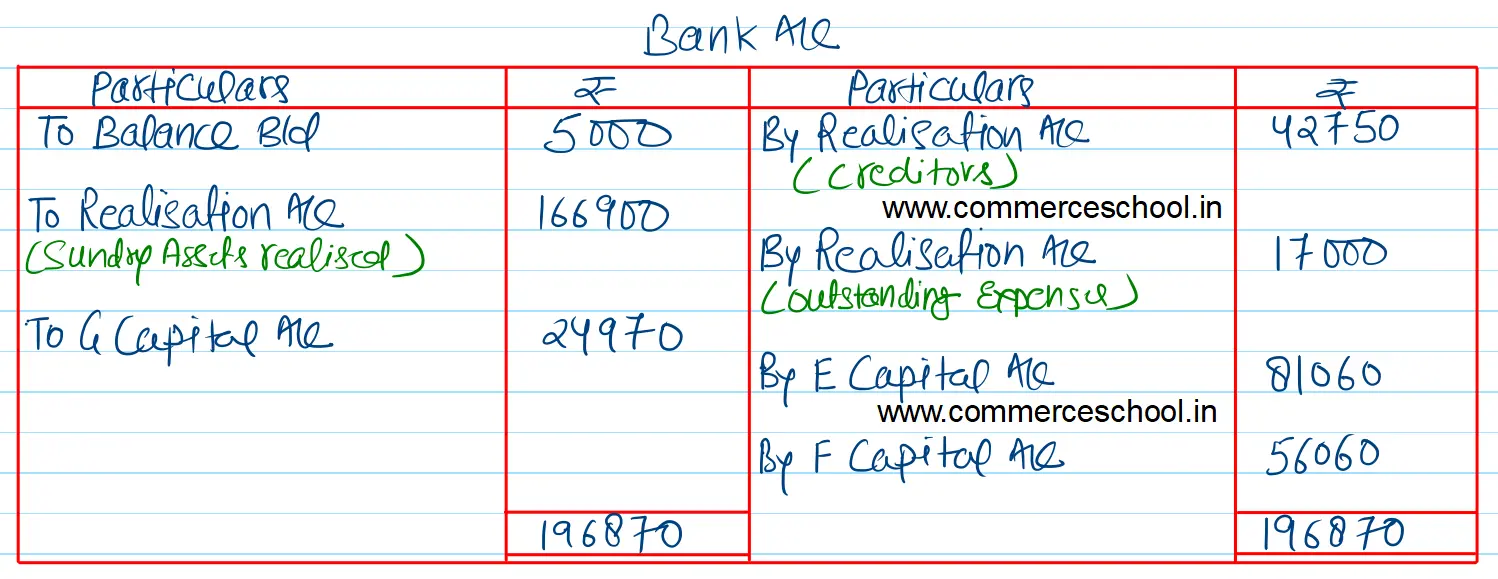

Creditors were payable on an average of 3 months from the date of dissolution. On discharging the Creditors on the date of dissolution, they allowed a discount of 5%.

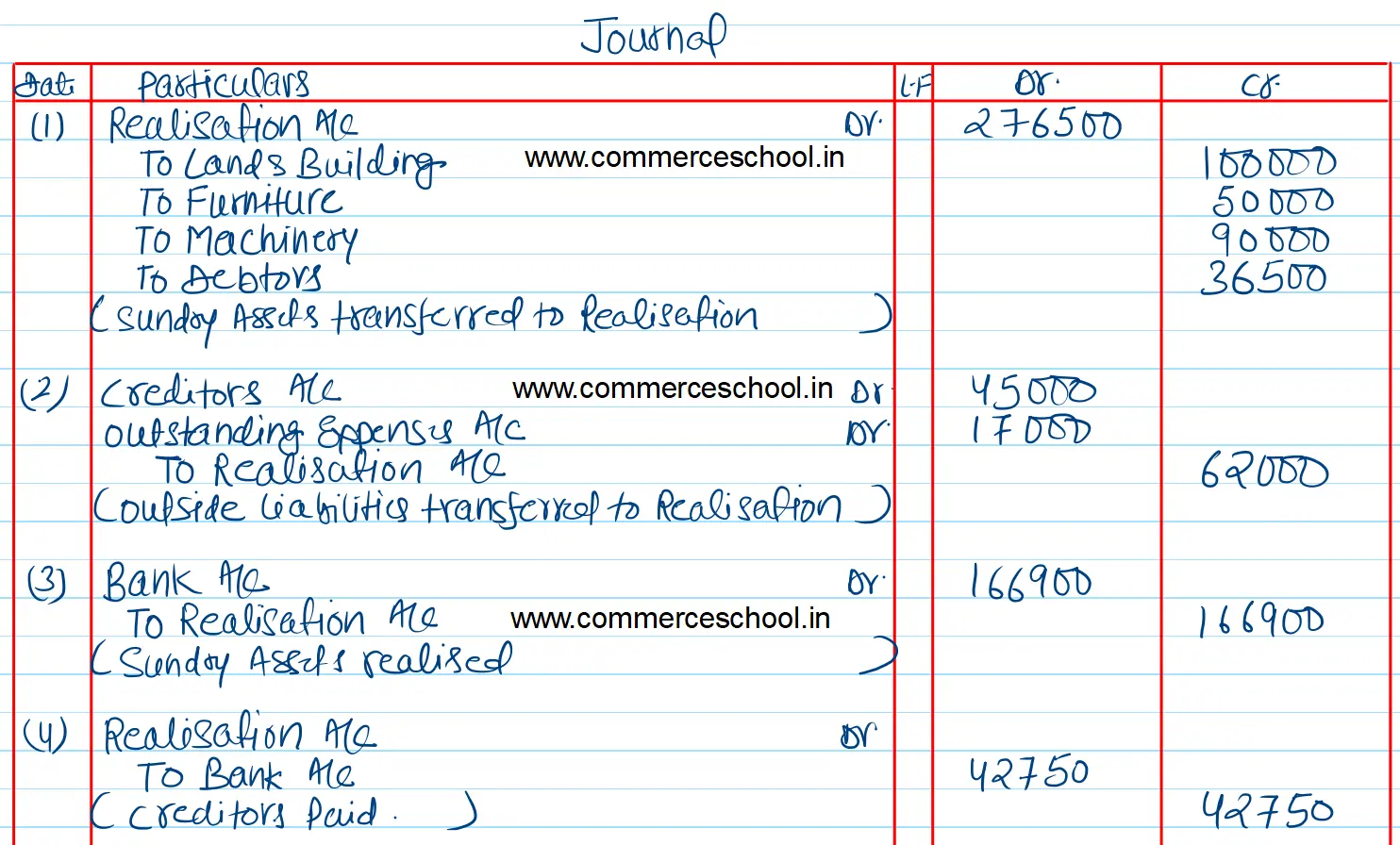

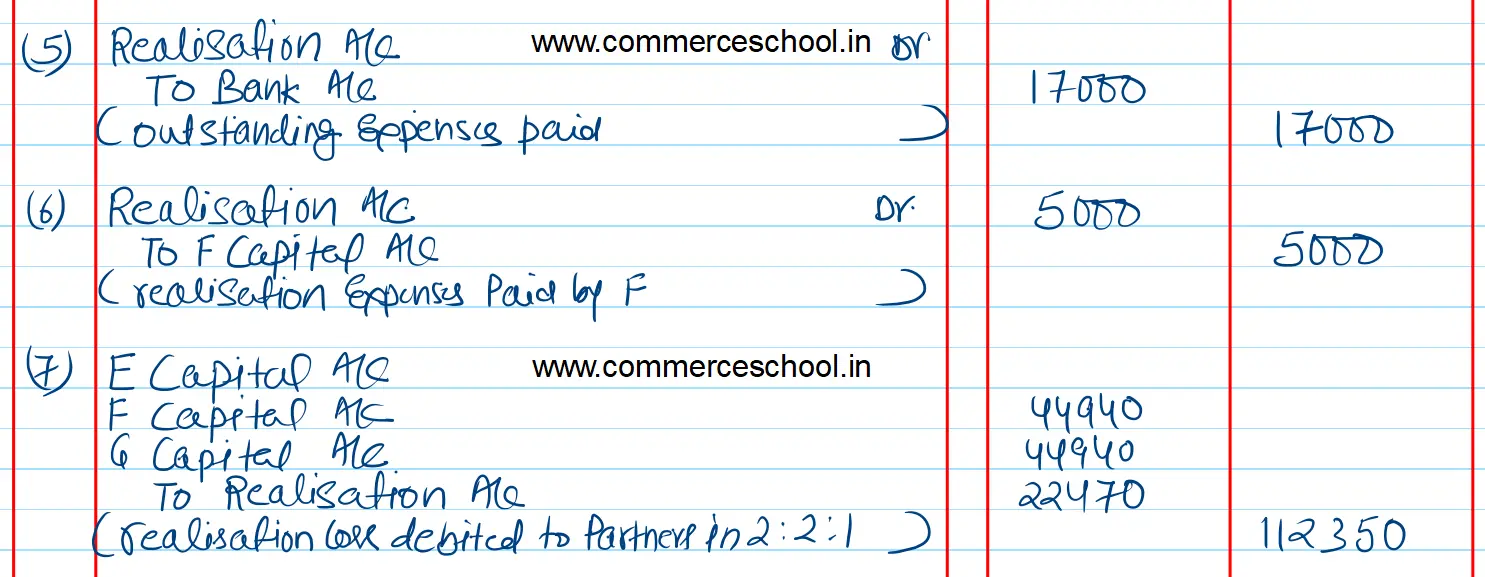

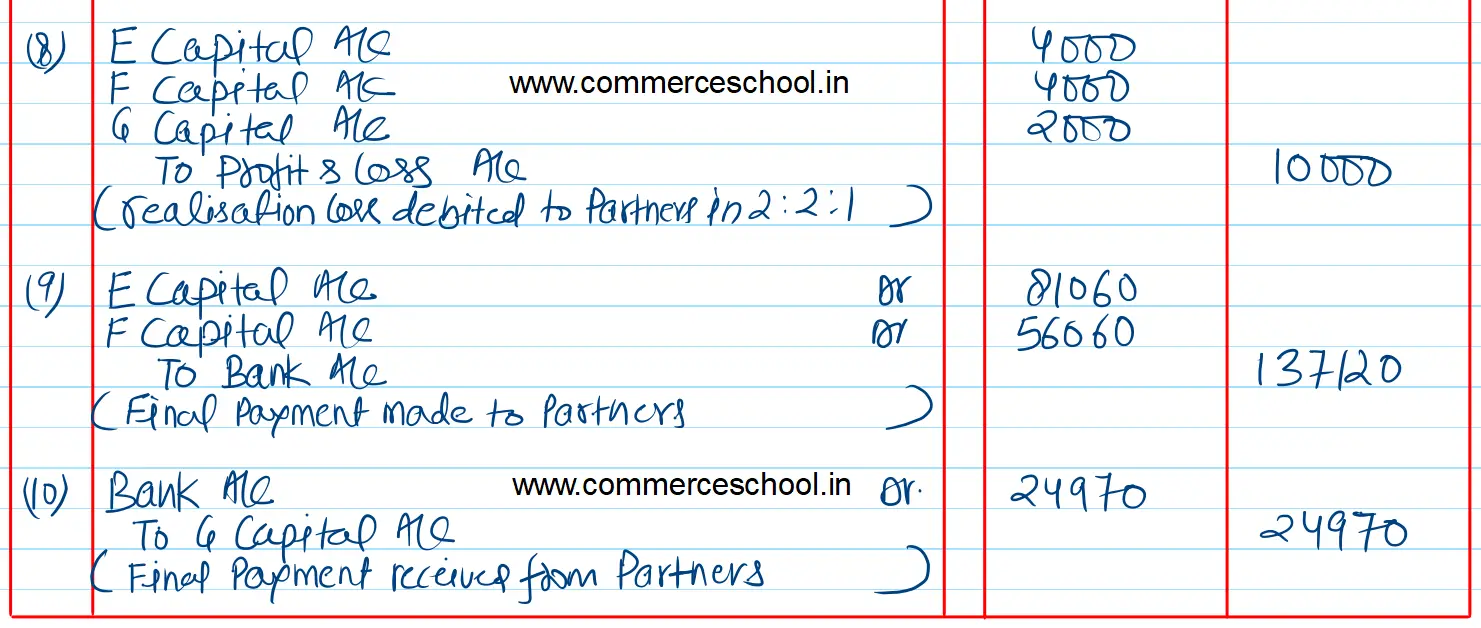

Pass necessary Journal entries for dissolution in the books of the firm.

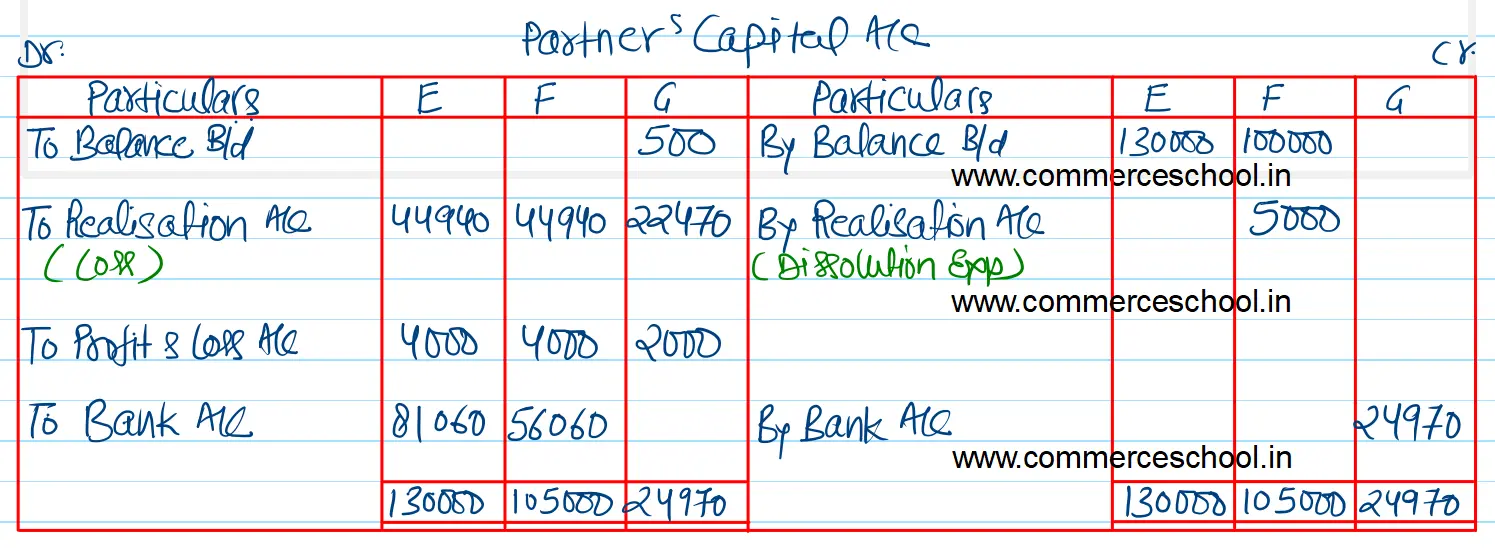

[Ans. Loss on Realisation ₹ 1,12,350; Net amount received from G ₹ 24,970 and Final Payment made to E ₹ 81,060 and F ₹ 56,060.]

| Liabilities | ₹ | Assets | ₹ |

| Capitals: E F | 1,30,000 1,00,000 | G’s Capital | 500 |

| Creditors | 45,000 | Profit & Loss Account | 10,000 |

| Outstanding Expenses | 17,000 | Land & Building | 1,00,000 |

| Furniture | 50,000 | ||

| Machinery | 90,000 | ||

| Debtors | 36,500 | ||

| Bank | 5,000 | ||

| 2,92,000 | 2,92,000 |

Anurag Pathak Answered question